NAND Flash Pricing Set to Spike 5-10% in 2Q22

Due to material contamination at WDC and Kioxia

This is a Press Release edited by StorageNewsletter.com on February 16, 2022 at 2:02 pmThis is a market report from TrendForce, Inc., written by analysts Avril Wu, Ben Yeh and Bryan Ao, and published on February 12, 2022.

NAND Flash Pricing Set to Spike 5-10% in 2Q22

Due to material contamination at WDC and Kioxia

WDC recently stated that certain materials were contaminated in late January at NAND flash production lines in Yokkaichi and Kitakami, Japan which are joint ventures with Kioxia, according to TrendForce’s investigations.

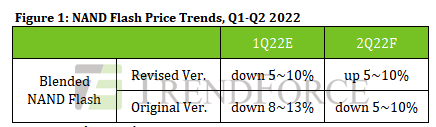

Before this incident, the analyst firm had forecast that the NAND flash market will see a slight oversupply the entire year and average price from 1Q22 to 2Q22 will face downward pressure.

However, the impact of WDC’s material contamination issue is significant and Samsung’s experience during the previous lockdown of Xi’an due to the pandemic has also retarded the magnitude of the NAND flash price slump. Therefore, the 1Q22 price drop will diminish to 5~10%. In addition, the combined WDC/Kioxia NAND flash market share in the 3Q21 was as high as 32.5%. The consequences of this latest incident may push the price of NAND flash in 2Q22 to spike 5~10%.

The contaminated products in this incident are concentrated in 3D NAND (BiCS) with an initial estimate of 6.5EB affected.

Damaged bits account for 13% of the group’s output in 1Q22 and approximately 3% of the total output for the year. The normal production schedule for the entire line has yet to be confirmed. It is worth noting that the damages announced by WDC likely do not account for total losses stemming for this event and the number of damaged Kioxia parts has not been aggregated, so the total number of affected bits may increase further.

Production primarily focused on client SSD and eMMC, subsequent spot pricing may climb

Currently, WDC and Kioxia are focused on supplying PC client SSD and eMMC products. Since WDC is the ≠2 and ≠1 supplier in the client SSD and eMMC markets, respectively, subsequent supply will inevitably be hampered.

Therefore, even if production demand for PC OEM is revised downward in 2Q22, client SSD prices may remain resistant to decline.

In terms of enterprise SSD, Kioxia PCIe 4.0 has been verified by a number of customers and the company’s market share in 2022 was originally forecast to increase. However, this incident will impact Kioxia’s ability to ship product and further affect subsequent customer procurement. Therefore, in order for buyers to satisfy their own production requirements, a 2Q22 decline in enterprise SSD product pricing will be largely restrained.

In addition, as buyers and sellers in the spot market are still clarifying events and incident assessments, they mostly responded by suspending quotations, with no new quotations having been generated.

However, TrendForce’s assessment indicates that subsequent events will obviously stimulate spot price appreciation. Judging from contract pricing, any orders negotiated on a whole quarter basis should be unaffected in the near-term but there may be an immediate price increase in wafer quotations this February and March.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter