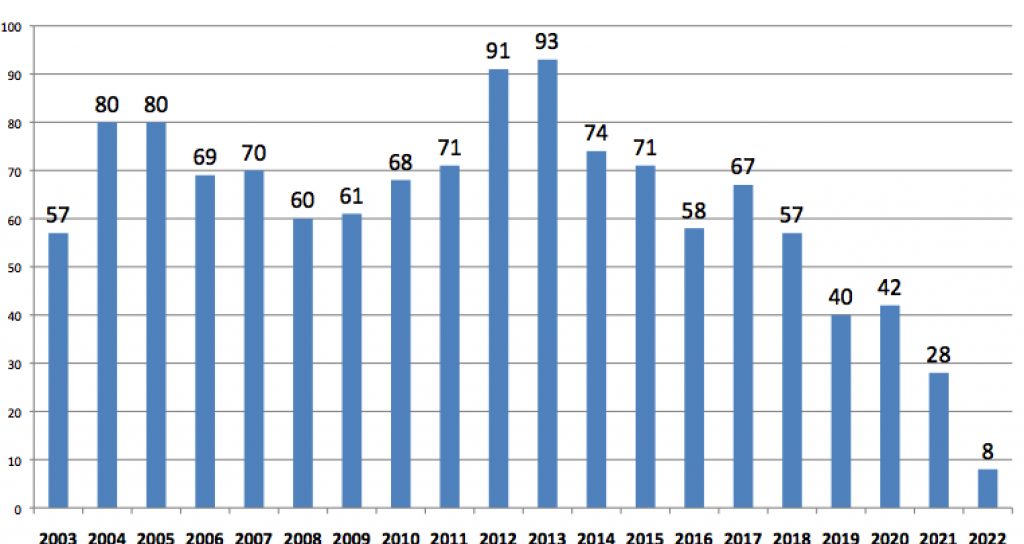

All Financial Rounds of Funding of Storage Start-Ups Since 2003

Total of 1,245, but less and less, 93 in 2013, only 28 in 2021

By Jean Jacques Maleval | February 17, 2022 at 2:03 pmWe have collected all financial rounds of funding raised since 2003 when known.

But there was several others before that, the first one apparenty being raised by Memorex, born in 1961 and, at this time, in tape and HDD IBM compatible subsystems and later, in 1965, being public through probably the first IPO in the storage industry, and then acquired by Burroughs in 1982.

1,245 rounds were recorded from 2003 to 2022 with a record of 93 in 2013 and then generally decreasing with only 28 in 2021. For 2022, the figure is 8 up to know.

≠ of financial rounds since 2003

(Source: StorageNewsletter.com)

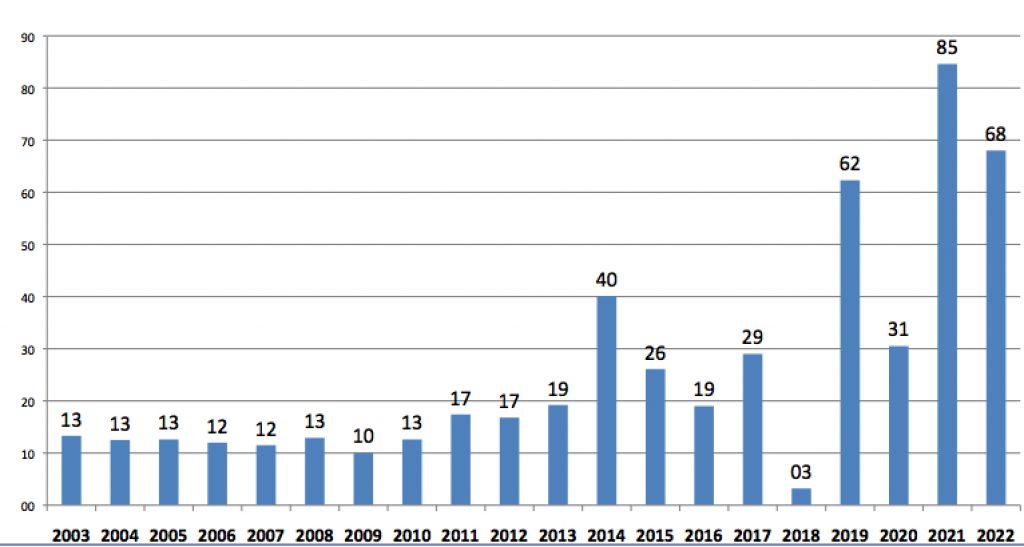

The average amount per round was $22 million for these 1,245 financial fundings for a total of $27,524 million.

Average amount per round since 2003

(Source: StorageNewsletter.com)

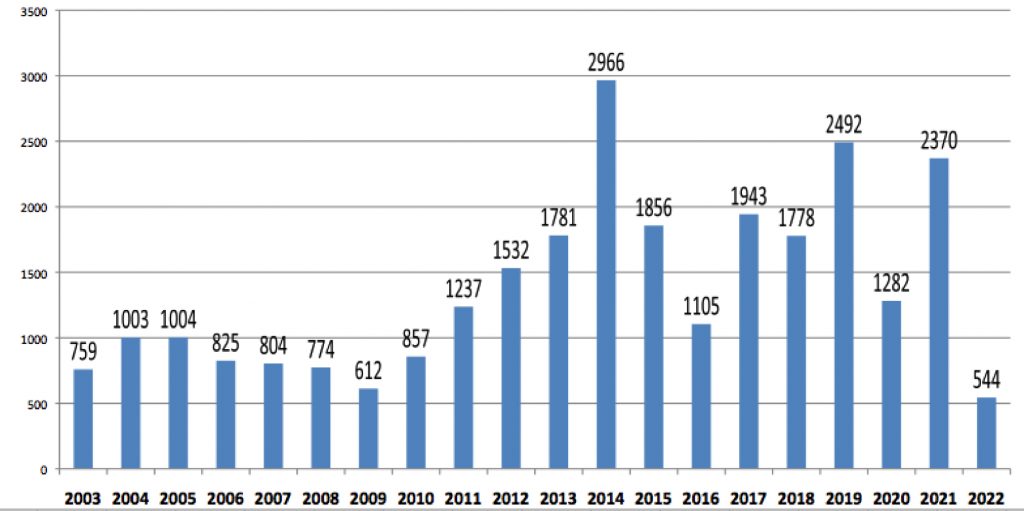

Total amount of financial rounds per year

(Source: StorageNewsletter.com)

Note that we also record the total investment when it was announced but, for some start-ups, we got only the figure for one or more rounds.

The global amount is here $36,816 million for 616 companies or an average of $59.8 million. The record here is $1,700 million by Dropbox in front of Cloudera with $1,041 million.

Historical records in total financial funding in $ million

(more than $300 million)

Dropbox 1,700

Cloudera 1,041

Cohesity 660

Kaseya 567.4

Box 554.5

Pillar Data 544

Rubrik 553

Pure Storage 531

Ownbackup 507.3

Veeam 500

DigitalOcean 491.3

Druva 475

Dremio 421.5

Acronis 408

Nutanix 370.3

Actifio 352.5

Qumulo 351

Infinidat 325

Actifio 308

(Source: StorageNewsletter.com)

Largest financial rounds in 2021 in $ million

(at more than $100 million)

Ownbackup 407.5

N-able 255

Acronis 250

Liqid 179

Wasabi 174.5

Druva 147

Dremio 135

(Source: StorageNewsletter.com)

Largest financial rounds in 2022 in $ million

(at more than $100 million)

Dremio 160

Minio 103

(Source: StorageNewsletter.com)

Financial rounds in 2021

| Companies | Year founded | 2021 funding* | Total funding* | Business |

| Acronis (Schafthausen, Switzerland) | 2003 | 250 | 408 | backup software with cyber protection |

| Alluxio (San Mateo, CA) | 2015 | 50 | 73 | memory-centric distributed storage system; formerly Tachyon Nexus |

| Catalog (Boston, MA) | 2016 | 35 | 54.3 | DNA-based platform for massive digital data storage |

| Dremio (Santa Clara, CA) | 2015 | 135 | 421.5 | data lake storage cloud software |

| Druva Software (Sunnyvale, CA) | 2007 | 147 | 475 | continuous data availability and de-dupe backup software for laptops; investment of NTT in 2016; originally in Pune, India |

| Filebase (Greater Boston Area, MA) | 2019 | 2 | 2 | object storage platform powered by decentralized storage networks |

| HYCU (Boston, MA) | 2018 | 87.5 | backup-as-a-service; also known as  Comtrade Software | |

| Internxt (Valencia, Spain) | 2017 | 1 | 2 | decentralized cloud storage service for files, apps, and websites |

| Intrinsic Semiconductor Technologies (London, UK) | 2017 | 1.4 | 1.4 | Memristive RRAM devices, UCL spinout company |

| Iridia (Carlsbad, CA) | 2016 | 30 | 40.1 | DNA-based storage solution; formerly Dodo Omnidata; $20 million and $6 million in 2021 |

| Kyligence (Shangai, China) | 2016 | 70 | 118 | cloud providing intelligent analytics performance layer that sits between data sources and BI tools |

| Liqid (Lafayette, CO) | 2013 | 179 | 228.2 | on-demand composable infrastructure; $79 and $100 million in 2021 |

| LucidLink (San Francisco, CA) | 2016 | 12 | 19.6 | cloud backed distributed file service |

| LyteLoop (NYC, NY) | 2015 | 40 | method to utilize power of ultra-high bandwidth lasers to store massive amounts of data in space | |

| Molecular Assemblies (San Diego, CA) | 2013 | 24 | practical method of synthesizing DNA | |

| N-able (Ottawa, Canada) | 2000 | 255 | 255 | cloud-based software solutions for managed service providers, formerly SolarWinds MSP, acquired by SolarWinds in 2013, IPO in July 2021 |

| Nyriad (San Jose, CA) | 2014 | 28 | 58.1 | storage solutions for big data and HPC, also in New Zealand |

| OpenDrives (Culver City, CA) | 2011 | 20 | 31 | all-flash and hybrid NAS for media workflows, series B in 2018 |

| OwnBackup (Englewood Cliffs, NJ) | 2015 | 407.5 | 507.3 | backup and restore ISV on the Salesforce.com AppExchange; also in Israel; two rounds in 2021: $167.5 million and $240 million |

| Rewind (Ottawa, ONT) | 2015 | 80 | 80 | online backup service that protects cloud data, $15 million and $65 million in 2021 |

| Robin.IO (San Jose, CA) | 2015 | 38 | 86 | cloud native Kubernetes storage |

| Scality (San Francisco, CA) | 2010 | 20 | 172 | massively scalable storage platform; spin-off from Bizanga; R&D in Paris; formerly BizangaStore; investment of HPE in 2016, probably around $10 million; born in Paris, France |

| Silk (Needham, MA) | 2008 | 55 | 239.5 | database supercharger, from AFA to storage-as-a-service vendor; R&D in Israel; round C in 2011; strategic investment from Western Digital Capital in 2018; formerly Kaminario |

| SkyKick (Seattle, WA) | 2011 | 130 | 200.5 | SaaS cloud automation and management products for Microsoft information technology service providers |

| StorageOS (London, UK) | 2015 | 10 | 20 | low entry point, full enterprise functionality storage array integrated with VMWare, Docker, AWS, and Google Cloud |

| Tsecond (San Jose, CA) | 2020 | 4.6 | 4.6 | technologies that reimagine how enterprises and organizations activate big data to drive insights and innovation, Bryck Portable Media Device to capture, process, move and store data from anywhere |

| VAST Data (New York City NY) | 2016 | 83 | 263 | Universal Storage Architecture with flash memory to bring end to enterprise HDD and storage tiering area; also in Tel Aviv, Israel |

| Wasabi Technologies (Boston, MA) | 2015 | 174.5 | 286.2 | cloud-based object storage as a service; formerly BlueArchive,successor of Storiant in software for cold storage (?); 2 rounds in 2017: $8.5 and $10.8 million; investment from NTT DOCOMO Ventures in 2019; 27.5 and 112 million and then $25 million in 2021 |

*in $ million

(Source: StorageNewsletter.com)

Financial rounds in 2022

| Companies | Born in | 2022 funding | Total funding | Business |

| Aleph.im (Paris, France) | 2019 | 10 | 10 | cross-blockchain decentralized storage and computing network |

| Dremio (Santa Clara, CA) | 2015 | 160 | 421.5 | data lake storage cloud software |

| GRAID Technology (Santa Clara, CA) | 2020 | 15 | 18 | NVMe and NVMeoF RAID card |

| Minio (Palo Alto, CA) | 2014 | 103 | 123.3 | multi-cloud object storage suite |

| Pavilion Data Systems (San Jose, CA) | 2014 | 45 | 107 | processor agnostic storage in PCIe-based shared storage environment; data analytics acceleration platform |

| PlIO/s (Ramat Gan, Israel) | 2017 | 65 | 115 | NAND storage processor; investment from State Of Mind Ventures |

| Virtana (San Jose, CA) | 2008 | 73 | 158 | virtual infrastructure optimization solutions; spin-out from Finisar; merged with Load Dynamix in 2016 with new $20 million investment; formerly Virtual Instruments |

| WekaIO (San Jose, CA) | 2014 | 73 | 158.9 | SDS scales storage to hundreds of petabytes, tens of millions of IO/s, sub milliseconds latency; also engineering in Tel Aviv, Israel |

* in $ million

(Source: StorageNewsletter.com)

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter