2020 Revenue of $400 Million for DDN

Said to be world's largest private storage company.

This is a Press Release edited by StorageNewsletter.com on February 26, 2021 at 2:19 pmDataDirect Networks, Inc. announced record annual revenue of $400 million and its highest ever profitability in 2020.

With an install base of more than 11,000 customers and a global network of resellers and distributors, the company delivered 52% in revenue growth from 2018 to 2020 under its DDN and Tintri brands.

2020 also marks the fifth consecutive year of customer expansion, and revenue and profitability growth for the company.

While global pandemic challenges touched the lives of everyone across the globe, DDN’s Intelligent Infrastructure solutions played a role in helping many of leading science and research facilities identify, prevent, treat, and pave the path to eradicate Covid-19. DDN’s storage systems at St. Jude Children’s Research Hospital and The Sanger Institute (COG-UK) consortium, are 2 examples of research facilities relying on the vendor to intelligently process massive amounts of data and deliver scientific breakthroughs.

“In 2020 we grew DDN’s topline to $400 million, delivering our best financial performance ever, and for that we thank our wonderful customers, partners and DDN team members. In addition, with a 65% increase in our R&D investments for the last two years, we continue to be fully committed to long term technological innovation,” said Alex Bouzari, CEO and co-founder. “However, we are most proud of having delivered technology which played a part in helping develop Covid-19 vaccines, curtailing the spread of the devastation caused by this disease, and ultimately saving many lives.”

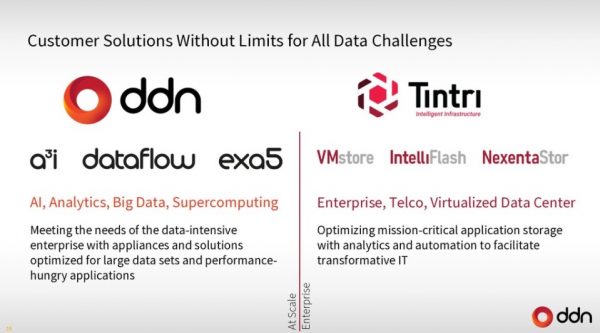

DDN solutions are deployed across enterprise at scale, AI and analytics, HPC, government and academia. 30% of the automobile and aerospace manufacturers, 40% of leading investment banks, 50% of the world’s largest oil and gas facilities, 70% of the top 500 HPCs and 100% of the world’s largest service providers use Intelligent Infrastructure products and solutions. Along with its Tintri Enterprise division, DDN continues to innovate in new markets, such as autonomous driving, AI and hybrid cloud, growing its overall enterprise revenue by more than 600% since 2018.

The measure of DDN and Tintri value is in helping its customers achieve success through advanced storage and Intelligent Infrastructure solutions, while reducing customer operating costs by up to 95% and saving them billions of dollars annually.

Comments

DDN world's largest private storage company? We doubt. At least 2 other private storage firms - but in software -, Veeam and Veritas, surpass $1 billion yearly in revenue. But it's true that it occupied ≠1 place in storage hardware.

Founded in 1998 following a merger between MegaDrive Systems and ImpactData, the company is historically known to be a leader in HPC storage and more globally for scientific and technical environments. Famous for its fast block storage array, remember S2A and later SFA. The team recognized the need to provide also optimized high performance file storage based on Lustre and IBM GPFS parallel file systems. EXAScaler and GRIDScaler were born and have extended the reputation of the company. Later DDN iterated on object storage first as Bucket FS in 2008 to become WOS in 2009. Adding all these flavors qualified DDN as a U3 player developing Unified, Universal and Ubiquitous solutions.

And the end-to-end portfolio with a real BFO - block, file and object - approach explains company's success. Products are globally used by the top research centers, universities and enterprises having serious storage challenges.

In the trajectory of the company, a few years ago, one episode some people have in mind revealed a management mistake that has weakened the business but it was rapidly solved by Alex Bouzari and Paul Bloch.

As a market opportunity, HCI was attractive and DDN decided to make a try with its Wolfcreek product but its adoption didn't reach original expectations.

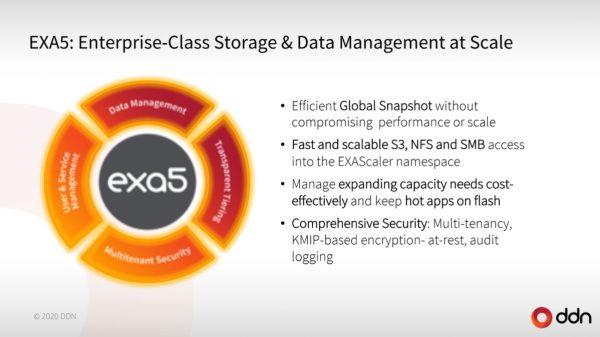

The management recognized for quite long time that the file system service really structures storage and secures the business relation between the vendor and users. IBM changed its license agreement for GPFS, now Spectrum Scale, and accelerated DDN's decision to "own" its file system. DDN then acquired Whamcloud, the Intel Lustre business division, that is now exclusively promoted by the company with the last iteration ExaScaler 5. Therefore GRIDScaler was eoled.

IO performance is almost synonymous of DDN and we have to mention IME - Infinite Memory Engine - its burst buffer based on NVM.

The team has jumped into AI as a natural fit and extension for its fast file storage line being a read intensive type of workload. They develop A3I as an integrated solution with Nvidia DGX systems and iterated with SuperPod in 2020. DDN is also one of the rare vendor that officially partners with Nvidia for GPU Direct Storage. The two others are Vast Data and WekaIO and there are some interesting results from Pavilion Data.

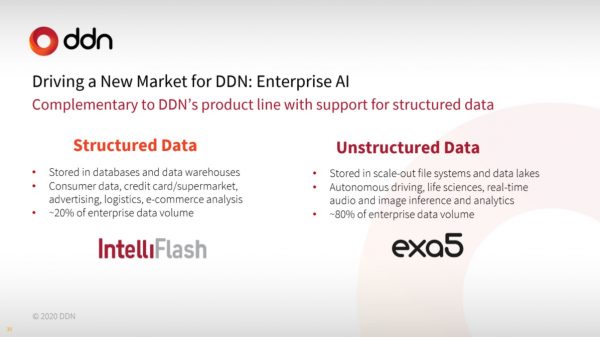

HPC has entered the enterprise for specific use cases and it was a segment globally ignored by DDN leaving millions to others. This triggered a real strategy illustrated by 3 acquisitions, we should say bargains, Tintri, Nexenta and IntelliFlash, the latter coming from WDC following the acquisition of Tegile Systems in 2017. WDC tried to build a system business that finally never took off, the company also sold ActiveScale to Quantum early 2020, the object storage product came from Amplidata acquisition by HGST, WDC subsidiary, in 2015.

And it's a winning idea as adoption is good. DDN has also adopted a new logo to indicate the start of a new era. Tintri, as a well respected brand, was kept as the enterprise business entity name promoting VMstore and the rest. IntelliFlash General File Services is an example of integration of NAS between Nexenta and IntelliFlash. Recent VMstore iteration towards database is a clever move surfing on the success of VMstore for VM, it makes sense.

These various product facts and market trends confirm once again the convergence of HPC and enterprise with features coming from each side to feed products on the other side. DDN continues to play a dual game with commercial and open source software. And simply it means a real push of ExaScaler with enterprise features to enterprises. In other words when the demand is related to unstructured data the answer is ExaScaler and for structured one it's IntelliFlash.

For 2 years in a row, Coldago Research elects DDN as a leader in file storage for HPC and enterprises.

Before concluding, we have to mention DDN's cloud strategy. It is addressed as well as a real multi-cloud offering available on AWS, Azure, GCP and on-premise of course. GCP recommends ExaScaler for HPC storage needs.

In 2021, it is expeced to see VMstore iteration around new databases like Oracle, some cloud mobility especially for AWS and new NVMe flavors. IntelliFlash should also received a major refresh related to security and data protection on any kind of product instance. And we think the team is working on something big again very U3 oriented...

We can't say it's just the beginning but DDN has entered into a new era.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter