Backblaze: Fiscal 4Q21 Financial Results

Backblaze: Fiscal 4Q21 Financial Results

Revenue up 28% and net loss not far from tripling

This is a Press Release edited by StorageNewsletter.com on February 18, 2022 at 2:03 pm| (in $ million) | 4Q20 | 4Q21 | FY20 | FY21 |

| Revenue | 14.6 | 18.7 | 53.8 | 67.5 |

| Growth | 28% | 25% | ||

| Net income (loss) | (3.4) | (9.6) | (6.6) | (21.6) |

Backblaze, Inc. announced results for its fourth quarter and year ended December 31, 2021.

“We were pleased to finish 2021 with strong 28% revenue growth driven by an increasing proportion of our B2 Cloud Storage service, with 56% growth in 4Q21, and 16% growth in our Computer Backup business,” said Gleb Budman, CEO. “Our accelerating 4Q21 growth rate provides an exciting backdrop for us to scale up our sales and marketing investments more than what we previously planned for 2022 to take advantage of our large market opportunity.“

“We believe 2022 will be a pivotal year in our long-term mission to become the leading independent cloud for storage. Armed with IPO proceeds, we are scaling our outbound sales team, launching our first major advertising campaign, establishing developer evangelism and dedicated partner marketing teams, thus capitalizing on key growth opportunities for B2 Cloud Storage,” he continued.

4FQ21 Financial Highlights:

- Revenue of $18.7 million, an increase of 28% Y/Y.

- B2 Cloud Storage revenue was $6.6 million, an increase of 56% Y/Y.

- Computer Backup revenue was $11.9 million, an increase of 16% Y/Y.

- Gross profit of $9.8 million, or 53% of revenue, compared to $7.6 million and 52% of revenue, in 4FQ20.

- Adjusted gross profit of $14.1 million, or 75% of revenue, compared to $11.2 million and 77% of revenue in 4FQ20.

- Net loss was $9.6 million compared to a net loss $3.4 million in 4FQ20.

- Net loss per share was $0.38 compared to a net loss per share of $0.18 in 4FQ20.

- Adjusted EBITDA was $(1.3) million, or (7)% of revenue, compared to $2.0 million and 14% of revenue in 4FQ20.

- Cash and cash equivalents were $104.8 million as of December 31, 2021.

FY21 Financial Highlights:

- Revenue of $67.5 million, an increase of 25% Y/Y.

- B2 Cloud Storage revenue was $22.6 million, an increase of 59% Y/Y.

- Computer Backup revenue was $44.1 million, an increase of 13% Y/Y.

- Gross profit of $34.3 million, or 51% of revenue, compared to $28.0 million and 52% of revenue, in FY20.

- Adjusted gross profit of $50.5 million, or 75% of revenue, compared to $40.5 million and 75% of revenue in FY20.

- Net loss was $21.7 million compared to $6.6 million in FY20.

- Adjusted EBITDA was $3.2 million, or 5% of revenue, compared to $11.1 million and 21% of revenue in FY20.

4FQ21 Operational Highlights:

- Annual recurring revenue (ARR) was $75.4 million, an increase of 27% Y/Y.

- B2 Cloud Storage ARR was $26.8 million, an increase of 57% Y/Y.

- Computer Backup ARR was $48.6 million, an increase of 15% Y/Y.

- Net revenue retention (NRR) rate was 110% compared to 114% in 4FQ20.

- B2 Cloud Storage NRR was 130% compared to 136% in 4FQ21.

- Computer Backup NRR was 102% compared to 107% in 4FQ21.

- Gross customer retention rate was 91% compared to 90% in 4FQ20.

- B2 Cloud Storage gross customer retention rate was 89% in both 4FQ21 and 4FQ20

- Computer Backup gross customer retention rate was 91% in 4FQ21 and 90% 4FQ20.

- Number of customers was 498,933 vs. 466,298 in 4FQ20.

- B2 Cloud Storage number of customers was 74,318 vs. 59,112 in 4FQ20.

- Computer Backup number of customers was 439,249 vs. 419,209 in 4FQ20.

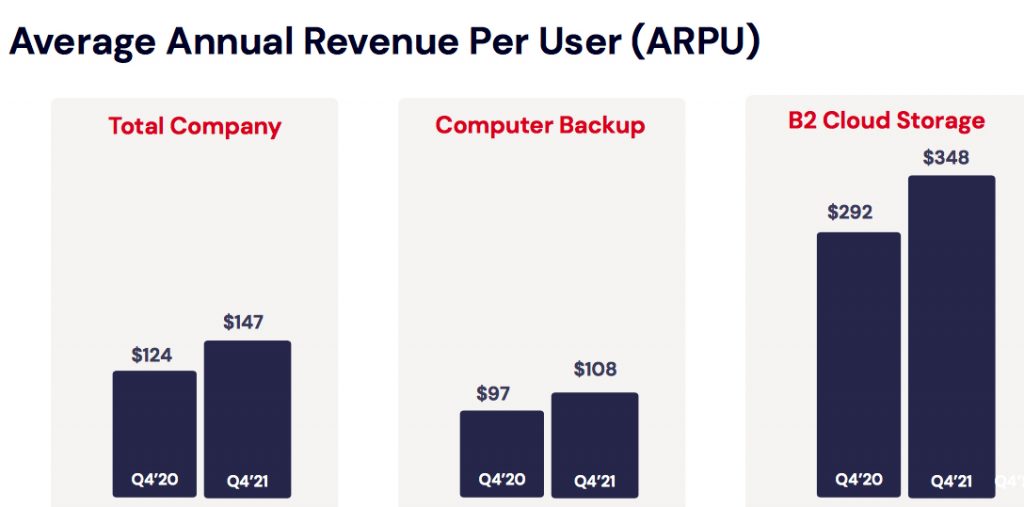

- Total Annual Average Revenue Per Customer (ARPU) was $147 vers$124 in 4FQ20.

- B2 Cloud Storage ARPU was $348 v vs. $292 in 4FQ20.

- Computer Backup ARPU was $108 vers$97 in 4FQ20.

Outlook

For 1FQ22:

• Revenue between $19.0 million to $19.5 million.

• Adjusted EBITDA margin between -20% to -16%.

• Basic shares outstanding of 30.5 to 31.0 million shares.

For FY22:

• Revenue between $83 million to $86 million.

• Adjusted EBITDA margin between -18% to -14%.

Comments

4FQ21 revenue totaled $18.7 million, an increase of 28% Y/Y, to be compared to estimation of $17.7 to $18.2 million announced the former quarter.

FY21 sales reached $67.5 million to be compared to estimation of $66.5 to $76.0 million.

B2 Cloud Storage service provides developers and IT people a public cloud storage service, as Computer Backup Service provides unlimited cloud backup for laptops and desktops for companies and individuals.

B2 contributed sales of $6.6 million, reflecting 56% growth, representing 35% of total revenue, and continuing its upward trend.

Computer Backup revenue totaled $11.9 million, reflecting 16% growth. In 4FQ21, and it benefited from the first full quarter of the price increase implemented in 3FQ21.

The cost, since most backup customers are on an annual or 2-year subscription, increase from approximately $6 per month to $7 per month, and will continue to phase.

Gross customer retention was 91% overall, with 89% for B2 and 91% for Computer Backup.

Paid customers increased Y/Y to 499,000 from 466,000 in 4Q20. The number of customers for B2 grew to 74,000 from 59,000 one year ago. For Computer Backup, it totaled 439,000 up from 419,000 for the same periods.

The company intends to increase its sales and marketing investments by over 100% in 2022, or about $10 million more than its prior internal plans. While it is increasing its spend in 2022, it is not not currently anticipating a significant benefit to revenue from this spend until late 2022, or 2023.

New cloud replication feature will be available by the end of the first half of 2022.

| (in $ million) | Revenue | Q/Q or Y/Y growth | Net income (loss) |

| FY19 | 40,748 | NA | (996) |

| 1FQ20 | 12.4 | NA | 13 |

| 2FQ20 | 13,0 | 5% | (1,4) |

| 3FQ20 | 13.8 | 6% | (1.9) |

| 4FQ20 | 14.6 | 6% | (3,4) |

| FY20 | 53.8 | 32% | (6.6) |

| 1FQ21 | 15.3 | 5% | (3.7) |

| 2FQ21 | 16.2 | 5% | (2,4) |

| 3FQ21 | 17,3 | 5%-7% | (6.5 to 7.5) |

| 4FQ21 | 18.7 | 28% |

(9.6) |

| FY21 |

67.5 | 25% | (21.6) |

| 1FQ22 (estim.) | 19.0-19.5 | 2%-4% |

NA |

| FY22 (estim.) |

83-86 |

23%-27% |

NA |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter