History (1993): FDD Shipments Soar to 64 Million

But revenue down by sagging prices

By Jean Jacques Maleval | December 25, 2020 at 2:11 pmShipments of flexible disk drives saw rapid growth during 1992 and 1993, but the industry’s sales revenues are again starting to decline due to rapid deterioration of the average price paid for floppy drives, according to the recently released 1993 Disk/Trend Report ($1,585) published by Disk/Trend, Inc. (Mountain View, CA) on flexible disk drives.

During 1992, overall FDD shipments jumped 23.4%, with the WW total over 59 million drives. The industry experienced a modest increase in total sales revenues, which were up 7.4%, to $2.7 billion.

1993’s shipment increase is expected to be a more conservative 8.3%, limited by a slower growth rate for PCs, the largest market for FDDs. The slower growth, combined with continuing reductions in the average price for individual drives, will cause a reduction in the industry’s total sales revenues, down to $2.6 billion.

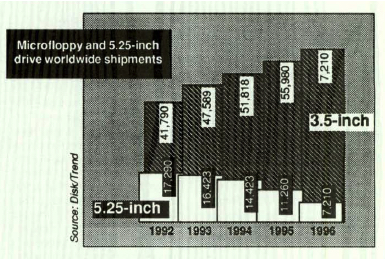

Dominating today’s floppy drive market is the microfloppy, mostly 3.5-inch models. They held 70.5% of overall floppy drive shipments in 1992, with 41.8 million drives, and are forecasted to grow to 60.2 million drives in 1996, 88.3% of the worldwide total. Last year, more than 90% of the microfloppy drives shipped were used with PCs, a growth market driven by lower prices, faster processors and improved software.

The products within the 3.5-inch microfloppy group vary in capacity and package size, but 1.44MB drives are now the industry’s mainstream product, with more than 90% of last year’s unit shipments and growing to an estimated 95% in 1996.

The industry’s expectations for the newer 2.88MB drives have declined in the last few years, as sales have grown more slowly than anticipated. Despite continued usage by IBM on high-end PCs, 2.8MB drives took a mere 2.7% of the microfloppy drive market in 1992, with their 1996 share projected at only 4.4%. The limiting factor for 2.88MB drives has been price levels more than 50% higher than those of 1.44MB drives. The PC industry’s reaction to 3.5-inch microfloppy drives with package sizes less than one-inch in height has also been mixed. The first 3.5-inch floppy from Sony was two inches high, but the one-inch height pioneered by Citizen Watch in 1984 has become the industry standard, with 79.3% of 1993 microfloppy drive shipments.

Many floppy drive manufacturers introduced drives with several heights in the 0.75-inch range in recent years, but shipments of most of these drives is now declining.

The half-inch high drives pioneered by Teac in 1991 have now become popular with notebook computer manufacturers, and are also being used in “combination drives” which offer a 3.5/5.25-inch pair of drives in the same height as a single half-high 5.25-inch drive.

However, because the half-inch 3.5-inch drives carry higher prices, the projected share of 1996 shipments of all microfloppy drives with heights less than one-inch is only 19.5%.

Although 5.25-inch floppy drives lost the industry’s shipment leadership to microfloppy drives in 1988, the 5.25-inch product group grew 15.1% in unit shipments in 1992, boosted by strong PC shipments and the continuing requirement of many PC users to maintain the ability to interchange diskettes with older PCs.

However, 3.5-inch microfloppies are almost universally used with new PCs and the demand for 5.25-inch drives for diskette interchange is now diminishing. Estimations of 1992 worldwide non-captive unit shipments indicate that Sony, the originator of the 3.5-inch floppy format, continued to hold first place in 3.5-inch drive shipments with 15.3% of the total.

Teac retained its strong lead in 5.25-inch drive shipments with 26% of the non-captive total.

The remaining small shipments of 8-inch floppy drives were dominated by Y-E Data’s 78.5% market share.

Iomega maintained leadership in high capacity floppy drives with 86% of the WW total, consisting mostly of 5.25 inch Bernoulli type drives.

The report also contains basic product specs on 170 FDDs and profiles on 29 existing and former manufacturers of flexible disk drives.

Flexible disk drives worldwide unit shipments

This article is an abstract of news published on the former paper version of Computer Data Storage Newsletter on issue 71, published on December 1993.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter