Dell: Fiscal 2Q22 Financial Results

Dell: Fiscal 2Q22 Financial Results

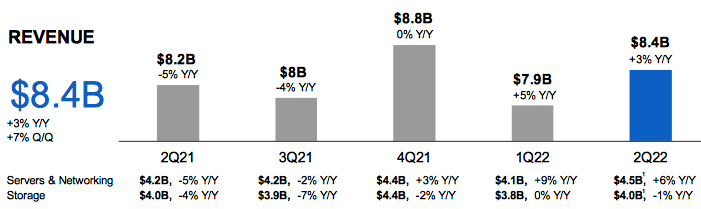

7th consecutive quarter with Y/Y storage revenue down or flat, but only -1% for most recent period

This is a Press Release edited by StorageNewsletter.com on August 30, 2021 at 1:32 pm| (in $ million) | 2FQ21 | 2FQ22 | 6 mo. 21 | 6 mo. 22 |

| Revenue for storage only |

4,011 | 3,970 | 7,833 | 7,772 |

| Growth | -1% | -1% |

Dell Technologies, Inc. announces record global financial results for its fiscal 2022 second quarter.

The period is the best second quarter in company’s history with total revenue of $26.1 billion, up 15% Y/Y.

But it’s much more different for storage as this quarter is the seventh consecutive one with Y/Y revenue down, but this time only 1% (at $3,970 million), like in 1FQ22.

It’s once more obvious that the integration of huge acquisition of EMC is not a success as storage revenue stable and lower in percentage than the WW market since many quarters.

Infrastructure solutions group

On an orders basis, the firm nevertheless saw positive overall storage growth of 2%, with ongoing demand in high-growth areas like HCI where VxRail orders were up 34%, and in mid-range storage, where orders were up 17%. PowerStore continues to ramp, making up approximately 38% of mid-range storage portfolio. 23% of PowerStore customers in 2FQ22 were new.

A Dell’s executive said: “We are focused on the midrange segment of storage and are pleased with the momentum we are seeing, but we know we still have work to do. When server and storage calendar 2Q share data is released in September, we expect share gains in both markets.”

Storage revenue of Dell

(in $ million)

| Period | Revenue | Y/Y growth |

| FY11* |

2,295 |

5% |

| FY12* |

1,943 |

-15% |

| FY13* |

1,699 |

-13% |

| FY14* |

1,518 |

-11% |

| FY15* |

1,437 |

-5% |

| FY16* |

2,217 |

54% |

| FY17** |

8,942 |

303% |

| FY18 | 15,254 |

+71% |

| FY19 | 16,767 | +10% |

| 1FQ20 | 4,022 | -1% |

| 2FQ20 | 4,184 | 0% |

| 3FQ20 | 4,184 | +8% |

| 4FQ20 | 4,487 | -3% |

| FY20 | 16,767 | -0% |

| 1FQ21 |

3,758 | -7% |

| 2FQ21 |

4,011 | -4% |

| 3FQ21 |

4,149 | -7% |

| 4FQ21 |

4,409 | -2% |

| FY21 |

16,091 | -4% |

| 1FQ22 | 3,802 | 0% |

| 2FQ22 | 3,970 | -1% |

* Without EMC

**without EMC for 1FQ17 and 2FQ17 following acquisition for $63 billion

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter