Alternatives to Amazon AWS S3

From Alibaba, Backblaze, DigitalOcean, Google, IBM, iland, Linode, Microsoft, Oracle, Wasabi, Zadara

This is a Press Release edited by StorageNewsletter.com on December 24, 2020 at 2:12 pm This research was written on December 7, 2020 by Enrico Signoretti, research analyst at GigaOm.

This research was written on December 7, 2020 by Enrico Signoretti, research analyst at GigaOm.

GigaOm Radar for Alternatives to Amazon AWS S3

Public Cloud Object Stores

1. Summary

Organizations today look to the cloud for their compute and storage needs. Amazon AWS is by far the current market leader in both revenue and number of customers, and its service ecosystem is the most complete. Amazon’s popular Simple Storage Service (S3) is an object store, meaning that data is stored as objects, along with associated metadata and identifiers. This architecture is inexpensive, scalable, and allows massive amounts of unstructured data to be more readily accessible and more easily analyzed. S3 is also the name of the API for accessing the data programmatically.

S3 has quickly become the standard protocol for object storage but there are alternative APIs from major cloud providers. Many third-party solutions are now compatible with more than just S3, offering additional options to users. API compatibility could remain an issue, though. Even if the customer has control of the entire stack, making changes to the application is not always economically or technically feasible. To simplify data access and the migration process, some service providers offer a “compatibility mode” that allows customers to use the S3 API or a subset of it, along with their native API. Note that Amazon Identity and Access Management (IAM) should always be taken into account when considering the compatibility requirements of most applications that use an S3 interface.

Object storage is excellent for many use cases and applications, both in the cloud and on premises, and is becoming a very popular target for backup, archiving, content management, file-based and cloud-native applications, big data lakes, HPC, and so on. Most applications that deal with unstructured data can take advantage of an object store easily, and this contributes to its appeal.

S3 is relatively inexpensive compared to other storage options available from Amazon AWS, but its performance is not always consistent. Moreover, the real cost of the service is not always immediately obvious and could become an issue for some customers.

The S3 pricing model is quite complex and depends on several factors:

• Type of data protection

• Data locality

• Storage tier

• I/O operations

• Data transferred out of AWS (egress)

At the end of the day, it is not easy to estimate the cost and it can be difficult to predict how it will evolve over time. The egress costs of public cloud services are what worry CFOs and project managers the most, limiting flexibility in the execution of a multi-cloud strategy.

Although AWS has a very compelling solution ecosystem, there are alternative solution providers with innovative services for vertical markets and use cases that offer interesting alternatives.

Thanks to the success of AWS S3, many competitors have begun providing similar services while trying to differentiate themselves on price, performance, and functionality.

2. Market Categories and Deployment Types

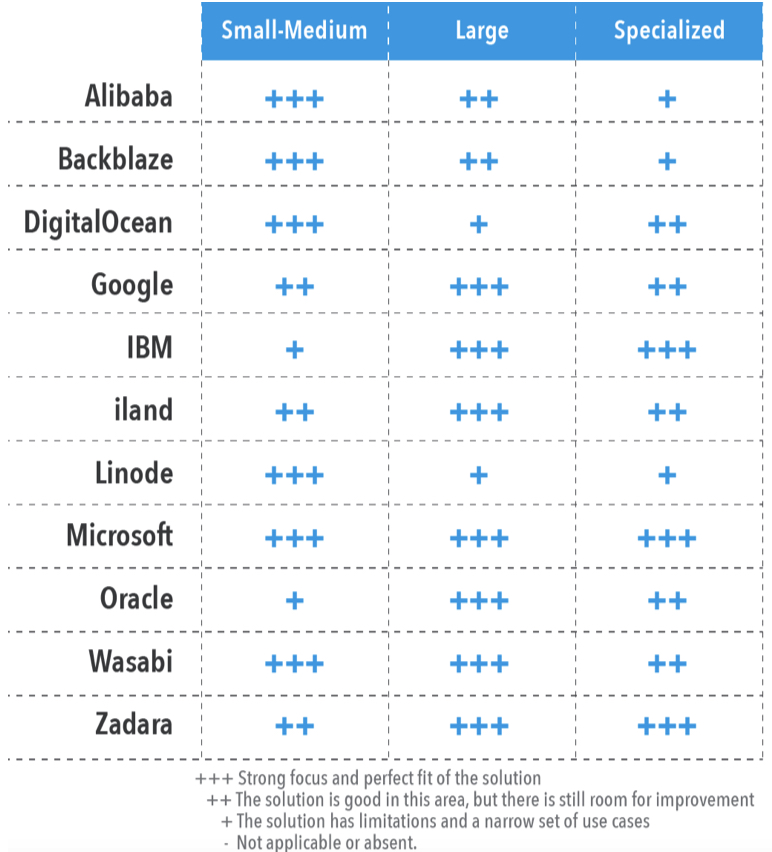

For a better understanding of the market and vendor positioning (Table 1), we assess how well alternatives to S3 are positioned to serve specific market segments.

• SME: In this category we evaluate solutions on their ability to meet the needs of SMEs. We also look at departmental use cases in large enterprises, where ease of use and deployment are more important than extensive management capabilities, data mobility, and feature set.

• Large enterprise: For this category, offerings are assessed on their ability to support large and business-critical projects. Optimal solutions will have a strong focus on fexibility, performance, data services, and features to improve security and data protection. Scalability is another big differentiator, as is the ability to deploy the same service in different environments.

• Specialized: We assess solutions designed for specific workloads and use cases, such as application development, big data analytics, IoT, and more.

Table 1: Vendor Positioning

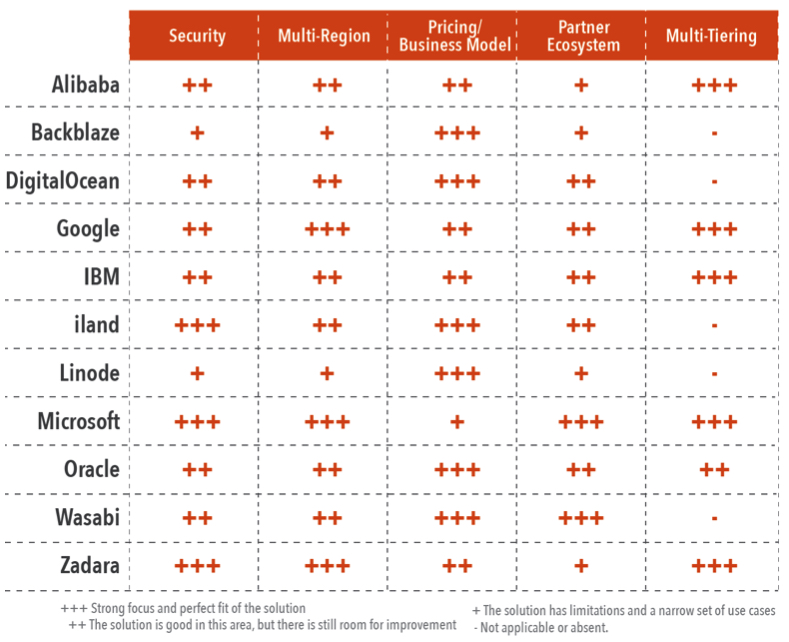

3. Key Criteria Comparison

Not all object stores are equal. In this report we will briefly analyze the most interesting services, focusing on key criteria like:

• Security

• Geographic (multi-region) availability

• Pricing and business model

• Partner ecosystem

• Multi-tiering capabilities

The first gen of object stores, including AWS S3, was not meant for active workloads. Object storage was designed to be persistent and very durable, for archiving applications with few writes and reads for any object over long periods of time. Now, thanks to the advent of mobile and edge computing, huge amounts of data have to be consolidated in large cloud repositories and be accessible to multiple devices everywhere. Workloads are more demanding, and the use cases for object stores are increasing and becoming more varied. AWS S3 can become expensive quickly in such scenarios, pushing more and more companies to look for alternatives.

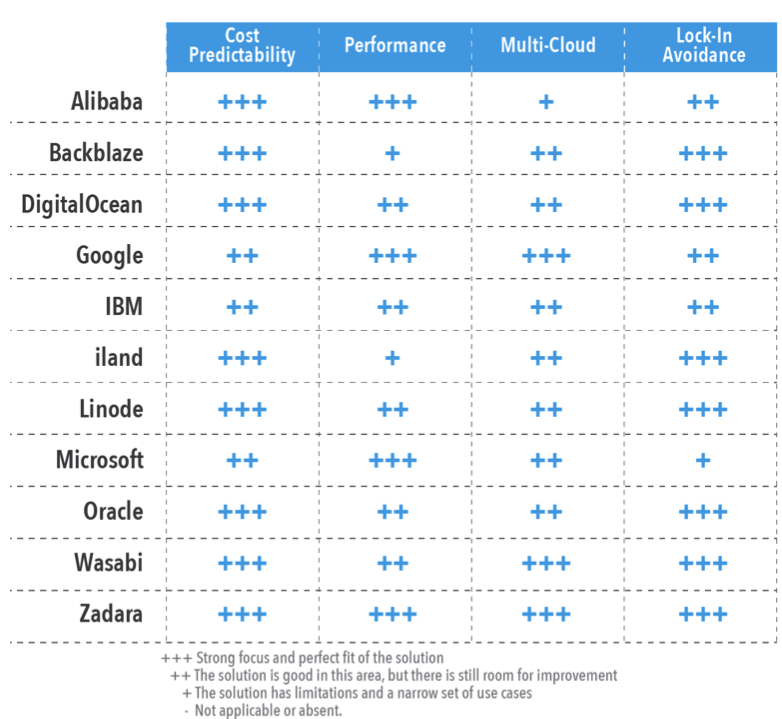

The most common metrics for evaluating S3 alternatives are:

• Cost predictability: Not only do organizations want cost-effective solutions, they want expenses to be predictable as well, for budgeting purposes.

• Performance: Some object stores are faster than others and may include flash memory options, which means less latency for better application performance, greater efficiency, and better overall TCO.

• Multi-cloud: Multi-cloud environments come with a major pain point – egress costs. Everybody wants to remove these costs from their cloud bills.

• Lock-in avoidance: Users want to avoid any sort of lock-in, and concentrating data in a single place is usually considered a risk. Making copies of data on two or more cloud providers is a valid option for eliminating this threat.

Predictability, performance, multi-cloud, and lock-in avoidance are very much connected to each other and contribute to the overall TCO of the infrastructure.

Following the general indications introduced above, Table 2 and Table 3 summarize how each vendor included in this research performs in the areas we consider differentiating and critical for AWS S3 alternatives. The objective is to give the reader a snapshot of the technical capabilities of different solutions and de ne the perimeter of the market landscape.

Table 2. Key Criteria Comparison

Table 3. Evaluation Metrics Comparison

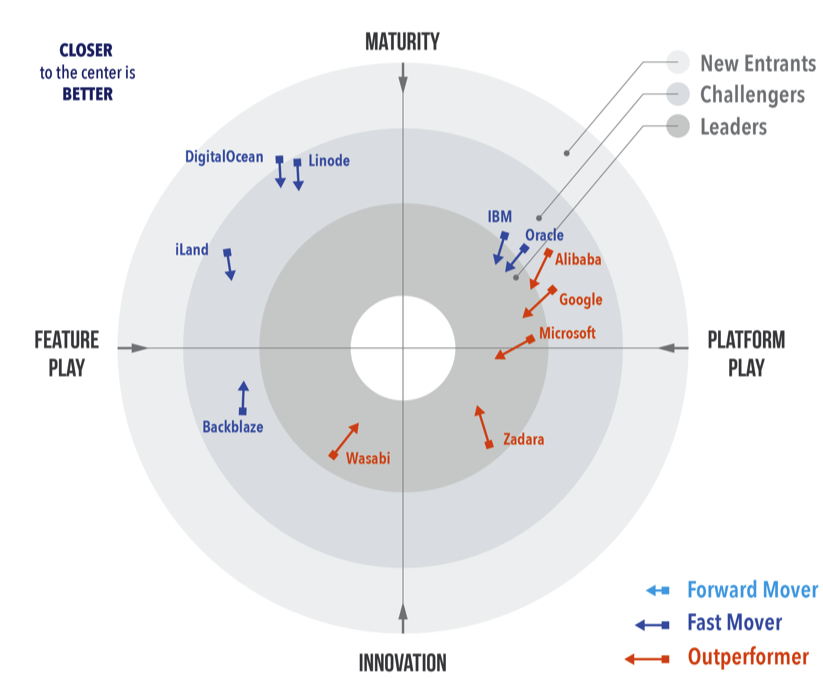

4. GigaOm Radar

This report synthesizes the analysis of the key criteria and their impact on evaluation metrics to inform the GigaOm Radar graphic in Figure 1. The resulting chart is a forward-looking perspective on all the vendors in this report, based on their products’ technical capabilities and feature sets.

Figure 1: GigaOm Radar for AWS S3 Alternatives

The GigaOm Radar plots vendor solutions across a series of concentric rings, with those set closer to center judged to be of higher overall value. The chart characterizes each vendor on two axes – Maturity vs. Innovation, and Feature Play vs. Platform Play – while an arrow projects each solution’s evolution over the coming 12 to 18 months.

As you can see in Figure 1, there are several solutions competing in the market right now. While hyperscalers (Microsoft Azure, Google Cloud, Alibaba) are direct AWS competitors and can offer a complete ecosystem, others focus more narrowly on object storage services and niche markets (Wasabi, Backblaze, iland), providing a better user experience and pricing for specific use cases.

It is interesting to see that some global and regional cloud providers are also investing in object storage in order to compete with hyperscalers. These vendors, such as IBM, Oracle, DigitalOcean, and Linode, present some appealing add-ons and pricing models that can bring down costs and improve application efficiency. Of particular interest is Zadara, which provides a true private cloud storage solution that can span multiple clouds and on-premises infrastructures, including Amazon AWS.

5. Vendor Insights

Alibaba

It has an impressive cloud storage ecosystem, based on a single back end that serves all front-end services, including block, file, and object storage. Though it is still mostly focused in the APAC region, the service is now available in multiple EU and US regions. In the APAC region, it offers flexible software-defined storage solutions to support customers with hybrid cloud needs.

Alibaba object storage differs from other cloud provider offerings in several ways, including integrated image processing and document previewing features that help to broaden the kinds of use cases without requiring additional application logic. Most of these services are included in the basic fees, and add a competitive edge, especially considering there are no egress fees. Customers can also access a smart reserved capacity option to use different storage services with a single prepaid contract.

Of particular note is the long-term retention service, based on a clever use of near-line HDD technology, which provides good access speed at a very low cost per gigabyte. Alibaba also focuses on performance, providing a solid base for big data lakes and AI workloads.

A lot of effort has been put into security as well. The service uses end-to-end encryption, for which the user can keep full control of the keys, thanks to integration with external key management systems.

Strengths: Interesting and different object storage proposition built with a series of services to enhance and improve the user experience. Flexible reserved capacity subscriptions are available.

Challenges: Alibaba has a strong presence in the APAC area but only few zones in the EU and North America.

Backblaze

It is well-known for its affordable, feature-rich cloud backup service, B2 Cloud Storage, that targets both consumers and SMBs. The company’s object storage solution is now S3-compatible, dramatically increasing the number of users and capacity under management. The service is primarily focused on non-regulated industries and relatively small organizations that need cloud storage at a low and predictable price, but its compelling pricing also attracts MSPs and others looking for low-cost, high-capacity storage solutions. The most common use cases include backup, archiving, file storage back-end, big data lakes, and any other workload that doesn’t require frequent data access.

B2 is available in 2 zones at the moment: US-West and EU-central, with customers from all across the world. Even though the service doesn’t have the security certifications of the competition, it does take security seriously, with extensive use of data encryption and identity management and support for two-factor authentication, single sign-on mechanisms, and more.

Thanks to its S3 compatibility, the Backblaze ecosystem is growing quickly, and there are many third-party products and best practices to integrate the service with hundreds of solutions. The company also developed alliances with other service providers to eliminate egress fees when data is accessed by other providers in the network. For example, all data transfers between Backblaze and CloudFlare (a CDN provider) result in no additional charges. And note that Backblaze offers a free migration program for large users who plan to migrate data from other cloud providers to B2.

Strengths: With low, predictable costs, this S3-compatible cloud storage service has a growing solution ecosystem and an interesting migration program.

Challenges: The service is currently available in only 2 regions. Lack of security certifications may be a limiting factor for some.

DigitalOcean

Based on the Ceph open source network file system, DigitalOcean Spaces targets developers and SMBs. Cost-conscious with a simple and predictable pricing model, an easy-to-use and intuitive user interface, integrated CDN features, and S3 compatibility, this service is easy to adopt and manage. Its primary use case is digital asset distribution for applications hosted in the DigitalOcean compute cloud, but it is also useful for other scenarios that benefit from object storage, such as log archives.

The service is available in 5 regions across the globe, but users cannot replicate data across different regions or availability zones. Its use in highly regulated environments is limited by a lack of compliance with common regulations.

The user interface is well-integrated in the management console and has all the necessary tools for basic administrative operations and user management.

Each single Space, a bucket, is limited to 250GB, which is also the limit per user. Other limitations include the maximum size of an object (5GB), the amount of data transferred per day, the number of operations per day, and the available bandwidth. These limitations affect the kinds of applications that potentially can be served by this object store.

Strengths: Relatively inexpensive and developer friendly. Well-integrated in an ecosystem that is growing in the number and variety of services users can take advantage of.

Challenges: Spaces presents several limitations that can restrict its adoption for applications.

Google Cloud

It is investing heavily in its cloud platform while continuing to address enterprise needs. Google Cloud Storage is now available in 24 regions across the globe, with increasing options for dual- and multi-region buckets. The object storage service provides several choices in terms of availability, SLA, latency, and performance, giving users multiple ways to cover their workload needs while offering a simpler, more competitive price model than AWS S3. Google Cloud Storage combines tiering capability in a single service for both cold and frequently accessed objects, and integrates functionalities that are optional in the AWS ecosystem, such as geo-redundancy and edge caching. This brings the overall cost down while improving application performance and efficiency.

A notable feature of Google Cloud Storage is its strong consistency, meaning that when a write operation is acknowledged by the system, the correct data is returned immediately, no matter where it is accessed from. This allows enterprises to take advantage of the platform for many use cases, especially analytics. Note that Google provides a Storage Transfer Service utility to move data stored in S3-compatible buckets to Cloud Storage.

Security is a priority for Google Cloud Storage, which is certified or compliant with all major global and local regulations. It is an easy-to-use product with integrated lifecycle management across tiers. The growing partner ecosystem helps enterprises find familiar solutions that can operate with Google Cloud. And migration is made easier with the S3 API compatibility.

Strengths: Strategy to produce more enterprise-ready solutions and grow its partner ecosystem is working, and Google Cloud Storage is a solid option for many workloads.

Challenges: Even though Google Cloud Storage checks all the boxes, direct competitors are extending their lead in terms of features and integration.

IBM Cloud

Its Cloud Object Storage is a solid solution for IBM Cloud customers – but it may be compelling for other users as well. It offers S3 compatibility and several storage tiers, including a smart tier option for automatic data placement driven by user-defined policies. Common use cases include backup and archiving and, in general, all cold data workloads, but the performance characteristics of this solution mean it can address big data analytics and IoT workloads as well.

IBM Cloud offers various pricing options, including subscriptions with discounts linked to spend commitment, helping customers to get predictable cloud storage costs. The service is available in several regions across the globe, with multiple data replication schemes to improve availability and resilience.

IBM Cloud Object Storage SQL Query, based on Apache Spark, differentiates this service from others. Users can query objects stored in predefined formats interactively without needing additional tools, simplifying the applications stack while producing quicker results.

Good security is in place, with many certifications for important regulations in the finance and healthcare fields as well as many features aimed at improving overall access control, data encryption, and object lifecycle. WORM functionality is available for those applications that need data immutability, compliance, and protection vs. ransomware.

Strengths: IBM is investing heavily in its cloud ecosystem, including object storage. The solution has a balanced price/performance combination, thanks to its smart tiering policy.

Challenges: IBM still lags when compared to major cloud providers and is not always perceived as a credible alternative.

iland

iland Secure Cloud Object Storage (Ob) adheres to the company’s strategy around its backup and DR services. Firm’s experience with its technology partners enabled the team to design a product highly focused on backup, archiving, cloud-tiering, and DR workloads while keeping the cost very predictable and fairly low. To buttress its position in this area, iland offers a long list of security certifications across all of its data centers across the globe, enabling users to pick the location they prefer with the assurance their data won’t leave that country.

The user interface is well integrated in the management console and has all the necessary tools to handle basic administrative operations and user management.

The service is S3-compatible and based on open source technology that includes the object immutability required by a growing number of backup solutions. The company also provides tools to help potential customers get a clear picture of the actual cost of its services by analyzing a client’s capacity needs. The service can be acquired through a standard, pay-as-you-go, consumption-based model or by using a multi-year reserved capacity agreement, meeting different budgeting needs.

iland boasts a high level of satisfaction among users for its excellent customer support. Potential customers can take advantage of a free 30-day trial with a 2TB capacity to try the service.

Strengths: It is designed to complement a broad range of services aimed at solving data protection and DR for enterprise users. It has a predictable cost model and an open and friendly approach.

Challenges: Even though this was by design, the service is limited in the number of use cases. Multi-region data replication is not available yet.

Linode

It is a cloud service provider with 11 data centers across the world and is strongly focused on developers and small-to medium-size enterprises. Its overall strategy applies also to its object store, which is cost effective, predictable, and simple to consume. The solution is based on Ceph, the popular open-source object store, which Linode has outfitted with some additions and UI integrations specifically designed for its users. Support is one of the key differentiators for Linode, which can count on a large community of enthusiastic users.

The object storage service is compatible with S3 APIs, without IAM support, available in 3 regions circling the globe, including North America, Europe, and Asia. The basic subscription starts at 250GB and includes 1TB of outbound traffic and can be expanded further to support more demanding applications. Only one performance tier is available but it is designed to keep the service simple while offering a good combination of performance and $/GB, addressing active workloads that don’t need high performance. Encryption is available as well, but key management is delegated to the user and there is no support for external key management systems.

Strengths: Object storage service is simple and cost effective and aligned with the rest of the services offered by Linode. 1TB of outbound traffic is included.

Challenges: Available only in 3 regions, the service presents limitations that could impact adoption of commercial applications that take advantage of advanced S3 APIs and enterprise features.

Microsoft Azure

Microsoft is investing heavily in its object storage platform, Azure Blob, with continuous improvements and new features released at a steady pace. It is already at the base of several other Azure storage and data services and is well integrated with the rest of the ecosystem, which includes an impressive and ever-growing partner network. When compared to other major cloud providers, Azure Blob stands out for providing a broader range of capabilities to address use cases that take on high-performance workloads using the flash memory-based storage tier. Object lifecycle management, based on user-defined policies, can help customers optimize data placement and costs.

Security concerns are addressed with numerous certifications as well as features designed to improve day-to-day operations, such as geo-fencing, anonymous access prevention, soft delete, point-in-time restores, and more. The change feed feature is noteworthy-once enabled, a log of all transactions on a specific storage account is saved in read-only mode and becomes accessible for auditing or other application purposes. Blob indexing and query functionality also help to improve object storage usability while simplifying application development.

Azure Blob now includes HDFS and NFS compatibility (the latter still in preview), with object-file parity, enabling users to migrate data quickly and seamlessly from legacy environments to the cloud.

The standard pricing model is aligned with other major providers, but Microsoft is also offering an all-inclusive capacity model (with limits on the number of prepaid transactions) as well as a reserved capacity option.

Strengths: Azure Blob is one of the best solutions on the market and central to a huge ecosystem. Many third-party vendors are adopting Blob APIs as an alternative to S3.

Challenges: The service is not compatible with S3 and potential customers should always check compatibility with Blob APIs. Standard pricing is still complicated compared to other solutions, but Microsoft is actively working to provide more predictable options to its customers.

Oracle Cloud Infrastructure

Oracle is a bit late to the cloud game, but it is building an advanced infrastructure designed for performance and reliability with an increasing global presence. Its object store is based on an HDD only infrastructure, but has good overall performance with SLAs and Amazon S3, and Amazon IAM and SAML compatibility. Even more so, the service can be accessed through hybrid appliances via NFS for data migrations with file to object parity, or via HDFS.

The object store offers multiple storage tiers for long term retention or frequently accessed data, and Oracle has a simple pricing model without data transfer costs for egress transactions. Even more so, the cost of this service is identical in every region, making overall application cost more predictable around the globe.

ILM functionality is another interesting aspect of this product and allows users to replicate data to different regions and set up policies to manage the object’s lifecycle.

In terms of security and data availability, Oracle is focusing on end-to-end encryption with support for its key management system, as well as user-provided keys while giving the user good control of resources and their visibility.

Cloud Object Storage is an interesting platform when leveraged alongside very high-performance Oracle compute instances for big data analytics and similar workloads. A data transfer service based on an appliance which provides an NFS interface is also available to speed up data migrations with limited bandwidth. The partner ecosystem is somewhat limited.

Strengths: Oracle Object Storage is a compelling service for Oracle users and provides very predictable pricing across the globe.

Challenges: The partner ecosystem is limited and when compared to direct competitors, the service is not differentiated enough to stand out in the crowd.

Wasabi

Wasabi offers simple and reliable cloud object storage. It gives organizations of all sizes a very good combination of cost, performance, and S3 compatibility for hot data, though it has no multi-tiering capabilities. It already boasts more than 18,000 customers worldwide, and the service is available in 4 locations, three in the US and 1 each in Europe and Japan. Customers can choose from 2 pricing models: a pay-as-you-go capacity-based subscription without any additional charges for I/O operations, or reserved capacity at a fixed price, with discounts based on term and capacity.

Wasabi is also attracting VARs and MSPs who can take advantage of the globally consistent and friendly pricing to provide end-to-end solutions at reasonable prices when compared to major cloud providers. Its technology partner network is growing steadily, with an increasing number of hardware and software vendors certifying their solutions to work with Wasabi. Partners with other cloud service providers, including content distribution networks (CDNs) and compute-focused CSPs, to avoid any sort of egress fees for data moved across different networks.

Security and compliance are other areas in which Wasabi invested heavily, resulting in a long list of certifications, including HIPAA, HITECH, FINRA, MiFID, CJIS, and FERPA for working with government and financial institutions.

Strengths: Simple, convenient, and straightforward pricing without hidden fees for a fast, S3-compatible storage service. Channel-friendly with a growing partner network.

Challenges: Even though Wasabi has significant expansion plans, at the moment the service is available only in 5 regions.

Zadara

It is not a cloud service provider, but offers a storage-as-a-service solution that combines the benefits of a public cloud with those of private infrastructures. Its Cloud Platform works on hardware dedicated to each customer, both in the cloud and on-premises, providing strong multi-tenancy, excellent security, and highly predictable performance. It can be configured for block, file, and object storage, which can scale with different types of media and options in the front end.

Zadara is already available in more than 56 regions in 18 countries. It’s accessible from 300 different cloud providers, with a goal of 1,000 locations before the end of 2021, thanks to the booming partner network the company is building. In fact, most sales are now driven by its channel partners, focusing on mid-size companies, ISPs, and MSPs that cover several different verticals. The solution has already proven its scalability in the field with the deployment of dozens of petabytes for a single object storage infrastructure. Furthermore, thanks to the presence of the product in multi-cloud regions, migrating data from cloud to cloud is quick and easy.

The pricing model is simple and the cost is predictable. It is based on actual resource allocation (flash memory and HDDs), without additional transactions or egress fees. The solution is also highly configurable in terms of data protection, with 2- or 3-way replication and erasure coding. Security is ensured with data encrypted both at rest and in transit, using encryption keys handled directly by the customers. Object immutability is supported as well, adding an additional level of protection vs. ransomware attacks.

Strengths: On-premises and multi-cloud Storage as a Service (STaaS) solution that is independent from the cloud provider. Strong multi-tenancy, enterprise-grade features, and security with highly predictable costs.

Challenges: Erasure coding support is available only with large pro le plans, limiting data protection options for small customers.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter