StrongBox Data Solutions Out of Market?

Partner One Capital tries to reboot company.

By Philippe Nicolas | November 9, 2021 at 2:02 pmEarthquake at StrongBox Data Solutions, Inc. (SBDS) as we just learned that the company has entered into a tough time with the brutal and sudden decision by its owner, Partner One Capital, to re-initialize the company. The financial investor has fired the management layer and other key employees in a very rapid way. It was confirmed by a recent talk with past employees.

So far the leadership page on its website returns an error as shown below illustrating a real management hole and a transition period.

The story of the company appears to be a bit fuzzy. It seems that the adventure has been initiated at Crossroads Systems around developing initially StrongBox-as-a-NAS LTFS appliance. Around 2008, the project has evolved into a new entity named StrongBox Data Solutions (SBDS) promoting this appliance. Later the firm started the development of a radical new data management solution named StrongLink being the answer to data lifecycle challenges for large data centers with a product coupling storage resource management, data management and data protection capabilities. It has been acquired by Partner One Capital in March 2016 masking the background acquisition of Crossroads Systems for $2 million by SBDS thanks to its financial arm. SBDS raised $27 million in 2017, round lead by Fonds de Solidarité FTQ based in Quebec, Canada. Since that move from the Canadian entity, SBDS has its HQ in Montreal, Quebec, Canada. We understand that Partner One Capital goal is to build a significant data management player and find a big exit. We’ll see.

It turns out that even with a very comprehensive solution, SBDS continued to be very confidential addressing specific high-end projects trying to change its visibility at the same time. It was tough, it is tough as several customers didn’t wish to be mentioned and the business trajectory has invited Partner One Capital to reconsider its plan for the firm.

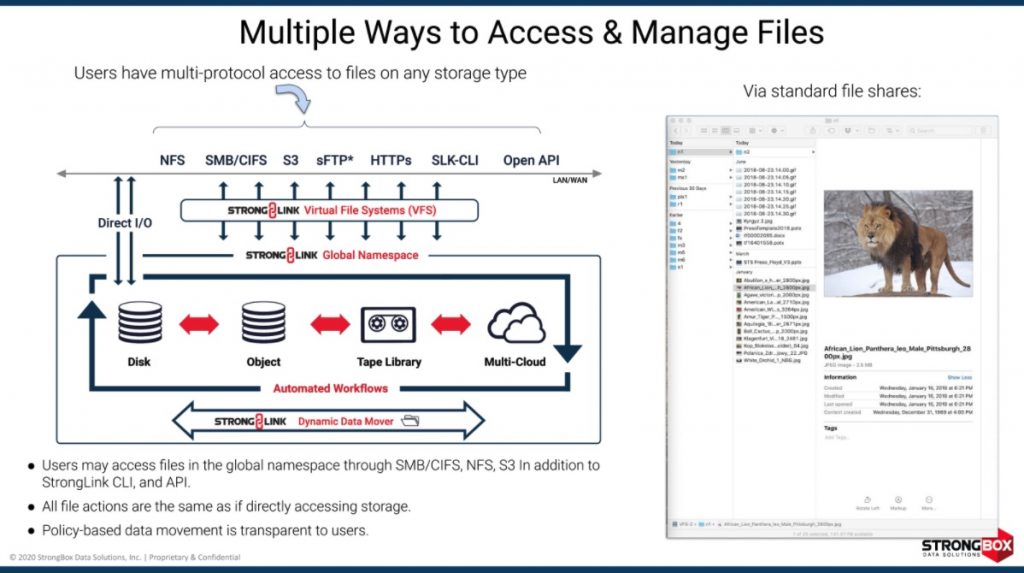

This abrupt trajectory is paradoxal as data management is a hot segment, we should say a red ocean, in the storage industry with at least 40 players illustrating a very active market but also confirming some difficulties for small actors to survive, promote a new approach and finally find the right path to success. Having lots of competitors from other agile players and gorillas finally make life very tough. In the case of SBDS it’s really incredible as the company develops a pretty unique product – StrongLink – on the market solving real challenges with key features and capabilities. Its success at Amadeus, DKRZ, Boeing, Bosch, Dreamworks, Fannie Mae, Hasbro, Lockheed Martin, NASA, Canon, Sony Pictures, E*Trade, The British Museum, Library of US Congress, US National Archives and Records Administration, ETH Zurich, University of Michigan or Notre Dame, the MLB to name a few, all with very challenging projects with strict IT needs confirmed that it was almost impossible to choose an alternative solution that meet all required functions.

So what this installed base will do now? It is a fantastic opportunity for competitors to try to replace StrongLink and it will be a mission. Who are the alternative solutions, from point product to more global approach? it won’t be so easy to find a perfect match. So we try to list some alternative solutions that compete with StrongBox and especially with StrongLink and we let users make their own choice by testing the product and checking features not all equal. Here is the list: Aparavi, Arcitecta, Atempo, Cohesity, Congruity360, Data Dynamics, Datadobi, Dell, FujiFilm, Hammerspace, IBM, Komprise, Grau Data, HPE with DMF, HPSS, Moonwalk, NetApp, Nodeum, Point Software and Systems, Quantum, QStar, Rubrik, Spectra Logic, Tiger Technology or Versity. We must mention that the tape dimension is critical for large environments and not all of these products support tapes.

We can list technologies as well from companies like Seven10 acquired by Congruity360 in 2020, Igneous with assets acquired by Rubrik also in 2020, ClearSky Data swallowed by AWS end of 2019 or the collapse of InfiniteIO in 2020. Interestingly Mark Cree, founder and CEO of InfintieIO, Lazarus Vekiarides, CTO of founder at ClearSky, Christian Smith, former VP product at Igneous, all work at AWS today, Ellen Rubin, CEO and founder of ClearSky, spent also almost 1.5 years at AWS to finally leave in June 2021.

This story is not over with such interesting product features set and installed base, with $50 to $100 millions on the table, SBDS should land in a different field to start a new life. As said, competition and even potential users can ignore a small company even with a good product but it would be tough and even ridiculous to ignore the product within a~cr line from a giant or gorilla player supporting a portfolio effect especially if that vendor is already in the place. Bids are open, think about this if Dell, IBM, NetApp, HPE or Veritas even Hitachi Vantara or Oracle decide to make an offer and then acquire the product, the potential impact would be significant with a change of market positions.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter