History (1994): Quantum Purchases DEC Storage Hardware Business

For $360 million

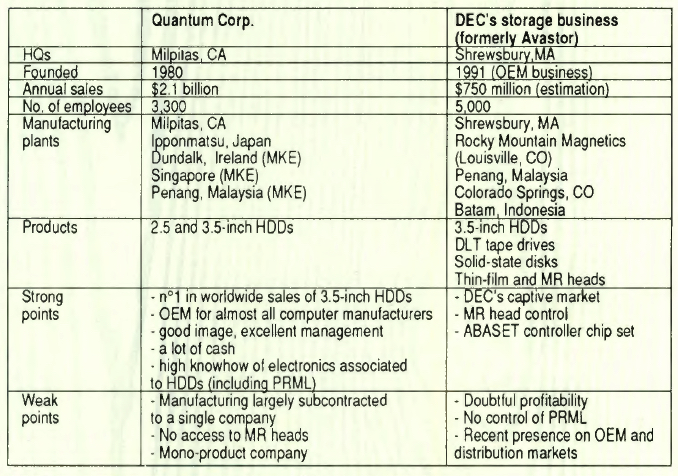

By Jean Jacques Maleval | January 18, 2021 at 2:23 pmQuantum has purchased Digital Equipment’s disk, tape, SSD and disk head for approximately $400 million.

The new group is valued at around $3 billion, and now ranks number 3 instead of 4 in the WW storage industry behind Seagate and IBM, but in front of Conner.

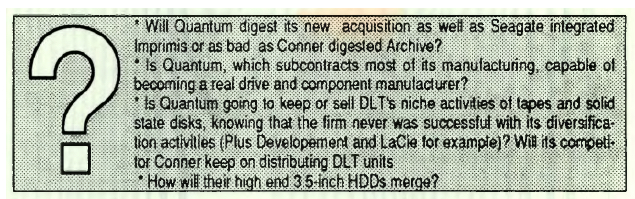

It’s the greatest event since the beginning of the year in the storage industry. And it’s also the most important since 1989, when Seagate acquired Imprimis. Meanwhile, Archive was bought over by Conner, in 1992, but the money and the impact involved then weren’t as considerable.

Thus, one of the rumors we mentioned in our previous issue has been confirmed. On July 19, Quantum Corp. (Milpitas, CA) has signed an agreement with financial-troubled Digital Equipment Corp. (Maynard, MA) to buy Digital’s magnetic disk drive, tape drive, solid state disk, and thin-film heads businesses valued at around $750 million for approximately $400 million. The transaction includes Digital’s 81% interest in head manufacturer Rocky Mountain Magnetics Inc. (Louisville, CO). The remaining 19% belong to StorageTek.

The transaction has been approved by the board of directors of both companies and, as usual in this type of operation, is subject to appropriate government approval, which shouldn’t be a problem.

The deal is expected to close on or about October 1, 1994.

Finally, Quantum is buying all Digital’s storage product manufacturing activity, i.e. the disk head production and Avastor, a name that only existed for a few days. DEC will keep the sub-systems, i.e. the StorageWorks solutions and the video and interactive information services.

In conjunction with this transaction, Quantum will supply a (non disclosed) percentage of disk drives for DEC’s StorageWorks subsystems and core computer systems businesses.

The amount paid by Quantum is high, but the company has put aside a huge amount of cash.

In comparison, in 1989 Seagate had no trouble acquiring Imprimis, valued at $1.15 billion, for about $450 million, when Seagate was only valued at $1.27 billion. Conner had paid about $180 million for Archive in 1992.

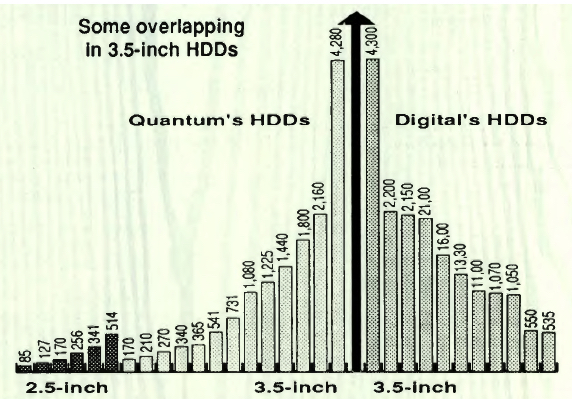

Some overlapping

Quantum’s strength is more in mass production of 3.5-inch HDDs; with standard capacities, which allowed the Californian company to get ahead of the WW market in number of units shipped, even in front of Seagate. It had more trouble competing with Conner, DEC, Fujitsu, HP, IBM, Micropolis or Seagate in large capacity drives.

Nevertheless, Claude Barathon, president of Quantum Peripherals Europe, admits there is some overlap in both manufacturers’ range of HDDs of more than 1GB but adds that “This way, we will double our market share in high capacity disks.”

Actually, Quantum was a bit late in high end drives, those with the biggest margins. But some decisions will still have to be taken quickly to merge the ranges from both origins. Quantum is now in competition with IBM (3480), Exabyte (8mm) and the 5.25-inch QIC drive makers on the high-end tape drive segment with the DLT based on an excellent technology but proprietary.

Will Conner keep on distributing solutions based on DLT which will serve one of its best competitors? The decision hasn’t officially been taken yet.

MR heads: with a cherry on top

For Quantum, the cherry is undeniably the acquisition of a MR head technology it was crucially lacking and was even threatening its future. DEC recently announced its first MR drive with a 2.2GB capacity available for 1994 and pre-production of 1Gb per square inch MR heads. Only IBM has a perfect control on this subject with already close to 20 million MR heads manufactured and, at a lower level 2 companies, Fujitsu which is supplied by SAE from Hong Kong, a subsidiary of TDK, and Seagate who is trying to negotiate with IBM which started a suit on this matter.

“Our ownership position in Rocky Mountain Magnetics will give us direct access to MR technology which is a critical technology for achieving the areal density increases the industry will see over the next gens of drives,” said William J. Miller, Quantum’s COB and CEO.

“For the future, it would have been a problem,” admits Barathon.

Quantum in front of Conner

With this operation, Quantum becomes a $3 billion company and is getting closer to Seagate with a range of HDDs entirely competitive. But the ≠1 in the non captive storage industry will keep its leadership for quite some time if you look at its sales in its last quarter that are over one billion dollar. At the same time, Conner Peripherals is going to be ≠3 if you consider its last quarter, however excellent with $650 million sales.

Additionally, Quantum is pinching the MR technology from Conner which also had an eye on Rocky Mountain and will now have to find another source for its components, maybe by buying another head manufacturer (some mention AMC in Goleta, CA).

Other companies were interested in buying DEC’s storage business but Quantum made an extra effort, paying a high price, and acquiring products it was completely unfamiliar with.

This article is an abstract of news published on the former paper version of Computer Data Storage Newsletter on issue 79, published on August 1994.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter