Macronix: Fiscal 4Q21 Financial Results

Macronix: Fiscal 4Q21 Financial Results

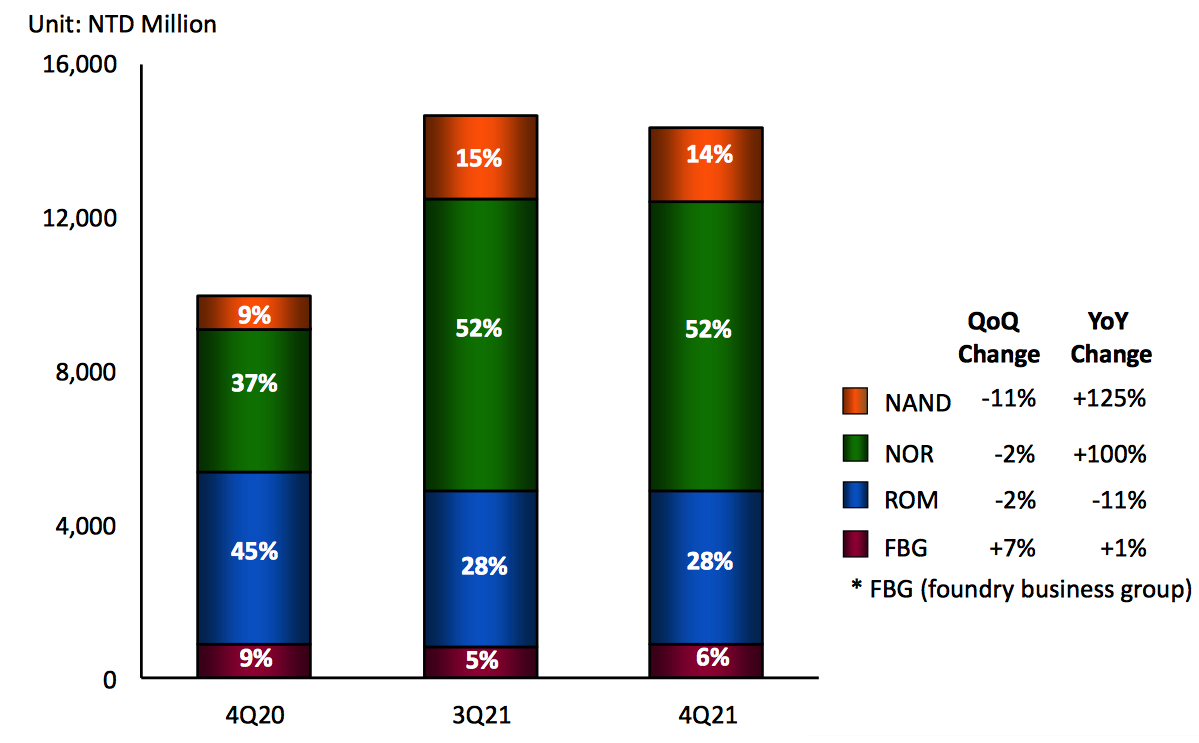

14% of sales for NAND flash, down 11% Q/Q and up 125% Y/Y

This is a Press Release edited by StorageNewsletter.com on February 15, 2022 at 2:01 pm| (in NTD million) | 4Q20 | 4Q21 | FY20 | FY21 |

| Revenue | 10,158 | 14,545 | 39,801 | 50,573 |

| Growth | 43% | 27% | ||

| Net income (loss) | 1,156 | 3,692 | 5,326 | 11,963 |

Macronix International Co., Ltd. announced the unaudited financial results for the fourth quarter ended Dec. 31, 2021. All numbers were prepared in compliance with the TIFRS on a consolidated basis.

Summary of 4FQ21:

- Net sales was NT$14,545 million ($523.9 million).

- Gross profit was NT$6,863 million ($247.2 million) with 47.2% gross margin.

- Operating income was NT$4,094 million ($147.5 million) with 28.1% operating

margin. - Income before tax was NT$4,041 million ($145.6 million); net income was

NT$3,692 million ($133.0 million). - EPS was NT$2.00; book value per share was NT$25.20.

4FQ21Financial Highlights:

Net sales of NT$14,545 million ($523.9 million), a decrease of 3% sequentially and an increase of 43% Y/Y.

Gross profit and Gross margin was NT$6,863 million ($247.2 million) and 47.2%, respectively. Gross profit was increased 7% sequentially and increased 109% year-over-year.

Operating expenses for this quarter were NT$2,769 million ($99.7 million), a decrease of 5% Q/Q and an increase of 50% Y/Y. Operating income for this quarter was NT$4,094 million ($147.5 million), an increase of 17% Q/Q and an increase 185% Y/Y.

Income before taxes was NT$4,041 million ($145.6 million), a decrease of 34% Q/Q and an increase of 199% Y/Y.

The income tax expense was NT$349 million ($12.6 million), the net income after tax was NT$3,692 million (US$133.0 million).

EPS was NT$2.00 (US$0.07).

For this quarter, the book value was NT$25.20 per share.

Current assets and cash flow:

- As of December 31, 2021, the debt-to-asset ratio was 39.1% which was lower than 41.6% on September 30, 2021.

- As of Dec. 31, 2021, the company had NT$18,565 million ($670.7 million) in cash and cash equivalents.

- As of December 31, 2021, net inventory was NT$13,156 million ($475.3 million), compared to NT$13,313 million on September 30, 2021, a decrease of NT$157 million.

- As of December 31, 2021, the total liabilities was NT$29,983 million ($1,083.2 million), compared to NT$30,662 million on September 30, 2021, a decrease of NT$679 million; Shareholders’ equity was NT$46,725 million ($1,688.0 million).

- Depreciation and amortization expenses were NT$1,106 million ($39.8 million) for this quarter. Net cash flow from operating activities was NT$7,043 million ($253.7 million) for this quarter. Capital expenditure for this quarter was NT$2,542 million ($91.6 million) mainly for the procurement of facility and production equipment.

4FQ21 Business Highlights

- NAND flash, NOR flash and ROM represent 14%, 52% and 28% of the net sales, respectively

- NAND flash products accounted for 14% of net sales, a sequential decrease of 11% and an increase of 125% Y/Y.

- NOR flash products accounted for 52% of net sales, a sequential decrease of 2% and an increase of 100% Y/Y.

- ROM revenue accounted for 28% of net sales, a sequential decrease of 2% and a decrease of 11% Y/Y.

- FBG products accounted for 6% of net sales, a sequential increase of 7% and an increase of 1% Y/Y.

Comments

Quarterly sales by products

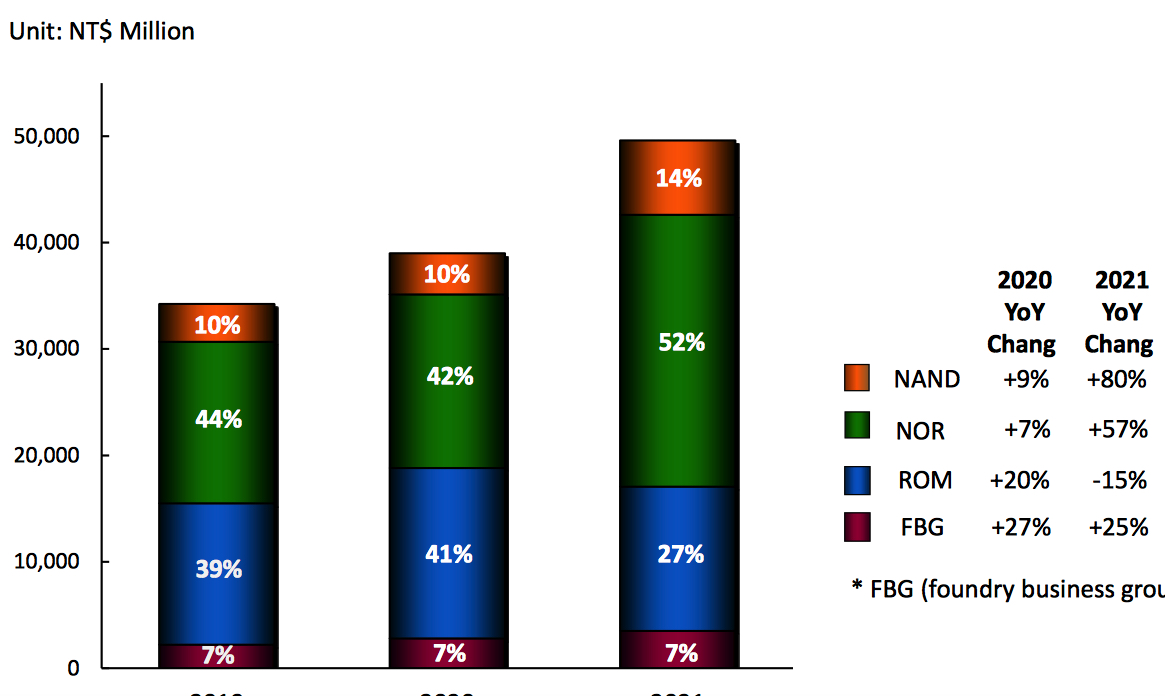

Annual sales by products

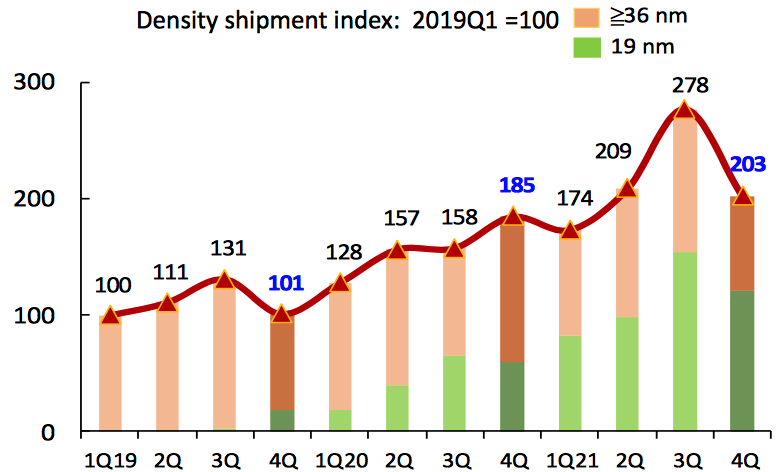

NOR business

• 4Q21 density shipments continued to remain high, +55% Y/Y and -7% Q/Q

• 55nm continued to expand the penetration, +55% Y/Y and +7% Q/Q, representing 58% of density shipment in 4Q21

• ASP hike continued, mainly on strong demand from target markets

SLC NAND business

• 19nm represented 59% of density shipment in 4Q21

• 4Q density shipment down mainly due to strategic capacity allocation

• ASP hike continued

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter