Seagate: Fiscal 2Q21 Financial Results

Seagate: Fiscal 2Q21 Financial Results

Revenue of $2.62 billion up 13% Q/Q and down 3% Y/Y, and capacity shipments 13% and 21% to 129EB, respectively

This is a Press Release edited by StorageNewsletter.com on January 22, 2021 at 2:30 pm| (in $ million) | 2Q20 | 2Q21 | 6 mo. 20 | 6 mo. 21 |

| Revenue | 2,696 | 2,623 | 5,274 | 4,937 |

| Growth | -3% | -6% | ||

| Net income (loss) | 318 | 280 | 518 | 503 |

Seagate Technology plc reported financial results for its fiscal second quarter ended January 1, 2021.

“Seagate delivered strong, double-digit revenue, earnings and free cash flow growth in the December quarter supported by broad-based improvement across nearly every served market and geography, and we had solid customer demand for our mass capacity products,” said Dave Mosley, CEO. “We also achieved our technology milestone by shipping 20TB HAMR drives in calendar 2020, paving the way for Seagate’s continued success for years to come. As demand for data increases in both the cloud and at the edge, Seagate’s new Lyve Storage Platform complements our HDD portfolio to help businesses address both the secular demand for mass capacity storage and the increasing complexity of managing data from edge-to-core cloud. We are well positioned to benefit from the tremendous opportunities we foresee ahead and remain focused on enhancing value for our customers, employees and shareholders.”

The company generated $473 million in cash flow from operations and $314 million in free cash flow during 2FQ21. It maintained a healthy balance sheet and during 2FQ21 and paid cash dividends of $167 million and repurchased 18 million ordinary shares for $1 billion. Additionally, the company raised $1 billion of debt and ended 2FQ21 with cash and cash equivalents totaling $1.8 billion. There were 240 million ordinary shares issued and outstanding as of the end of the quarter.

Quarterly Cash Dividend

The board of directors of the company declared a quarterly cash dividend of $0.67 per share, which will be payable on April 7, 2021 to shareholders of record as of the close of business on March 24, 2021. The payment of any future quarterly dividends will be at the discretion of the board and will be dependent upon Seagate’s financial position, results of operations, available cash, cash flow, capital requirements, distributable reserves, and other factors deemed relevant by the board.

Business outlook for 3FQ21

• Revenue of $2.65 billion, plus or minus $200 million

• Non-GAAP diluted EPS of $1.30, plus or minus $0.15

Comments

Revenue of $2.62 billion for the quarter is up 13% Q/Q and down 3% Y/Y, above guidance midpoint.

Non-GAAP operating profit expanded 31%.

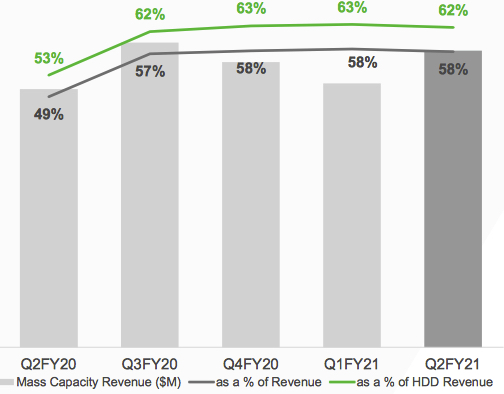

Quarterly Mass Capacity Revenue Trend

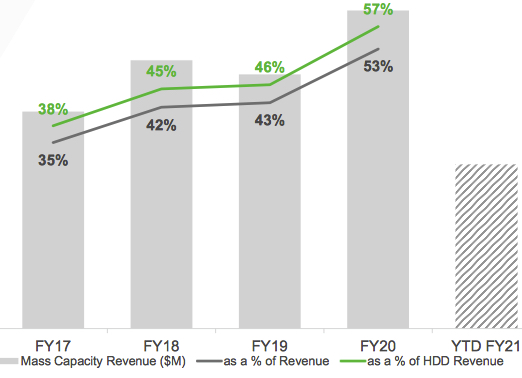

Annual Mass Capacity Revenue Trend

14% CAGR (FY17- FY20)

During the December quarter, the enterprise market began to recover for the first time since the onset of the pandemic. The improvement was most pronounced among large enterprise OEMs, which led to strong sequential revenue growth for both nearline and mission critical drives. The company anticipates this positive trajectory to continue.

Cloud data center demand remains healthy with the overall data demand drivers intact and with the projected strong double-digit growth in cloud Capex in 2021, which bodes well for the company and aligns with its expectation for cloud HDD storage demand to increase through the balance of the fiscal year and drive significant growth longer term.

For the second consecutive quarter, Seagate experienced stronger than expected growth in video and image applications (VIA) markets, due in part to the pent-up demand following the impact incurred in these markets during the economic shutdowns early in the pandemic.

Strong seasonal demand for desktop PC and consumer drives contributed to double-digit sequential revenue growth in firm's legacy business during the December quarter.

In the most recent quarter, the manufacturer shipped a record of 129EB of HDD capacity up 13% Q/Q and 21% Y/Y. Roughly three-fourth of this total exabytes were shipped into the mass capacity market which include nearline, VIA and mass products. Mass capacity shipments increased to a record 97EB in the December quarter. The firm shipped a total of 365EB in CY20, up 59% Y/Y, which is ahead of its long-term CAGR forecast of about 35% for this segment.

On a revenue basis, HDD accounted for 92% of total December quarter revenue and mass capacity storage represented 62% of HDD revenue and only 8% for enterprise data solutions, SSD and others.

Sales from mass capacity storage was $1.5 billion, up 12% Q/Q and 15% Y/Y.

Nearline revenue increased Q/Q driven by stronger-than-expected demand from enterprise and OEMs. Nearline demand was 71EB, up 11% Q/Q and 45% Y/Y reflecting ongoing demand for 16TB high capacity lines as well as increased demand for mid-capacity nearline products as the enterprise market recover. These dynamics resulted in average capacity for nearline drives staying relatively flat at 11.4TB. The company expects 16TB to remain its highest revenue product over the next couple of quarters. It also continue to increase shipment of 18TB drives and make positive progress on qualification plans at multiple cloud customer with volume ramp aligned with their timing. Shipments of first 20TB HAMR drive began in late November.

The legacy market represented 38% of December quarter HDD revenue, compared to 37% in the prior quarter and down from 47% in the year ago period. Revenue and exabyte shipment both increased 15% sequentially resulting in a total of 32EB shipped into the legacy market. The growth was driven by a seasonal uptick for consumer drives and desktop PCs and improving demand for mission-critical drives, consistent with the recovery in the enterprise market which also impacts demand for firm's mission-critical drives. Seagate expects ongoing enterprise market recovery to moderate a seasonal decline it typically sees in the March quarter.

Seagate said that it is in good position to capture the $24 billion mass capacity storage opportunities it forecasts for 2025

Cash and cash equivalents remained relatively stable at $1.8 billion.

Revenue for next quarter is expected to increase between 1% and 2%.

Revenue by products in $ million

| 1FQ21 | 2FQ21 |

Q/Q Growth | % of total revenue in 4FQ20 |

|

| HDDs | 2,137 | 2,425 | 13% | 92% |

| Enterprise data solutions, SSD and others |

177 | 198 | 12% | 8% |

HDDs from 2FQ15 to 2FQ21

| Fiscal period | HDD ASP | Exabytes shipped |

Average GB/drive |

| 2Q15 | $61 | 61.3 | 1,077 |

| 3Q15 | $62 | 55.2 | 1,102 |

| 4Q15 | $60 | 52.0 | 1,148 |

| 1Q16 | $58 | 55.6 | 1,176 |

| 2Q16 | $59 | 60.6 | 1,320 |

| 3Q16 | $60 | 55.6 | 1,417 |

| 4Q16 | $67 | 61.7 | 1,674 |

| 1Q17 | $67 | 66.7 | 1,716 |

| 2Q17 | $66 | 68.2 | 1,709 |

| 3Q17 | $67 | 65.5 | 1,800 |

| 4Q17 | $64 | 62.2 | 1,800 |

| 1Q18 | $64 | 70.3 | 1,900 |

| 2Q18 | $68 | 87.5 | 2,200 |

| 3Q18 | $70.5 | 87.4 | 2,400 |

| 4Q18 |

$72 | 92.9 | 2,500 |

| 1Q19 | $70 | 98.8 | 2,500 |

| 2Q19 |

$68 | 87.4 | 2,400 |

| 3Q19 |

$72 | 76.7 | 2,400 |

| 4Q19 | $79.7 | 84.5 | 2,700 |

| 1Q20 |

$81 | 98.3 | 2,900 |

| 2Q20 |

$77 | 106.9 | 3,300 |

| 3F20 | $86 | 120.2 | 4,100 |

| 4F20 |

$89 | 117.0 | 4,500 |

| 1F21 |

$82 | 114.0 | 4,400 |

| 2F21 |

$81 | 129.2 |

4,300 |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter