Quantum: Fiscal 3Q21 Financial Results

Quantum: Fiscal 3Q21 Financial Results

Revenue grew 14% Q/Q and decreased 5% Y/Y, not profitable since 4 quarters.

This is a Press Release edited by StorageNewsletter.com on January 29, 2021 at 2:22 pm| (in $ million) | 3Q20 | 3Q21 | 9 mo. 20 | 9 mo. 21 |

| Revenue | 103.3 | 98.0 | 200.4 | 153.6 |

| Growth | -5% | -23% | ||

| Net income (loss) | 4.8 | (2.7) | (1.4) | (18.0) |

Quantum Corporation announced financial results for its fiscal third quarter ended December 31, 2020.

3FQ21 Financial Summary

• Revenue grew 14% sequentially to $98.0 million

• Gross margin was 43.1%

• GAAP net loss was $2.7 million, or ($0.07) per share

• Non-GAAP adjusted net income improved to $0.01 million, $0.00 per share

• Adjusted EBITDA increased $0.6 million sequentially to $9.4 million

Jamie Lerner, chairman and CEO: “Revenue in the third quarter once again exceeded our guidance due to continued growth across our traditional market verticals, including with our hyperscale customers, as well as an initial recovery in our Media and Entertainment business, coupled with increasing evidence that our new strategy is resonating with customers. Notably, the higher-than-expected revenue resulted in continued improvement in adjusted EBITDA and our achievement of breakeven on an adjusted basis ahead of plan. These accomplishments are particularly noteworthy considering the higher sales and channel expenses incurred in the quarter to support our new product introductions as well as the expansion of our leadership team.”

“In addition to our strong financial results, our business transformation continued with the introduction of multiple new products to classify, manage and protect unstructured data, on premise or in the cloud. We closed our first ATFS and StorNext 7 deals with the subscription software pricing, and we expect these solutions will drive a growing contribution of recurring revenue and higher margins, while also increasing the total addressable market of Quantum’s solutions. Also during the quarter, we further expanded our software offerings through the acquisition of Square Box Systems, including its flagship product, CatDV, a software platform that leverages artificial intelligence and machine learning technology to catalog and analyze digital assets.”

“Looking ahead to 4FQ21, we expect to continue our recent momentum and are guiding for another quarter of solid operating performance in what has historically been a seasonally weak quarter for Quantum, driven by a combination of ongoing operational execution and incremental traction across our market verticals, including with our leading hyperscale and global web scale customers.”

3FQ21 vs. 2FQ21

Revenue increased 14% to $98.0 million for 3FQ21, exceeding the guidance of $91 million to $95 million.

Gross profit was $42.3 million, or 43.1% of revenue, compared to $38.7 million, or 45.1% of revenue, in the prior quarter. The decrease in gross margin reflected the higher product revenue in the quarter, which was comprised of a less favorable product mix.

Total operating expenses in 3FQ21 were $36.2 million, or 36.9% of revenue, compared to $35.2 million, or 41.1% of revenue, in the prior quarter. Selling, general and administrative expenses were $26.4 million in the quarter, compared to $23.4 million in the second fiscal quarter. Research and development expenses were $9.6 million in3FQ21, compared to $10.2 million last quarter.

GAAP net loss in 3FQ21 was $2.7 million, or ($0.07) per basic and diluted share, compared to a net loss of $4.6 million, or ($0.11) per share, in the second fiscal quarter. Excluding stock compensation, restructuring charges and other non-recurring costs, non-GAAP adjusted net income in 3FQ21 improved to $0.01 million, or $0.00 per basic and diluted share, compared to an adjusted net loss of $0.2 million, or ($0.01) per basic and diluted share last quarter.

Adjusted EBITDA in 3FQ21 increased to $9.4 million, compared to $8.9 million in the prior quarter.

Comments

Revenue increased 14% sequentially to $98 million (but down 5% Y/Y), exceeding guidance of $91 million to $95 million, and compared to $85.8 million in the previous fiscal quarter.

It represents second quarter of sequential growth after two periods of high decreased sales.

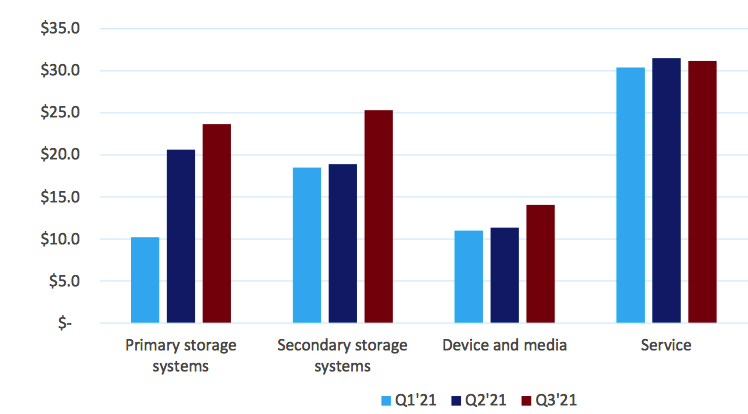

This growth in 3FQ21 was driven by sequential increases across the revenue categories on primary and secondary storage systems, royalty, devices and media.

The 24% sequential product growth was driven by a combination of market recovery and contributions from new products and initiatives.

Revenue Growth Across All Product Categories

Average deal sizes have been increasing over the past 2 years by 24% Y/Y. The company closed a record number of 6 and 7 figure deals in the quarter.

Hyperscale business is lower in the first nine months of FY21 than the same period last year. But for the current quarter, hyperscale revenue grew Q/Q and Y/Y, and the vendor expects for the full year this business will be nearly at the same level at last fiscal year.

Cash and cash equivalents were $17.4 million at December 31, 2020, compared to $12.3 million at March 31, 2020.

Quantum expects continued recovery across its market verticals and increasing contribution from its new software solutions, resulting in expectation of revenue for 4FQ21 to be at $98 million plus or minus $3 million, or representing sequentially flat revenue and what is typically a seasonally weak quarter for the company.

Fiscal year ended March 31

| (in $ million) | Revenue | Y/Y Growth | Net income (loss) |

| 1998 | 1,189.8 | NA |

170.8 |

| 1999 | 1,302.7 | 9% | (29.5) |

| 2000 | 1,418.9 | 9% | 40.8 |

| 2001 | 1,405.8 | -1% | 160.7 |

| 2002 | 1,087.8 | -23% | 42.5 |

| 2003 | 870.8 | -20% | (264.3) |

| 2004 | 808.3 | -7% | (62.0) |

| 2005 | 794.2 | -2% | (3.5) |

| 2006 | 834.3 | +5% | (41.5) |

| 2007 | 1,016.2 | +22% | (64.1) |

| 2008 | 975.7 | -4% | (60.2) |

| 2009 | 809.0 | -17% | (356.1) |

| 2010 | 681.4 | -16% | 16.6 |

| 2011 | 672.3 | -1% | 4.5 |

| 2012 | 652.4 | -3% | (8.8) |

| 2013 | 587.6 | -10% | (52.4) |

| 2014 | 553.2 | -6% | (21.5) |

| 2015* | 543.7 | -2% | 15.4 |

| 2016* | 479.8 | -12% | (75.6) |

| 2017* | 493.1 | 3% | (2.4) |

| 2018 |

437.7 |

-11% | (43.3) |

| 2019 |

402.7 |

-8% | (42.8) |

| 1FQ20 |

105.6 |

-2% | (3.8) |

| 2FQ20 |

105.8 |

18% | (2.3) |

| 3FQ20 |

103.3 | 1% | 4.7 |

|

4FQ20 |

88.2 |

-15% | (3.8) |

| 2020 |

402.9 |

0% | (5.2) |

| 1FQ21 |

73.3 |

-31% | (10.7) |

| 2FQ21 | 85.8 |

-19% | (4.6) |

| 3FQ21 |

98.0 |

5% | (2.7) |

* figures as restated

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter