History (1998): Thanks to IPO, Maxtor Forced to Disclose Financial Results

In rhythm of more than $2 billion sales per year

By Jean Jacques Maleval | February 25, 2022 at 2:00 pmMaxtor has filed a registration statement with the SEC relating to a proposed IPO of $500 million in common stock, $10 0 million of which will be sold by its current owner, Hyundai Electronics America (HEA), itself a majority-owned subsidiary of the Korean Hyundai Electronics Industries (HEI).

This is the third IPO for the company, organized in 1982 by Jim McCoy (now CEO and COB of TeraStor), after two initial offers in 1985 and 1986.

Hyundai purchased 40% of the company in 1994 for $150 million and then all the remaining shares in 1996 for $215 million, which is how Maxtor ceased being listed on the stock exchange. The firm nonetheless h a succinct quarterly report, because it has publicly traded bonds.

The benefit of any IPO is not just that the company collects a sizeable bundle of cash to finance development, but also that the public, and not only shareholders, learns nearly everything it can about that company. In order to pocket the money, the firm must first bare itself. Maxtor’s IPO corporate presentation report is no less than 850 pages! It’s not just a summary, which space constraints oblige us to provide here. Even so, we have culled a good 2 pages of little-known or unknown facts about the company, with commentary.

Cannon fire

For those who follow the industry and read Maxtor’s report, there can be no doubt. The arrival of Mike Cannon, an IBM veteran in July 1996 changed everything. The new president and CEO has refocused the company on 3.5-inch desktop HDDs only, ceasing all development in the 1.8-inch and then 2.5-inch form factor.

Product performance consequently improved, and the move to MR heads was especially swift, to the point where these heads now outfit all models, with the drives in time-to-market and time-to-volume manufacturing. Behind all this, the sales and marketing team are working overtime.

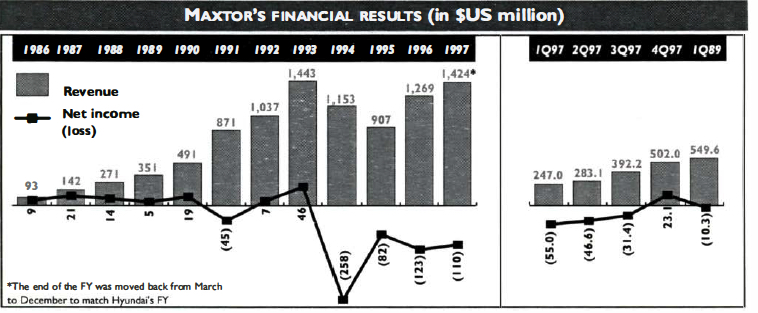

Financial results for the company have shown a marked rise, despite serious fluctuations in the overall HDD market. Maxtor is now in a rhythm of more than $2 billion per year, and has regained its financial equilibrium. Its gross margin, in the red by 2.9% in 1Q97, is now in the black at 11.3%, or sales that have grown by 122% in the same interval (see below).

During 1Q97, 1.3 million drives were sold. This figure has leapt to 3.5 million in 1Q98. The firm’s WW market share in desktop units has thus climbed from 5.6 to 13.4% in that period, according to IDC.

Customers

Cannon has never disguised the fact that his initial target base was PC OEMs. Sales for the entirety of these customers represented 6.5% of total revenue in 2Q96. They represented 54.5% by 1Q97, and 75.8% in 1Q98. For the entire FY97, Compaq and Dell led the pack, with 21% and 10% of orders, respectively. During 1Q98, Dell Computer and IBM accounted for respectively 25 and 18% of the company’s total revenues, and the top 10 customers accounted for 74%. Maxtor is currently Dell’s number one supplier of HDDs. If one adds up total sales to the trio Compaq/Dell/lBM, they were at 24% in 1Q97 and will have hit 51.8% in 1Q98. Among Maxtor’s other clients are distributors such as Ingram, Karma, SED, and retailers such as Best Buy, CompUSA and Staples.

Factories

With the exception of a pilot production in Longmont, CO, all products ship from a single 384,000 square foot facility in Singapore, with current yearly manufacturing capacity of 16 million drives, and the possibility to increase to 25 million, but no more than that.

The company’s growth will therefore depend upon investment in a new plant. To this end, HEI has already spend $23 million in the consturction of a new 450,000 square foot plant in Dalian, China. But an additional estimated $60 million will be required to complete the facility, not to mention another $25 million for machinery and equipment.

This investment was initiated back when things were still going well in South Korea, clearly no longer the case. It remains to be seen whether Hyundai pursues the project, knowing that, whatever happens, at the moment the plant doesn’t belong to Maxtor.

People

Personnel took some heavy hits in 1996, when the staff was reduced that year from 9,330 to 4,330. As of March 28, 1998, Maxtor’s employees numbered 5,600, including 714 in engineering and R&D, particularly in Longmont, CO and Milpitas, CA, as well as 206 in marketing, sales and customer support, 4,389 in manufacturing and 351 in general management and administration.

At the top of the ladder sits Mike Cannon, who received a salary of $500,000 in 1997, plus a bonus of $750,000. Other high-paid execs that year were Bill Roach, SVP, WW sales and marketing, at $581,000, and Vic Gibson, SVP, engineering, at $314,000. These figures do not include stock options, which more than round things off.

Sources

Maxtor doesn’t manufacture any of the components used in its HDDs. Texas instruments is its sole source of DSP/controller and spin/servo ICs, Lucent is also alone in supplying IC channels. MR heads are acquired from Alps, Headway, IBM, Read Rite and TDK, while the platters come from HMT, Komag and MMC.

The latter firm, formerly known as MaxMedia, is, incidentally, a wholly-owned subsidiary of HEA (and therefore not of Maxtor). In 1997, MMC supplied 17.4% of Maxtor’s media, 28.8% in 1Q98, with advantageous pricing, 3.7% below the best price for media available from any of its other qualified merchant vendors.

But will Maxtor continue to benefit from these favorable terms in the future? Even if Maxtor was granted 180 US and foreign patents since its founding, its parent company HEI and subsidiaries (including Maxtor) were obliged to sign a patent licensing agreement with IBM. The license fee is $1.0 to $2.3 million per year, payable in installments through 2007.

Risks

Like the majority of HDD manufacturers, Maxtor has a few lawsuits weighing it down. The main dispute, with magnetic platter maker StorMedia, dates from 1996 and has yet to be settled. Maxtor claims that the disks supplied by StorMedia at that time did not meet its requirements, and cancelled the contract between the 2 firms. StorMedia subsequently sued Maxtor, which responded with its own countersuit.

Meanwhile, like certain other providers of HDDs, Maxtor has received correspondence from the German company Papst, which is claiming infringement of at least 13 patents relating to motors that Maxtor purchaes from other motor vendors.

Aside from the current lawsuits, Maxtor’s long term problems lie elsewhere. Firstly, following the IPO, the company will no longer enjoy the financial support of shareholder Hyundai, which no longer has the means to stay the course. The accumulated stockholder’s deficit was $783 million as of March 28. Another cause for concern: like Western Digital, for example, Maxtor has, at the moment, absolutely no involvement in new techniques that may eventually infringe on the turf of traditional HDD drives, such as optical-assisted recording technologies.

To soon for an IPO?

Isn’t this IPO just a little premature, and wouldn’t it have been more fruitful to wait 6 months or even a year? The timing seems bad, because the HDD industry is not well at the moment, and is certainly getting bad press in the financial milieu, after 6 months that could almost be characterized generally catastrophic, with oversupplies and price reductions.

Of course, Maxtor came back nicely to profit in 4Q97, but its most recent known financial quarter, 1Q98, is currently in deficit, even if only by a small amount, which is not exactly going to reassure traders [even though this $10.3 million loss can be interpreted as a net income of $4.4 million, if you exclude compensation charges of $14.7 million related to the variable accounting features of the 1996 stock option plan].

Hyundai urgently needs fresh money, and has decided to stop putting any more into Maxtor, which nonetheless needs something like $100 million this year to add to manufacturing capacity and to implement a company SAP program. The Korean firm, however, seems in a hurry to get back at least some of its marbles.

This article is an abstract of news published on issue 126 on July 1998 from the former paper version of Computer Data Storage Newsletter.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter