2021 NAND Bit Supply to See Y/Y Increase in Low 30% Range

Slightly under current estimated NAND bit demand

This is a Press Release edited by StorageNewsletter.com on December 16, 2021 at 2:03 pmHere is an abstract of a report of analyst firm Omdia, with a selection concerning only NAND.

Global Semiconductor, Market Update

A survey of research data and insights covering the semiconductor industry 2H21

Memory and Storage

– DRAM supply & demand are trending up

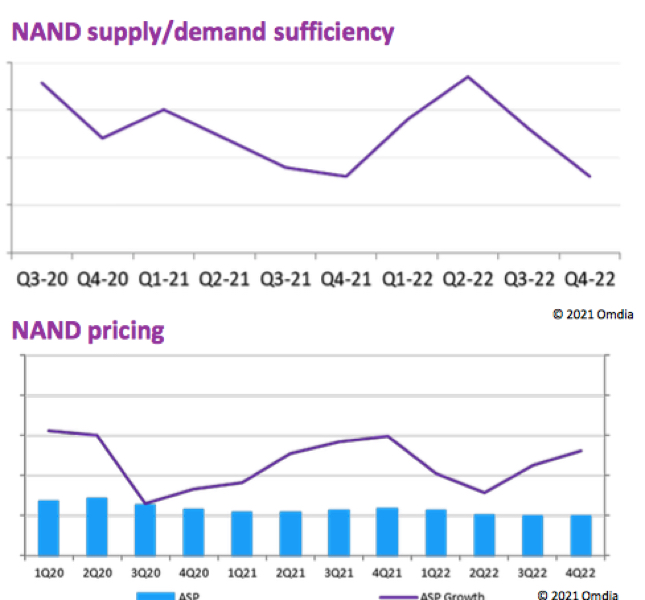

– Ramp-up in NAND supply could reduce ASP increases

NAND 2021 Supply/Demand Summary

Supply

• 2021 NAND bit supply projected to see Y/Y increase in low 30% range, slightly under the current estimated NAND bit demand.

• Risks

– The aggressive ramp could move the overall industry bit growth for 2021 to be on par with demand.

– This could reduce the rate of ASP increases previously projected for 2H21.

Demand drivers

• Total NAND bit demand is projected to see Y/Y growth of 36.6%. All 3 major markets (enterprise, mobile, client) are projected to see sustained demand strength through the 2021.

• Risks

– Should vaccinations continue to be distributed worldwide, there is risk that PC demand may neutralize later in 2021.

Here are more information on NAND and DRAM market in a recent press release from Omdia:

NAND market leading growth in the semiconductor industry

Within memory, the NAND market grew to its highest ever quarterly revenue, jumping from $16.4 billion to $18.7 billion.

Craig Stice, Omdia chief analyst for semiconductor research, commented: “Preliminary data shows the NAND market reached nearly $18.7 billion in 3Q21, an impressive Q/Q increase of 13.8%. The NAND market was fueled by strong shipment growth to meet demand coming out of the enterprise and data center markets, as well as stable demand out of the smartphone market. Additionally, average selling prices in 3Q21 saw a near 5% Q/Q increase as supply and demand remained slightly out of balance.”

Top 10 market share

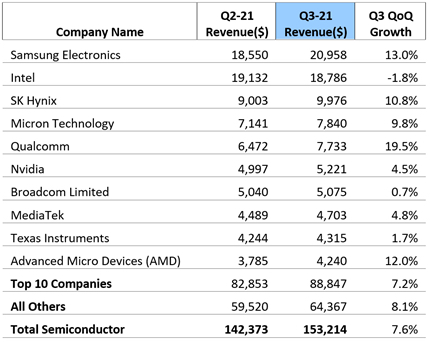

After 11 straight quarters as the ≠1 ranked semiconductor firm, Intel slipped to ≠1 behind Samsung Electronics as the memory segment, where Samsung is t≠1 DRAM and NAND supplier, was the largest growth area for semiconductors in 3Q21.

Memory semiconductor revenue rose 17% in 2Q21 from 1Q21 and another 12% in 3Q21 from 2Q21, lifting Samsung above Intel. Strong demand for DRAM and NAND to support applications and infrastructure for work-from-home and educate-from-home has benefited the memory sector.

Intel, the largest MPU maker, was limited as overall MPU revenue in 3Q21 was nearly flat, up just 0.5%.

Memory-focused semiconductor firms (Samsung Electronics, SK Hynix, and Micron Technology) made up 3 of the top 4 semiconductor firms in 3Q21 and continue to dominate the quarterly revenue rankings.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter