History (1998): HDD Shipments Anticipate to Grow 17% in 1998

But price will be cut in half, compared to 1997.

By Jean Jacques Maleval | February 10, 2022 at 2:00 pmDisk/Trend anticipates a 17% increase in WW shipments of HDDs in 1998. But, the price of these magnetic memories will be cut in half, compared to 1997, falling to 5 cents per megabyte by the end of the year.

The publication of Disk/Trend’s annual report on hard disk drives is always a major event in the industry. Jim Porter’s company has been an authority within the field for over 20 years, and his statistics are questioned by none, even if his main competitors (Dataquest, IDC, Trendfocus) are not just there to make him look good.

Some surprises

The 22nd edition of Disk/Trend’s “HDD Bible” has just come out. Some of its conclusions are not very surprising: the per megabyte price dropped again in 1997, but it will be even worse in 1998, due to oversupply, unrestrained competition among manufacturers, and certain technological advances that led to an increase in the areal density of . magnetic platters.

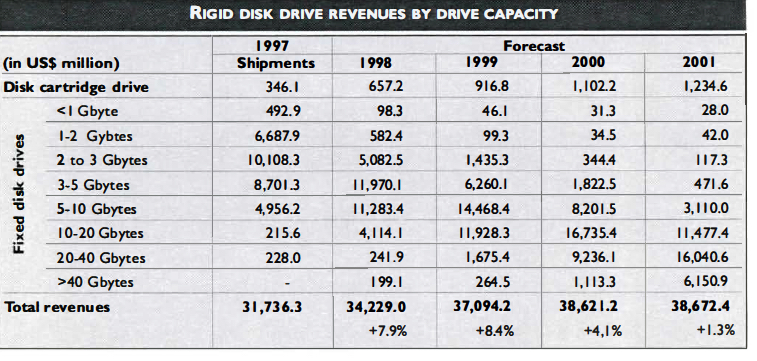

Yet, the comprehensive study also has some surprises in store, surprises that won’t please everyone. As a result of falling prices, the total industry revenue is unlikely to grow by more than 4% between now and the year 2001 .

Disk/Trend revised its forecasts for growth downward, in terms of business revenue. Last year, it projected $74 billion for the year 2000, but now the figure has been set at $39 billion, for nearly the same number of shipments (201 million instead of 203 million drives).

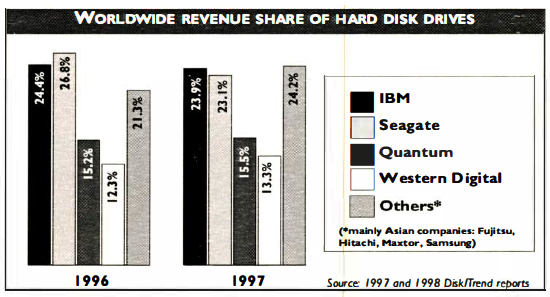

Asian manufacturers (Fujitsu, Hitachi, Maxtor, Samsung) are slowly gaining on the Americans. Even so, for the first time, and after what seems like many years, IBM took the lead, becoming ≠1 one in total sales (captive and non-captive), ahead of Seagate, for years the undisputed leader.

The area of greatest growth, according to the California-based expert, will be in disk cartridge drives.

Overall, the 1998 report is one of the most pessimistic in years, to the point where the question arises whether the opportunity still exists for a start-up to enter this industry – even if it has considerable financial means – or whether existing manufacturers will remain viable, when you consider that there are only 2°0or so left, compared to some 60 at the beginning of the 90s.

Here, then, are the highlights of the new 1998 Disk/Trend report on rigid disk drives, the complete edition priced at $2,875.

Five cents per megabyte

Tough competition in the rigid disk drive industry, combined with rapid advances in magnetic recording technology, is delivering ever increasing value to disk drive buyers. The average price per megabyte for all disk drives shipped in 1997 was below 10 cents, and the 1998 average price is expected to fall below 5 cents per megabyte.

By comparison, the industry’s average price per megabyte 10 years ago was over $11.

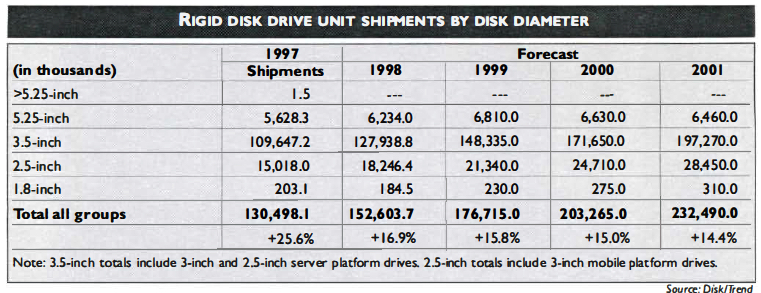

An industry worth $34 billion rigid disk drive shipments WW are expected to rise 16.9% in 1998, with 152.6 million drives, climbing to 232.5 million drives in 2001.

One of the reasons for the profit squeeze several major disk drive manufacturers are currently experiencing can be seen in the lower rate of increase for sales revenue, up only an estimated 7.9% in 1998. The industry’s forecasted 1998 sales revenues of $34.2 billion will increase to $38.7 billion in 2001, an average annual increase of only 4.2%.

Asian manufacturers capture 23% of the market

Non-U.S. disk drive manufacturers have been growing faster during 1997-98 than the U.S. industry leaders, especially with drives sold in the OEM market to computer system manufacturers. Non-U.S. manufacturers captured 22.7% of 1997 WW disk drive sales revenue, with their share projected to rise to 30% in 2001. Most U.S. manufacturers have programs to limit their loss of market share by accelerating new product availability and countering aggressive price competition with lower cost drives.

The drive manufacturers with the largest 1997 market share increases for non-captive disk drives were IBM, Fujitsu, Samsung Electronics and Maxtor.

Big Blue ≠1

Captive disk drives, produced and sold by manufacturers of computer systems, hold a smaller share of WW sales revenues each year, down from 24.3% in 1996, to 19.9% in 1997, to an estimated 16.6% in 1998.

IBM, with a boost from its growing non-captive drive sales, became the 1997 WW leader in overall sales revenues, with 23.9%. Seagate Technology, shipping only non-captive drives, had declining disk drive sales revenue in 1.997 and dropped to second place, at 23.1%. Quantum and Western Digital, each with all non-captive drives, held 15.5% and 13.3 percent, respectively.

20 to 40GB per drive in 2001

The average disk drive capacity grows higher each year. In 1997, 2 to 3GB drives were shipped in higher quantities than any other group. In 1998, 3 to 5GB drives have assumed shipment leadership, and by 2001 the lead will be captured by drives in the 20-40GB range.

The report also breaks down shipments by computer platform, with groups for desktop drives used with PCs, mobile drives used with notebook computers, and server drives typically used with mainframe or network file servers, plus high performance workstations.

The breakdown shows that the 152.6 million unit shipments forecasted for 1998 will be 75.4% desktop drives, 12.1% mobile drives, and 12.4% server drives.

The disk drive industry’s short product life cycles and extremely competitive nature continue to take a toll, especially on companies with small market shares. 59 companies manufactured rigid disk drives at the beginning of the 1990’s, but in 1998 only 20 active manufacturers remain, a net reduction of two from the previous year.

The market for removable disk cartridge drives continues to increase, with an estimated 2.8 million drives in 1998, growing to a forecasted total of 6.2 million in 2001. Five manufacturers are now active in the market, with a variety of 5.25-inch, 3.5-inch and 2.5-inch drives, for publishing, multimedia, video editing and other expanding applications.

The report also contains basic product specifications on 315 disk drive models and profiles on the 20 existing manufacturers of rigid disk drives, plus start-up firms and recent industry dropouts.

This article is an abstract of news published on issue 126 on July 1998 from the former paper version of Computer Data Storage Newsletter.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter