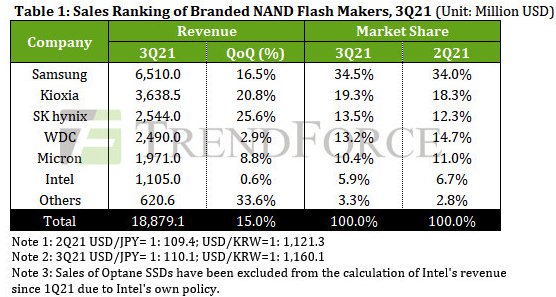

NAND Flash Revenue Rises by 15% Q/Q for 3Q21 to $19 Billion

Samsung largely leader (34%) in front of Kioxia (19%) and WD (15%)

This is a Press Release edited by StorageNewsletter.com on November 30, 2021 at 2:32 pmThe growth of the NAND flash market in 3Q21 was primarily driven by strong demand from the data center and smartphone industries, according to TrendForce, Inc.‘s investigations.

More specifically, NAND flash suppliers’ hyperscaler and enterprise clients kept up their procurement activities that began in 2Q21 in order to deploy products based on new processor platforms.

Major smartphone brands, on the other hand, likewise expanded their NAND flash procurement activities during the quarter as they prepared to release their new flagship models.

As such, clients in both server and smartphone industries made significant contributions to the revenue growth of the NAND flash industry for 3Q21. At the same time, however, suppliers also warned that orders from PC OEMs began showing signs of decline.

On the whole, the industry’s quarterly total NAND flash bit shipment increased by nearly 11% Q/Q for 3Q21, and the overall NAND flash ASP rose by nearly 4% Q/Q for the same quarter. Thanks to rising prices and expanding shipments, the quarterly total NAND flash revenue increased by 15% Q/Q to a new record high of $18.8 billion in 3Q21.

Moving into 4Q21, the impact of the ongoing component gaps has widened to numerous application segments of the NAND flash market as the capacity crunch in the foundry market remains unresolved. Currently, NAND flash components are in abundance relative to other kinds of key components. For OEMs and ODMs, the differences between the NAND flash inventory level and the inventory levels of other components have been growing over the past several months. Therefore, they have to scale back orders and reduce stock for NAND flash. As inventory adjustments are happening, NAND flash contract prices will start to drop and thus bring about an end to the several quarters of strong revenue growth enjoyed by suppliers.

Samsung

Owing to procurement demand from hyperscalers and smartphone brands, the NAND flash market generally reitSamsung’s NAND flash bit shipment increased by only about 5% Q/Q due to weakening demand from PC OEMs and low inventory levels of certain other components carried by Samsung’s clients. It NAND flash revenue for 3Q21 reached $6.51 billion, a 16.5% Q/Q increase.

Kioxia

Although orders from PC OEMs began to wane, it still benefitted from orders from its major smartphone and data center clients in 3Q21, during which its NAND flash bit shipment underwent a major Q/Q increase exceeding 15%. As the NAND flash market remained in a shortage situation, ASP increased by about 4% Q/Q, resulting in a revenue of $3.64 billion, which represents a 20.8% Q/Q increase and the highest single-quarter revenue in firm’s history.

SK hynix

Among all NAND flash suppliers in 3Q21, it registered the highest growth in bit shipment at more than 20% Q/Q. This performance can be attributed to several reasons: the cyclical upturn in procurement activities from smartphone brands, persistently strong demand from the data center segment, and inventory-clearing by the company in anticipation of weak demand in the upcoming off-season. Thanks to an ASP increase of about 5% Q/Q, its NAND flash revenue for 3Q21 reached $2.54 billion, a 25.6% Q/Q increase.

Western Digital

Although its PC OEM clients reduced their SSD orders due to supply chain disruptions, and demand from the retail end also remained weak, the firm was able to increase its NAND flash bit shipment by 8% Q/Q in 3Q21 due to enterprise SSD demand from the data center segment and NAND flash demand from smartphone brands for the release of new smartphone models. Nevertheless, ASP fell by 3% Q/Q because the company increasingly focused on major clients and high-density products. Its NAND flash revenue for 3Q21 reached $2.49 billion, a 2.9% Q/Q increase.

Micron

Demand from the data center segment remained strong, and clients continued to adopt 176L products. However, shipment share in the smartphone market lagged behind that of other NAND flash suppliers. Furthermore, its PC OEM clients were starting to be affected by the uneven supply of semiconductor chips. In light of these factors, NAND flash bit shipment increased by a modest 4% Q/Q. On the other hand, the NAND flash market remained in a severe shortage in 3Q21, thereby driving up ASP by about 5% Q/Q. Hence, NAND flash revenue for 3Q21 reached $1.97 billion, an 8.8% Q/Q increase.

Intel

Although persistently strong demand from the data center segment led to a massive price hike for enterprise SSDs and a nearly 6% increase in firm’s ASP in 3Q21, the company was unable to fully meet its client demand since it could not procure sufficient upstream components. This lack of upstream components resulted in a severe decline of about 5% Q/Q in NAND flash bit shipments and offset the upward momentum generated by an increase in ASP. NAND flash revenue for 3Q21 reached a mere $1.11 billion, a slight 0.6% Q/Q increase.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter