Another Interesting Comment on WD/Kioxia Deal

Combined entity would be huge player, only narrowly trailing market leader Samsung in market share.

This is a Press Release edited by StorageNewsletter.com on August 30, 2021 at 1:32 pm Author of this report is Walt Coon, VP of NAND and memory research, Yole Développement, who spent 16 years at Micron Technology, managing the team responsible for competitor benchmarking, and industry supply, demand, and cost modeling.

Author of this report is Walt Coon, VP of NAND and memory research, Yole Développement, who spent 16 years at Micron Technology, managing the team responsible for competitor benchmarking, and industry supply, demand, and cost modeling.

Renewed rumors of a Western Digital/Kioxia tie-up – NAND consolidation update

With the report from The Wall Street Journal (WSJ) on August 25, 2021 that Western Digital is in advanced talks to merge with its longtime NAND manufacturing and technology partner Kioxia in a $20+ billion deal, it is once again time to revisit the consolidation scenarios that Yole Développement (Yole) presented at the Flash Memory Summit (FMS) in August of 2019.

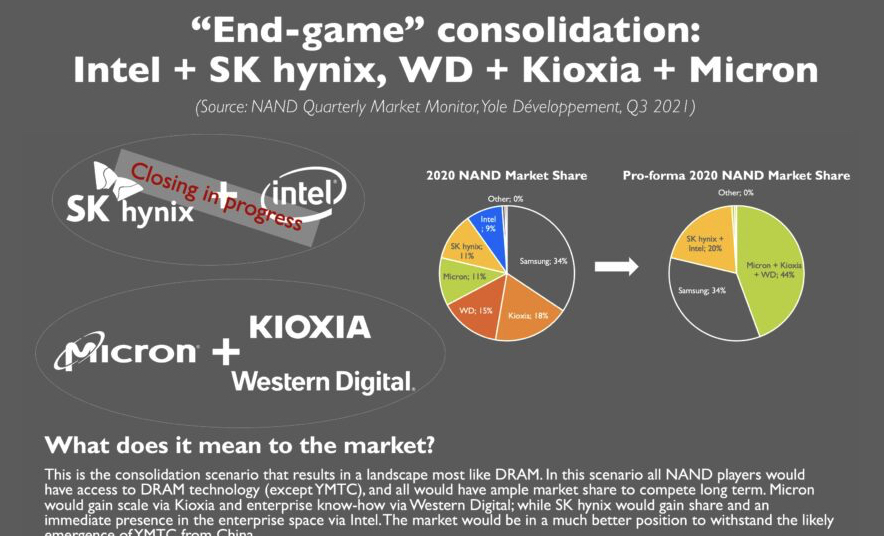

Based on Yole’s NAND Quarterly Market Monitor, this presentation included a consolidation scenario that moved the NAND market structure closer to that of the DRAM industry. Part one of this scenario included the combination of SK hynix Inc.’s and Intel Corp.’s NAND businesses, while the next part involved some combination of Micron Technology Inc., Western Digital Corp., and Toshiba Memory Corp. (which is now Kioxia Corp.).

“We labeled that as the ‘End-game Consolidation’ scenario, with the hope that the industry would become healthier, allowing the suppliers to generate sustainable profits to support the billions of $s of investments needed each year to keep moving the technology forward,” says Coon.

With the announcement on October 20, 2020 of SK hynix’s acquisition of Intel’s NAND business-including its Dalian factory in China, its NAND-related IP, and its SSD business-for $9 billion, that analysis by Coon’s team at Yole turned out to be correct. This deal currently awaits final regulatory approval from China.

Western Digital’s potential merger with Kioxia is a much bigger step, combining 2 larger players at a rumored cost of $20+ billion in an all-stock transaction. With Western Digital’s market capitalization currently in the $19 billion range and with $5 billion in net debt, this is a heavy price to pay. According to WSJ, the new entity would be led by Western Digital’s CEO David Goeckeler and could occur as soon as mid-September 2021.

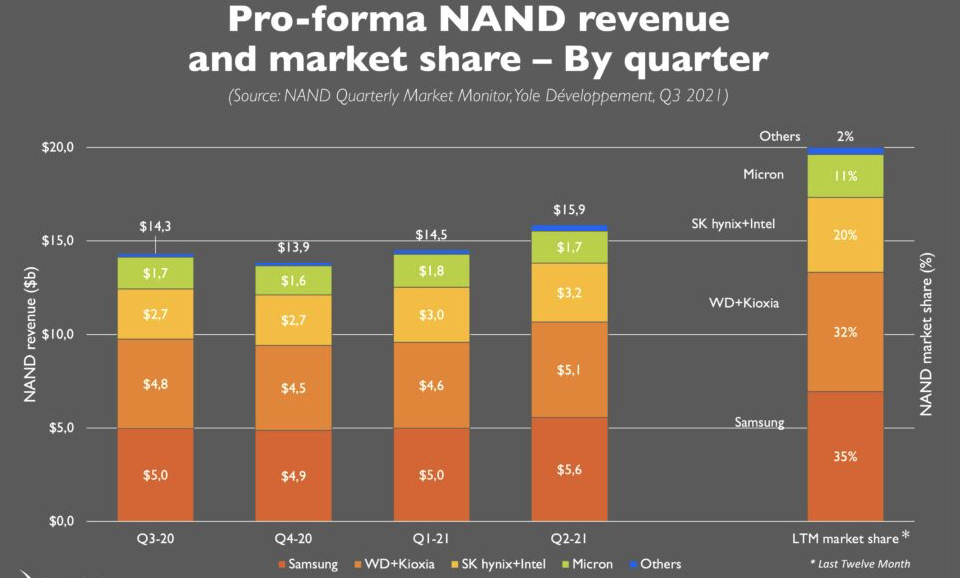

This deal would move the market one step closer to the ‘end-game’ consolidation scenario as presented by Yole at FMS 2019. The combined entity would be a huge player in the market, only narrowly trailing market leader Samsung in terms of market share.

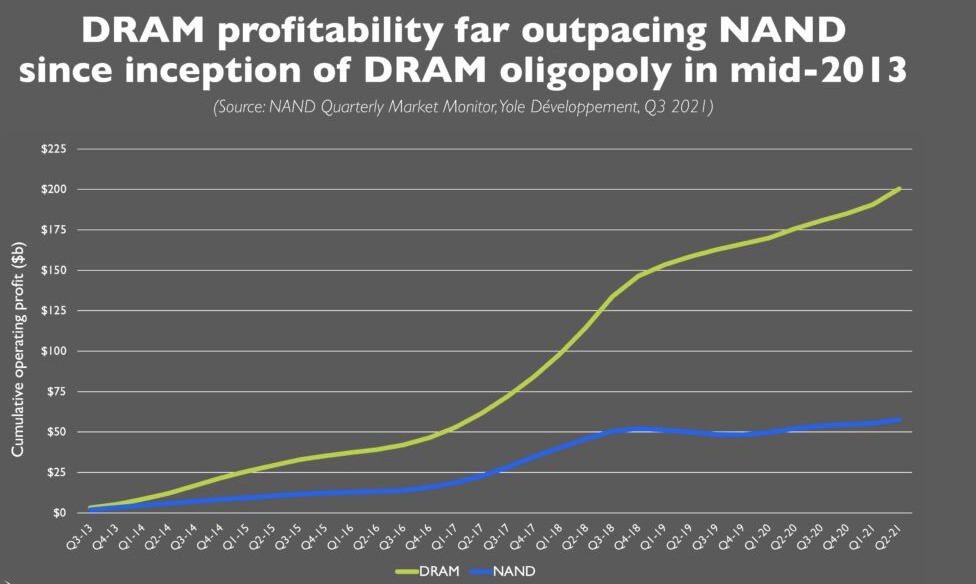

The proposed merger would not likely disrupt the market from a supply perspective in the short term, as the 2 companies already share the same technology and manufacturing facilities. However, Kioxia and Western Digital compete across multiple end markets, and removing one player from these highly competitive segments would certainly be a positive for the remaining suppliers. In addition, over the long-term fewer players in this highly capital intensive industry should result in better management of supply, similar to what occurred in the DRAM industry post-consolidation.

The new entity would lack DRAM, limiting access to the large mobile multi-chip package (MCP) market and leaving it without the DRAM profits utilized by its peers to withstand NAND market volatility. This could be especially important in the coming years as the NAND market could experience added turbulence caused by an influx of supply arriving from China’s YMTC.

For these reasons, Yole believed Micron was the preferred suitor for both Kioxia and Western Digital. If the rumored merger goes through, Micron will be left in a challenging position as the smallest remaining NAND player, at roughly half the size of the next closest competitor.

This may provide further motivation to pursue what would be a very costly consolidation path or other strategic options with existing competitors, which could include SK hynix or YMTC.

Given its limited manufacturing scale relative to the other suppliers, Micron could also decide to narrow its market focus to strategic segments where it can optimize its strengths and take advantage of potential synergies with its large DRAM business.

Assuming Western Digital and Kioxia reach an agreement, several hurdles to this rumored deal remain. These include the significant cost to the acquiring company and likely challenges with regulatory approvals, with strained relations between the US and China acting as a potential roadblock.

As WSJ mentioned, several recent high-profile acquisitions have been blocked by Chinese regulators, including Qualcomm Inc.’s proposed acquisition of NXP Semiconductors NV in 2018. However, it is feasible that China may view the combined market share having no change compared to the current JV structure, which would increase the likelihood for approval. Additionally, this deal will need the blessing of the Japanese government, as it will look to protect one of its key technology assets.

Given these challenges, it would not be surprising if the deal fails to materialize and Kioxia proceeds with an IPO in the not-too-distant future (or turns to other potential suitors). Regardless of the outcome, the need for consolidation is clear.

A more balanced and consolidated industry should lead to healthier market dynamics, as we have witnessed in the post-consolidation DRAM industry, providing the suppliers the financial resources to support the massive investments required to continue driving the technology forward.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter