History (1994): Can SAE Take MR Head Market by Storm?

By Dr. Nigel Mackintosh in Hong Kong

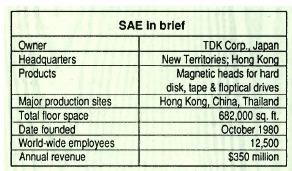

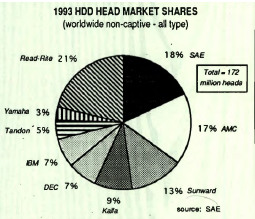

By Jean Jacques Maleval | January 22, 2021 at 2:21 pmFew people realize that Hong Kong is the home to the world’s second largest merchant supplier of HDD heads.

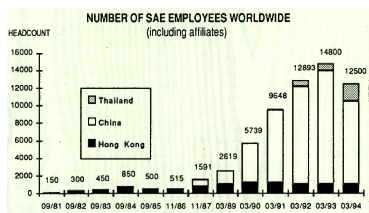

Founded here in 1980 by American Ben Yates, to develop floppy disk heads, in recent years SAE has pioneered the use of low-cost workers in China for the labor-intensive manufacture of Winchester heads, and as a result has seen production levels increase dramatically to peak at almost five million heads per month.

In general, the main focus of the business is the design, manufacture and OEM sale of magnetic heads for HDDs.

Key products include:

– Sliders: MIG composite, LAM composite, TPC thin-film.

– HGAs: composite, LAM, monolithic, monolithic MIG, MIG composite, thin-film.

– HSAs: composite, LAM composite, monolithic, thin-film, MIG composite.

I met with Frankie Lo, director of materials, at SAE’s HQs, the SAE Tower, in Kwai Chung, New Territories. This is about half an hour on the underground from central Hong Kong.

According to Lo, although SAE was initially formed to produce floppy disk heads, by 1983 it had completely switched over to HDD heads, both monolithic and composite. At this time the company also moved out of its 10,000 square feet (85,000 square feet) of the Join In Centre.

In 1984 it had grown so much that it acquired all 17 floors of the building (140,000 square feet) and renamed it the SAE Tower.

In 1985, with US companies dominating the order books, SAE opened its first US office for sales and customer support.

In 1986 the company became a fully-owned subsidiary of TDK, its main supplier and the world’s largest ferrite producer with annual revenues of $2 billion.

In 1987, SAE decided to address the growing cost of manually winding each R/W coil (still too difficult to automate) by setting up a factory in Fa Yuen, PRC (People’s Republic of China). This proved to be so successful, with yields gradually approaching the same levels as in Hong Kong, that in 1988 all coil winding processes were transferred to China, where the company also started making complete HGAs.

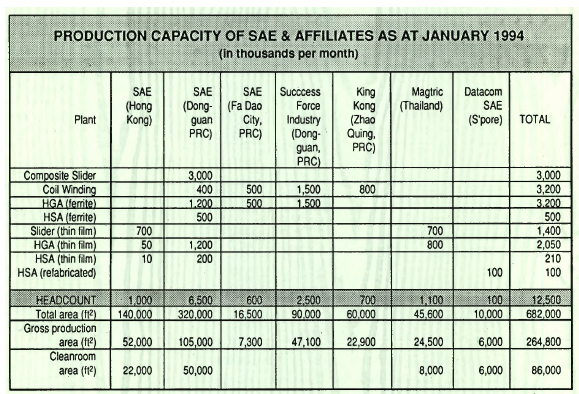

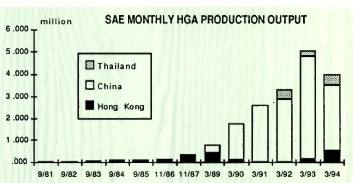

By 1989, SAE was producing one million per month and therefore, opened a new plant in Dongguan, PRC, with a floor space of 250,000 square feet.

By 1990 production was up to 3 million HGAs per month in this new facility.

1991 SAE’s status within TDK was upgraded to that of a business division, with total profit and loss responsibility. At the same time, a sister operation was set up in Thailand for coil winding and HGA assembly, and another one in Singapore for customer support and rework.

In late 1991, SAE started producing its first thin-film heads and in 1993 it introduced a TPC version of this, to allow constant flying height at all radii.

Dongguan now has its own complete engineering functions, staffed with engineers from Hong Kong and the best universities in China. The plat is equipped with 5,200 square feet of class 100, 19,500 square feet of class 1,000, and 7,500 square feet of class 10,000 clean room space, where HGAs and HSAs are produced under strict controls using the latest assembly and test equipment.

There is only a small amount of thin-film manufacturing left in the Hong Kong HQs now, and the only development there is some of the inductive thin-film research, such as the TPC design. Most of the thin-film development is in Japan, and all of the composite development is in PRC.

The Thailand operation currently does thin-film slider fabrication and HGA production, this operation was actually set up with 1997 (China’s take-over of Hong Kong) in mind, just in case!

SAE’s biggest product is currently composite heads, where it is world leader, producing around 3 million MIGs and 300,000 LAMs per month.

The company also still produces a very small number of monolithic heads. In addition to this, it produces 15 different flavors of thin-film heads, totalling about 1.2 million per month. This business is growing fast, and is expected to hit 4 million per month by next year.

SAE currently supplies heads to almost every disk drive company in the world, with the main exceptions being Seagate and Micropolis.

The parent company, TDK, is allowed to sell SAE products, but only in Japan. TDK does not manufacture any heads, though it does develop them for SAE and produce pre-production quantities of the most advanced ones. TDK’s intention is always to transfer manufacturing to SAE.

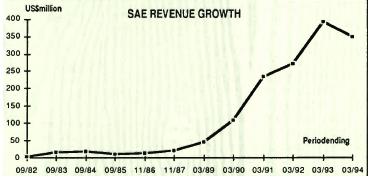

SAE buys in core pieces for composite heads (from TDK, Hitachi and Sanyo) and wafers for thin-film heads (from TDK). Total sales for the year ending March 1994 were $350 million, at which time production was running at 4 million HGAs per month.

As can be seen from the accompanying charts, this represents the company’s first significant setback in 14 years of trading. Apart from the continuing squeeze on prices by the customers, this decline has undoubtedly been the result of a late entry into thin-film technology.

The switch by the disk drive manufacturers from ferrite to thin-film heads has increased dramatically in the last couple of years, and SAE is frantically altering its production capacity to compensate. If it had been able to achieve this a little faster, by now SAE would certainly have been the leading overall noncaptive head supplier in the world.

Even as it ramps up production on inductive thin-film heads, SAE is working to establish a stronghold in the new magneto-resistive heads that are taking the disk drive world by storm.

All of SAE’s thin-film heads are developed in Japan by TDK, which has recently completed the design of a range of MR heads. TDK is currently producing small quantities of these in Japan, and SAE is sampling them to customers. Two of them are Toshiba and Fujitsu, the second companies in the world to announce a disk drive using MR heads (IBM was by far the first to do so, and DEC has finally just announced some machines using magneto-resistive heads made by Rocky Mountain Magnetics, CO).

TDK expects to be producing MR heads at the rate of 50,000 per month by September, probably in a few different flavors. By the end of 1994, TDK hopes to reach 100,000 to 150,000 per month and then ramp at 10% each month, with a gradual changeover so that SAE will be manufacturing approximately 1 million per month by the end of 1995.

SAE will actually not start making magneto-resistive heads itself until April 1995, first in Hong Kong and then 6 months later in the PRC or, more likely, Thailand.

Lo anticipates MR heads selling for about $20 per HGA next year in quantities of 100,000 per month (around 2x the cost of an inductive thin film). He also warned that it is clear already that MR head allocation is likely to occur, and because of the long lead times involved, highest priority will be given to those customers committing orders well in advance.

For example, wafer fabrication takes 65 days (an economical size is 12 wafers, around 30,000 heads). Slider fabrication takes 8 to 10 days, HGA assembly 7 days, and head stack assembly another 7 days.

He suggested that, from a technological point of view, 270MB on a 3.5-inch platter was likely to be the limit for MIGs. 420MB is the highest equivalent capacity currently being shipped to use SAE’s inductive thin-film head, which the company feels it can push up to a maximum of about 600MB. In comparison, MR heads start out at 500MB, and will certainly hit 1GB next year.

Returning to the economic situation, the bottom line is clear: SAE’s future depends on its ability to successfully combine the advanced technology of TDK with its own proven high volume, high quality manufacturing operations, and thus grab a major share of the impending magneto-resistive head boom.

This article is an abstract of news published on the former paper version of Computer Data Storage Newsletter on issue 79, published on August 1994.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter