History (1998): Little HDD Company Samsung That Grew (Big)

Goal of $1.3 billion in 1998

By Jean Jacques Maleval | January 27, 2022 at 2:00 pmSamsung Electronics, part of a Korean group with annual sales of $93 billion, has been making HDDs for a very long time now. Back in 1987, the company released its first 3.5-inch units (20MB capacity, using technology acquired from Comport), followed quickly on by 2.5-inch drives. This production remained confidential, and was reserved for internal use only.

All that changed in 1996 with the group’s strategic decision to take the drive business more seriously: one billion dollars in total investment by the end of last year to build a new 250,000 square foot factory in Kumi, 30.000 square feet of cleanroom, capable of churning out 12 million drives yearly at full production.

The storage system division current employs a total of 1,470 people, 310 of whom are in R&D, in San Jose, CA in particular.

Samsung is an underdog in the disk drive industry, just like Maxtor, another Korean group’s subsidiary.

Se Yeon Lee, manager, strategic marketing team in Samsung’s storage division, a veteran of Philips and AMC, informed us that the company produced they’re just getting started: “Currently, we can produce 700,000 drives per month, and we will reach a million per month before the end of the year.“

IDC accorded Samsung roughly 5% of the WW drives in 1997 and predicts that the company will have closer to 7% this year.

Lee points out also that the storage division attained sales of about $700 million in 1997, and set a goal of $1.3 billion for this year (which nonetheless would represent only 1/75th of the total group’s business!).

“From this year, the division will be profitable,” he added.

“Samsung is committed to being one of the world’s top storage providers by the year 2000,” said European marketing sales director Eric Holt.

“We target the top 3 suppliers,” confirmed Lee.

So how do you explain Samsung’s low prices, which tend to cause competitors to rip out their hair?

“There are two reasons,” Lee explains. “Our vertical integration, and our automation.“

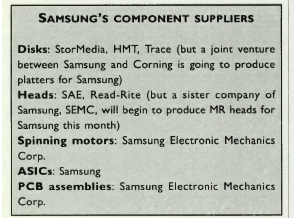

For the moment, the HDD manufacturer makes only a small fraction of its heads, and outsources all the magnetic platters (see inset), but that should change. On the other hand, all the other important components (motors, PCBA, ASICs) are made in house.

Like MKE, Quantum’s drive manufacturer, Samsung has excellent know-how when it comes to robotics, relying on its mass manufacturing electronics business.

Lee also explains that Kumi has 5 entirely automated assembly lines (except for the testing) and 5 more semi-automated.

The captive portion of the production is less than 5%.

Lee preferred not to disclose the names of his OEM clientele. Suffice it to say that they are not the largest PC manufacturers, but rather mid-sized makers. Yet, some US giants are currently evaluating the drives.

“Until now, we didn’t’ have enough volume to have them as customers.”

OEM or integrator orders account for roughly 50% of sales, the other half going to distribution. By region, the break-down is the following: 45% Americas, 35% Europe, 20% Asia.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter