DataCore Acquires MayaData

To accelerate container deployments for cloud-first enterprises with container storage software

This is a Press Release edited by StorageNewsletter.com on November 19, 2021 at 2:03 pmDataCore Software Corp. will acquire MayaData, Inc., the original developer of OpenEBS and developer of MayaStor.

The move follows a joint venture between the two companies in January 2020 that included funding, technology licensing, transfer of the DataCore container team to MayaData, and seats on the board of directors for DataCore’s CEO and primary investors. Today, MayaData and its entire San Jose, CA based team become part of DataCore.

Financial terms were not disclosed.

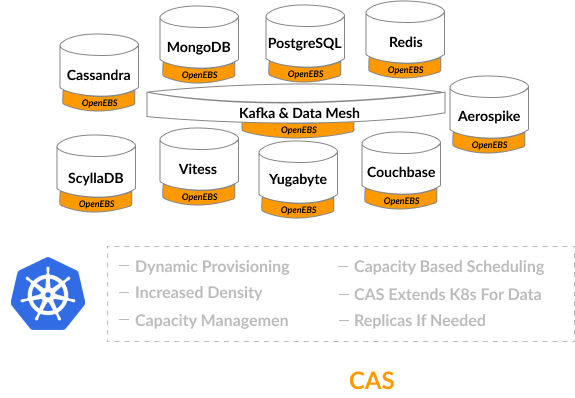

As more container workloads enter production, Container-Attached Storage has generated an interest for solving the problems of storage persistence, portability and performance that remain with container native approaches. OpenEBS is a Kubernetes-native Container Attached Storage solution that has generated enthusiasm among the cloud community and was adopted as a Cloud Native Computing Foundation (CNCF) initiative shortly thereafter its version 1.0 release.

Since then, the OpenEBS platform has seen adoption and rapid advancements in capabilities including MayaStor, the super-high-performance engine. The CNCF 2020 Survey cites OpenEBS as the #1 cloud-native storage software used in production. At the end of 3Q, OpenEBS has over 600,000 pulls per week – which represents 300% growth in 8 months – and was the top ranked container native storage solution being used or evaluated in a recent ad hoc Kubernetes developer poll. DataCore will continue to support and invest in OpenEBS and the community around it, as it accelerates product development and go to market activities.

With over half of IT organizations deploying containers in production, the 2 companies’ offerings now can help medium and large enterprises to simplify container technology with storage that’s purpose built for the scalability, availability, manageability, and security workload requirements of cloud-native container-based applications.

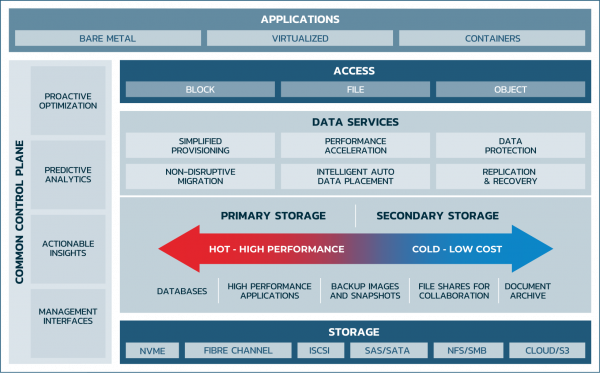

At the same time, DataCore can provide a one-stop shop resource for enterprise software-defined storage needs including block, file, and object storage. MayaData will benefit from DataCore’s engineering expertise, IP and patent portfolio, go to-market muscle, support organization, and relationships with DataCore’s channel.

In early 2019 DataCore became one of the first companies to offer a CSI interface for SDS, as the company recognized the importance of containers in the future, and the value of standardizing on a community-led interface like CSI. IT organizations that prefer to support container-based workloads with their existing infrastructure can do so with the CSI interface for SANsymphony. Alternately, cloud-native teams that prefer a native storage interface in the container stack will find ant option in OpenEBS.

“MayaData inside DataCore will have the technical resources to reach a wider community of enterprises, faster, while meeting the strict technical requirements of enterprise applications,” said Nick Connolly, technical lead for the CNCF Technical Advisory Group on storage and DataCore’s chief scientist.

“OpenEBS has become the de-facto standard for enterprise workloads on Kubernetes. OpenEBS is seeing millions of pulls every month, and every survey shows it has a good lead on other storage technologies, which reflects the technical superiority of its architecture,” said Kiran Mova, architect and maintainer of OpenEBS, who is also co-founder and chief architect at MayaData. “Joining DataCore will accelerate our plans to bring even more attractive capabilities to market.”

MayaData’s production customers include Bloomberg, Flipkart, Optoro. Its platform makes it simple to achieve availability, security, and scalability for enterprise-grade container workloads with workload-specific storage and increasing granularity and control. Backed by portability across clouds and hybrid environments with its OpenEBS deployments, MayaData users can run production applications on a container stack and gain performance and streamlined management at scale, backed by 24/7 support. With the addition of DataCore’s storage solutions, optimizations for NVMe, and tuning, MayaData customers can run stateful workloads on Kubernetes, move faster and save on IT costs.

“The rapid proliferation of containers has elevated the importance of IT teams finding the right container storage to fit application requirements,” said Dave Raffo, senior analyst, Evaluator Group. “That has led to the emergence of container-native storage, designed for DevOps’ storage and data services requirements. DataCore is moving into this space by acquiring MayaData and OpenEBS, and pledges to put its engineering force behind delivering OpenEBS MayaStor as a hardened enterprise product.”

“With this acquisition, DataCore is proud to remain the independent software-defined storage vendor with the broadest product offering spanning block, file, object, HCI, and now container-native storage – and the deepest IP portfolio, expertise, and technology,” said David Zabrowski, CEO, Datacore. “We are committed to investing in OpenEBS as an open-source technology, and expanding the community of users, developers, and contributors around it, while providing a streamlined path to leveraging container storage fast, easily and affordably. You’ll be hearing from us soon with additional solutions for this space.”

Comments

This announcement marks a milestone for DataCore's trajectory confirming the new era started a few years ago in 2018 with the arrival of Dave Zabrowski as CEO.

It also illustrated that his mission is really to shake the company's palm from being a hidden gem for 2 decades to a player that counts in the industry and finds a way to grow with much more visibility that should invite stakeholder to investigate an exit. Following Zabrowski's company, Cloud Cruiser, acquisition by HPE in 2017, it is crystal clear and for sure he would have not joined DataCore without a compelling schema in place.

The software firm was founded in 1998, and so far has raised $95 millions according to Crunchbase and it's still a private company. It acquired RTware in 1999, Demand Technology Software in 2000 and Caringo earlier this year, we'll come back to this below.

Back around the century, in fact a bit before, remember the SAN explosion with the storage virtualization wave with DataCore being one of the earlier vendors to deliver a block storage aggregation layer to unify various storage arrays exposed on the FC network. It was a period with players like FalconStor, Troika Networks, StorageApps, StoreAge, EMC Invista, TrueSAN, IBM SAN Volume Controller, Convergenet and many others... and the battle was around in-band and out-of-band technology implementation... it's a long and old story now. Some vendors disappeared, got acquired or just pivoted towards new models and solutions.

At the same time, the virtualization lost some of its storage association as server virtualization gained in popularity and the world completely forgot that we do virtualization for more than that and even the mainframe had and has a role in that. Never mind, a few years later, pushed by commodity of the self hardware, Linux and open source, appliance needs, standards. The SDS wave appeared and storage was one of the early winner of this, claiming that it is the new mantra for the sector. It's a fact, a reality, SDS is finally what all players do, they develop software and pick a go-to-market model to push their solution, either pure software or hardware with their embedded software. Someone said that software has eaten the market, the industry... everything, it's still true even for infrastructure and in storage in particular. What is true and we all believe that differentiator and value come from software.

But the market has evolved with VMs everywhere, now containers knocking the door of all companies, file storage continues to be largely used with the pressure of object storage and cloud is ubiquitous being a serious alternative to on-premises environments. Having said that, DataCore has missed something, it seems that they were glued into their block SDS model without the need, desire or capabilities to extend and go beyond, leaving real opportunities for others. It was one of the disconnect we saw for a long time, why and how DataCore management didn't jump into these adjacent sectors?

Sadly aligned with a company event, DataCore entered into a new era with the arrival of Zabrowski. Immediately we got the feeling that something is happening, promoting a new vision with DataCore ONE, new components, layers and services. We understood that the company wished to enter into the appliance market with a HCI solution but rapidly realized that this market is controlled by a few gorillas and success required a giant effort. Our recent talk with Zabrowski confirmed that this axis was tough and the decision finally obvious to rationalize development effort and address other growing markets and not saturated ones. This product disappeared but the product strategy was set and has triggered an interesting decision with the acquisition of Caringo, a pioneer and well respected object storage vendor, Hammerspace partnership with an OEM agreement for file storage available as DataCore vFilO and the investment, with Insight Partners, into Maya Data, a developer of persistent storage for container-based workload and applications. The playbook was set and elements are all in place for a new DataCore.

This summer, the arrival of Abhijit Dey as chief product officer, makes a new step in that dimension, having spent almost 20 years at Veritas, before, during and after Symantec era. He's in a role to transform the product DNA and story at DataCore, leveraging of course SANsymphony but also new developments and partnerships around Swarm, Caringo's object storage software, and container-attached storage (CAS) axis. Dey told us that clearly Swarm has to become an ubiquitous object storage solution on the market both for primary and secondary storage workloads and especially for data protection. It is illustrated by recent backup and archiving software validations, Atempo, Commvault, iTernity, Veritas, Versity and Veeam are done, players such CTera Networks as well, now we wait Rubrik and others.

Swarm will also be used as foundational storage layer for multiple purposes being exposed with industry standard file sharing protocols such NFS, SMB and S3. As Caringo did in the past with some success, vertical integrations with industry solutions are key, so we anticipate healthcare, oil and gas, financial services, solutions around Swarm. On the file side, it will be a mix, Swarm already has Swarm[N]FS service layer and it has its place in the product line. FileFly, just announced with the 4.0 release, addresses the glue between object, file and cloud, both full on-premises or hybrid. vFilO is also critical and represents the file storage strategy with both what we just said about Swarm and with the contribution of Hammerspace product. Market studies confirm that users want solutions that give them the choice between file and object access to the same content without duplicating it.

When we learned that DataCore invested into MayaData, we thought that it was a good new iteration of the DataCore ONE strategy but we were surprised to not see an acquisition as they leave on the table developments for everyone as an open source product.

Founded in 2017, MayaData (formerly CloudByte) has raised $32.1 millions with a venture round in 2020 with the active participation of Insight Partners and DataCore.

Of course we get the idea of a community and enterprise edition to create differentiators and make product and service revenue but it seems to us that that piece was not fully terminated. With OpenEBS, MayaData is recognized as one of the strong player in the domain to address data persistency for cloud-native applications, key for large adoption. It also confirms that CSI is not enough to fully receive the benefits of this application deployment model. The market is enormous and Dey confirmed: "DataCore has to acquire this company and owns the technology to be considered as a key player in the domain". Leaving MayaData independent doesn't solidify DataCore's image, DataCore must have MayaData as an internal asset to contribute to its image exclusively.

On the business side, the channel opportunity with this new portfolio is tremendous, new partners should arrive, current ones will increase their users footprint with Swarm, vFilO and CAS from MayaData.

Short note: the storage industry is remarkable in recycling acronym, we used the CAS term for Content Addressable Storage, sometimes Aware, at the time of disk archiving appeared almost 20 years ago when Filepool got acquired by EMC and became Centera, it was the early days on what we know today as object storage with http data access protocol. At that time we heard about Archivas, Bycast or Permabit all acquired companies.

DataCore current portfolio and its ONE vision illustrates once again the U3 - Universal, Unified and Ubiquitous - model introduced a few years ago serving to qualify products and solutions capabilities in these 3 dimensions.

On the market side, Red Hat is a gorilla here with VMware and a few others large storage players promoting CSI for many of them or dedicated offering like EMC ObjectScale, Portworx was acquired by Pure Storage more than a year ago, later Rancher Labs by SUSE, now MayaData by DataCore. Robin.IO has strong partnerships with IBM for instance and we'll see where Robin, Diamanti, Ondat, Arrikto, Storidge, Linbit, even things like Rook or players like Ionir or MinIO could land. It has become a red ocean even if the adoption is around the famous chasm... but again the potential is enormous and represents the future of the IT model for many users and companies.

We'll monitor carefully the new DataCore and see if the late comer theory could be applied here.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter