History (1998): HDD Industry Poised for Tremendous Growth Over Next 5 Years

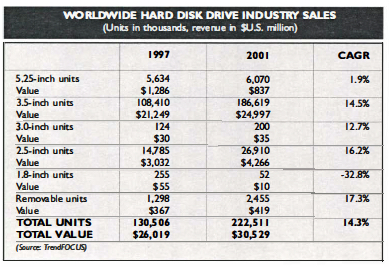

130.5 million units shipped in 1997, 222.5 million expected in 2001

By Jean Jacques Maleval | January 10, 2022 at 2:01 pmThe HDD industry is poised for tremendous growth over the next 4 years, according to a market research report published by research firm Trendfocus.

PC shipments and evolving storage requirements will provide for a 14.3% CAGR through 2001.

The HDD industry shipped record 130.5 million units in 1997, and will ship 222.5 million in 2001. PC shipments, growing sales of network servers and workstations, and rising storage requirements brought on by new software, wider bandwidth in Internet applications, voice recognition and the like are the main factors in the projections.

“Our research demonstrates that the disk drive industry is poised to break out of its slump to post impressive gains in the coming years,” stated John Donovan, VP, Trendfocus. “Concurrently, prices will continue to slide down as capacities and performance rise, so users will be treated to values unparalleled in the IT industry. Desktop PCs consumed the majority of disk drives in 1997. However, the broad reach of sub-$1,000 PCs will force fundamental changes in desktop pricing and supplier strategies. Single-disk products will become more commonplace to support the desktop market, which should remain dominant. Portable systems have suffered with a poor price/performance ratio, but sales have grown regardless. The notebook PC pricing model is shifting and will become much more cost competitive.”

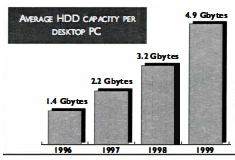

The enterprise/server sector’s demand patterns for drives shifted downward in 1997, but growth server sales will be healthy through the 4-year period, pulling up storage requirements. Average storage capacities have skyrocketed in recent years. The trend will slow slightly in 1998 and 1999 before accelerating again.

“Entering 1997, the average disk drive for desktop PCs stored 1.4GB. At year’s end, the average capacity was over 2.2GB, a growth of 60%,” adds Donovan. “This trend will generally continue, with fluctuations, through 2001.” With entry-level PC pricing rapidly approaching $500, drive pricing for that segment will collapse and pull down prices for higher-capacity drives.“

“A year ago, a 2GB drive cost $210, now it is half that, and 4GB drives have fallen slightly faster,” he added. “We got what we hoped for cheap PCs to broaden global usage. Unfortunately, this is recreating HDD cost models and reducing profitability. Drives to support ultra-cheap PCS will need to be priced under $80.”

US HDD suppliers continue to dominate the market, but changes are underway.

“Non-US suppliers made impressive gains for the third year running,” states Donovan. “Fujitsu, Maxtor, Toshiba, Hitachi, and Samsung are all investing heavily and are challenging US dominance across the product spectrum. Since 1994, there has been a 4x increase in non-US market share.“

The analyst anticipates that non-US vendors will continue to increase output to boost share and generate sustained market momentum. This will force prices lower still.

“We believe that the industry’s current issues are just a seam in the market’s evolution. New operating systems, application software, video editing, digital photography, home servers, and true Internet usage via greater bandwidth will boost storage requirements,” added the analyst. “This doesn’t mean it will be smooth sailing for industry players. With the cheap PC and rising areal densities forcing the industry into new design and price models and the competitive gap closing, the overall HDD contest is changing. The focus will be on technology and cost, more than ever.”

This article is an abstract of news published on issue 124 on May 1998 from the former paper version of Computer Data Storage Newsletter.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter