Micron: Fiscal 3Q21 Financial Results

Micron: Fiscal 3Q21 Financial Results

+19% Q/Q and +36% Y/Y for revenue driven more by DRAM than NAND

This is a Press Release edited by StorageNewsletter.com on July 2, 2021 at 2:33 pm| (in $ million) | 3Q20 | 3Q21 | 9 mo. 20 | 9 mo. 21 |

| Revenue | 5,438 | 7,422 | 15,379 | 19,431 |

| Growth | 36% | 26% | ||

| Net income (loss) | 803 | 1,735 | 1,699 | 3,141 |

Micron Technology, Inc. announced results for its third quarter of fiscal 2021, which ended June 3, 2021.

3FQ21 highlights

• Revenue of $7.42 billion vs. $6.24 billion for the prior quarter and $5.44 billion for the same period last year

• GAAP net income of $1.74 billion, or $1.52 per diluted share

• Non-GAAP net income of $2.17 billion, or $1.88 per diluted share

• Operating cash flow of $3.56 billion vers$3.06 billion for the prior quarter and $2.02 billion for the same period last year

“Micron set multiple market and product revenue records in our third quarter and achieved the largest sequential earnings improvement in our history,” said president and CEO Sanjay Mehrotra. “Our industry-leading 1α DRAM and 176-layer NAND now represent a meaningful portion of our production, and Micron is in the best position ever to capitalize on the long-term demand trends across the data center, intelligent edge and user devices.”

Comments

Highlights

- Strong execution enabled the company to achieve its largest sequential EPS improvement in history and set multiple revenue records

- NAND hit record revenue, propelled by record mobile MCP, consumer SSD, and client SSD revenues

- Embedded business exceeded $1 billion for the first time, with record revenue across automotive and industrial markets

- 1α DRAM and 176-layer NAND reached a meaningful portion of bit production, and QLC NAND accounted for as majority of client SSD bit shipments

- Firm expect DRAM and NAND supply to remain tight into CY22

DRAM

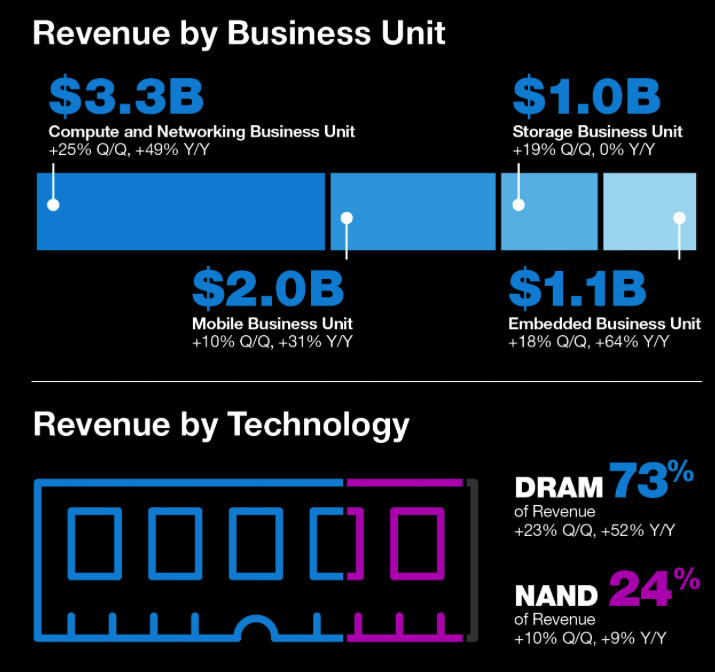

- 73% of total revenue in 3FQ21

- Sales up 23% Q/Q and 52% Y/Y at $5.4 billion

- Bit shipments up low-single-digit percent range Q/Q

- ASPs up 20% Q/Q

NAND

- 24% of total revenue in 3FQ21 at $1.8 billion

- Sales up 10% Q/Q and 9% Y/Y

- ASPs up high-single-digit percent range Q/Q

- 176-layer NAND node accounted for a meaningful portion of bit production in 3FQ21 and on track to become also a meaningful portion of revenue in 4FQ21

- Driving an increased mix of QLC NAND; delivered record QLC SSD revenue and bit mix in 3FQ21

- Data center SSD bit shipments and revenue grew sequentially, driven by cloud and enterprise.

- Client SSD for PC market bit shipments were up sharply Q/Q and Y/Y

Revenue by business unit

- For the compute and networking business unit, it was $3.3 billion, up approximately 25% Q/Q and 49% Y/Y. This growth was driven by broad-based sequential pricing increases.

- For the mobile business unit, it was $2 billion, up 10% Q/Q and 31% Y/Y. Mobile demand remained healthy as 5G handset sales continue to ramp.

- For the storage business unit, it was $1 billion, up 19% from the prior quarter and flat Y/Y. Both client and consumer SSD revenues set records.

- The embedded business unit generated record revenue of $1.1 billion, which was up 18% Q/Q and 64% Y/Y. Automotive and industrial revenues were at an all-time high.

Outlook

- Targeting to align long term bit supply gowth growth CAGR with the industry bit demand growth CAGR across DRAM and NAND

CY21 DRAM and NAND Micron bit supply growth expected to be below industry demand growth - Placed orders for multiple EUV tools from ASML as part of long term agreement

- FY21 Capex revised to somewhat above $9.5 billion; mostly from areas that don't impact CY21 and long payments, construction spending and other R&D and corporate items

Non-GAAP guidance

Expected revenue to be $8.2 billion, plus or minus $200 million or +8% to 13% Q/Q; gross margin to be in the range of 47%, plus or minus 100 basis points; and operating expenses to be approximately $900 million, plus or minus $25 million.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter