Backblaze: Fiscal 3Q21 Financial Results

Sales up 25%, Y/Y net loss never ending and growing

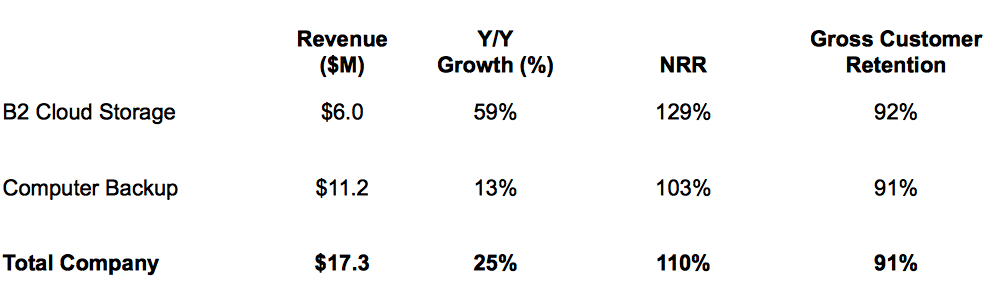

This is a Press Release edited by StorageNewsletter.com on December 14, 2021 at 2:03 pm| (in $ million) | 3Q20 | 3Q21 | 9 mo. 20 | 9 mo. 21 |

| Revenue | 13.8 | 17.3 | 39.2 | 48.8 |

| Growth | 25% | 24% | ||

| Net income (loss) | (1.9) | (6.0) | (3.2) | (12.1) |

Backblaze, Inc. announced results for its third quarter ended September 30, 2021.

“We delivered continued strong 3FQ21 growth overall, led by rapid 59% revenue growth in B2 Cloud Storage and consistent double-digit growth of 13% in Computer Backup,” said Gleb Budman, CEO. “Our successful IPO in November was an important milestone for the company and a recognition by the markets of the mid-market public cloud storage opportunity. We believe the future is being built on independent clouds, and we plan to use our IPO proceeds to help accelerate future growth in this large and fast-growing market.”

3FQ21 Financial Highlights:

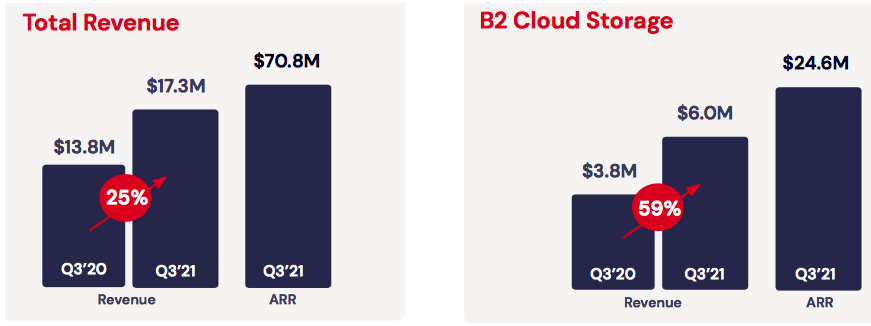

- Revenue was $17.3 million, an increase of 25% Y/Y .

- B2 Cloud Storage revenue was $6.0 million, an increase of 59% Y/Y.

- Computer Backup revenue was $11.2 million, an increase of 13% Y/Y.

- Gross profit of $8.8 million, or 51% of revenue, compared to $6.7 million and 49% of revenue, in 3FQ20.

- Adjusted gross profit of $12.8 million, or 74% of revenue, compared to $10.0 million and 72% of revenue in 3FQ20.

- Net loss was $6.0 million compared to $1.9 million in 3FQ20.

- Net loss per share was $(0.32) compared to $(0.10) in 3FQ20.

- Adjusted EBITDA was $0.8 million, or 5% of revenue, compared to $2.8 million and 20% of revenue in 3FQ20.

- Cash and cash equivalents were $4.7 million as of September 30, 2021. This does not include net cash proceeds of $103 million from our IPO in November 2021.

3FQ21 Operational Highlights:

- Annual recurring revenue (ARR) was $70.8 million, an increase of 28% Y/Y.

- B2 Cloud Storage ARR was $24.6 million, an increase of 58% Y/Y.

- Computer Backup ARR was $46.2 million, an increase of 16% Y/Y.

- Net revenue retention (NRR) rate was 110% compared to 116% in Q3 2020.

- B2 Cloud Storage NRR was 129% compared to 139% in 3FQ20.

- Computer Backup NRR was 103% compared to 109% in 3FQ20.

- Gross customer retention rate was 91% compared to 90% in 3FQ20.

- B2 Cloud Storage gross customer retention rate was 92% in both Q3 2021 and 3FQ20.

- Computer Backup gross customer retention rate was 91% compared to 90% in 3FQ20.

Outlook for 4FQ21

- Revenue between $17.7 million to $18.2 million.

- Adjusted EBITDA margin between -10% to -6%.

Comments

This is the first quarter the company reveals its financial results after a succesful $100 million IPO last November.

Revenue reached an historical record of $17.3 million, up 25% Y/Y, exactly at top of guidance, with net losses not only never ending but growing.

The firm has 2 storage-focused cloud offerings:

- Original cloud offering Computer Backup which ended 3FQ21 with $46 million of ARR. It's a cloud service that protects data on laptops and desktops for businesses and consumers. It's unlimited and costs $7 per month. Revenue here totaled $11.2 million, reflecting 13% growth.

- B2 Cloud Storage or B2 is a storage platform for businesses and developers, a pay-as-you-go, storage-as-a-service, public cloud offering that serves a range of use cases, including application development, ramp similar protection, backup and multi-cloud. While this market includes large diversified cloud vendors, namely AWS, Google Cloud and Azure, they have increasingly focused on the largest enterprises with the most complex use cases. This business ended 3FQ21 with $25 million of ARR. It contributed sales of $6 million, reflecting growth of 59%, B2 represented 34.5% of total revenue, continuing it's upward trend. The primary driver of growth for both products is new customers and secondarily, growth in spend by existing customers.

Firm's revenue is nearly 100% recurring, primarily paid via credit card.

Total company NRR was 110% with B2 at 129% and Computer Backup at 103%. Gross customer retention was 91% overall, 92% for B2 and 91% for Computer Backup. All of these NRR and gross customer retention metrics were within 1 point of the values for 2FQ21. Adjusted gross margin which excludes non cash expenses of depreciation, amortization and stock-based compensation was 74%, improving from 72% last year and in line with expectations. The increase is due to slower headcount growth in firm's data center and support teams.

| (in $) | Revenue | Q/Q or Y/Y growth | Net income (loss) |

| FY19 | 40,748 | NA | (996) |

| 1FQ20 | 12.4 | NA | 13 |

| 2FQ20 | 13,0 | 5% | (1,4) |

| 3FQ20 | 13.8 | 6% | (1.9) |

| 4FQ20 | 14.6 | 6% | (3,4) |

| FY20 | 53.8 | 32% | (6.6) |

| 1FQ21 | 15.3 | 5% | (3.7) |

| 2FQ21 | 16.2 | 5% | (2,4) |

| 3FQ21 | 17,3 | 5%-7% | (6.5 to 7.5) |

| 4FQ21 (estimate) | 17.7-18.2 | 2%-5% |

NA |

| FY21 (estimate) | 66.5-76.0 | 24%-41% |

NA |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter