DRAM and NAND Prices to Continue Rising in 3Q21

As suppliers keep low level of inventory.

This is a Press Release edited by StorageNewsletter.com on June 10, 2021 at 2:33 pmMemory suppliers are currently carrying a relatively low level of inventory because of aggressive stock-up activities of clients across different application segments in 1H21, according to analyst firm TrendForce, Inc.

More specifically, inventories of DRAM suppliers and NAND flash suppliers are averaging 3-4 weeks and 4-5 weeks, respectively. The overall procurement of server memory products is expected to intensify in 3Q21, so memory suppliers do not see the necessity in lowering quotes to drive sales.

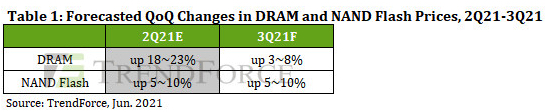

It is forecasted that DRAM prices will rise further by 3-8% Q/Q for 3Q21. On the other hand, thanks to the growing demand for enterprise SSDs and NAND flash wafers, the analyst firm has also corrected up the magnitude of the Q/Q increase in NAND flash prices for 3Q21 to 5-10% (compared with the previous projection of 3-8%).

High inventory may pose potential risk for smartphone brands in 2H21 due to decreased smartphone production targets

Under the market spotlight are smartphone brands and notebook manufacturers, which drastically differ in their inventory levels. Regarding the smartphone market, TrendForce has already lowered the Y/Y growth rate of the global total smartphone production in 2021 to 8.5% from the previous projection of 9.4% as the second wave of the Covid-19 pandemic takes place across India. Presently, smartphone brands are carrying 8-10 weeks of inventory on average for DRAM and NAND flash.

Two newly emerged factors are generating some concerns about the high level of inventory. First, Chinese brands have lowered their production targets and begun to adjust inventories in order to address the issue of component gaps. Second, Southeast Asia is bracing for a resurgence of Covid-19 outbreaks that could disrupt smartphone production and weaken consumer demand.

PC OEMs are holding up to 10 weeks’ worth of DRAM inventory on average; price hike of PC DRAM in 2H21 will likely be limited as a result

Regarding the notebook market, on the other hand, PC OEMs are currently carrying about 8-10 weeks’ worth of DRAM inventory on average, with some PC OEMs having an even higher inventory level, primarily because the stay-at-home economy this year will continue to propel the demand for notebook computers, about 238 million units of which are expected to be produced this year, a 14.3% increase Y/Y. Furthermore, in view of the shortage of components in the upstream supply chain, including audio CODECs, analog ICs, power ICs, MCUs, and LED drivers, PC OEMs are anticipating that DRAM will be in similar shortage as well, thus potentially leading to an inability to manufacture notebooks.

In response, PC OEMs are therefore prompted to expand their DRAM procurement in 1H21.

On the NAND flash front, the persistent shortage of NAND flash controller ICs means that PC OEMs generally carry about 4-5 weeks’ worth of NAND flash inventory on average, which is relatively lower than their DRAM inventory.

TrendForce forecasts that Chinese smartphone brands will slow down their procurement of mobile DRAM and NAND flash solutions during 2H21. However, contract prices of memory products on the whole will unlikely experience a general decline in the second half of the year because demand remains fairly robust in other application segments. On the PC and NB front, changes in the fulfillment rates of components that are in shortage will become the key determinant of how PC OEMs evaluate their inventory of well-stocked components. It should be pointed out that, as PC OEMs have been maintaining a relatively high inventory of DRAM, the increase in PC DRAM prices in 2H21 will be markedly muted as a result.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter