EMEA Purpose-Built Backup Appliance Market Down 4.5% Y/Y at $311 Millon in 3Q20

Even if Covid-19 accelerates data protection-as-a-service

This is a Press Release edited by StorageNewsletter.com on December 16, 2020 at 2:19 pmIncreased use of data protection as a service and economic constraints caused by the pandemic have affected the EMEA purpose-built backup appliance (PBBA) market, which declined 4.5% in value year on year to $310.9 million in 3Q20, according to IDC Corp.‘s Worldwide Quarterly Purpose-Built Backup Appliance Tracker.

“Due to social distancing and working from home, there has been an acceleration of data protection-as-a-service (DPaaS), which includes DR-as-a-service, backup as a service, and archive as a service, to reduce in-house infrastructure and labor,” said Jimena Sisa, senior research analyst, EMEA storage systems. “When enterprises were considering IT offers aimed at reducing TCO, they were more eager to shift to an operational model when purchasing their backup and DR solutions to reduce uncertainty and get a framework that would help address their future demand needs.”

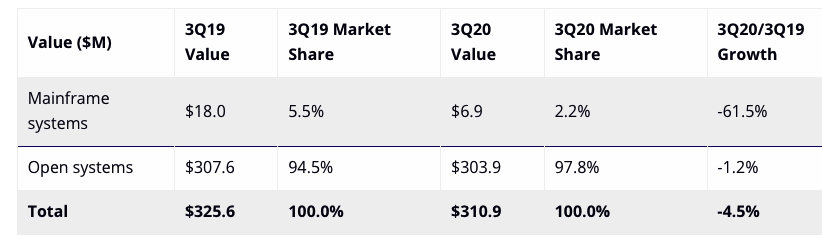

EMEA PBBA Value by Product, 3Q20

(in $ million)

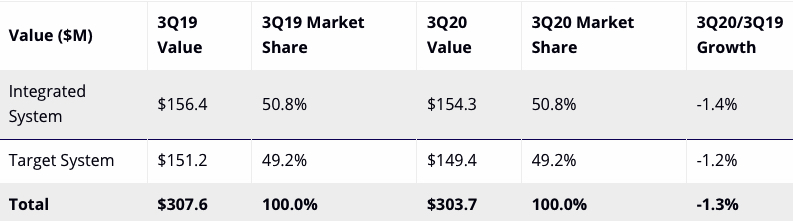

EMEA PBBA Open Systems, 3Q20

(in $ million)

Regional Highlights

Western Europe

The PBBA tracker there declined in value 5.7% Y/Y, reaching $248.1 million in 3Q20.

Although the DACH market continued to be the largest and strongest in Western Europe in 3Q20, responsible for 26.6% of market value, it reported a yearly decrease of 30.8%.

The UK&Ireland lost 1.8 points in market share since last year, at 23.7% market value, and declined 12.2% in value Y/Y.

The French PBBA market reported a rise of 2.5% Y/Y in value and 16.6% market share.

PBBA demand in Western Europe in 3Q20 has been somewhat reduced by a move to cloud data protection, with the greatest impact on mainframes (VTL), which declined 61.4% in market value, followed by target systems (-2.9% Y/Y) and then integrated systems (-1.2% Y/Y).

“The relationship of technology to the success of businesses is considered critical not only during the pandemic, but also in the digital economy post-pandemic. Hence, PBBA vendors that support different consumption models, exploit cloud economics, and provide protection for different and new architectures would be the most successful and considered by enterprises,” said Sisa.

CEMA

As expected, the growth in value of the PBBA market slowed and remained flat Y/Y during Q320, recording $62.8 million.

The shares of the two sub-regions were almost equal as CEE recorded impressive growth of 34% Y/Y fueled by most of the countries in the region. Part of this performance was due to the decline in the quarter a year ago. Despite the growing demand for data protection in the context of remote work and education, MEA saw a reduction in PBBA spending of 18% Y/Y coming from the largest countries in the region.

“End users’ investment plans in the second half of 2020 were more focused on shifting to public cloud and HCI, restraining the investments in DC infrastructure,” said Marina Kostova, research manager, CEMA storage systems. “Data protection was undoubtedly a priority in the pandemic environment, but public cloud solutions partially cannibalized the traditional backup appliances market.”

Major companies covered in the tracker include Dell Inc., Veritas, HPE, IBM, Quantum, Barracuda, Oracle, Fujitsu, Exagrid, HDS, Unitrends, and FalconStor Software.

Taxonomy notes

IDC defines a PBBA as a standalone disk-based solution that uses software, disk arrays, server engines, or nodes that are used for backup data and specifically for data coming from a backup application (e.g., NetWorker, NetBackup, TSM, and Backup Exec) or that can be tightly integrated with the backup software to catalog, index, schedule, and perform data movement. PBBAs are deployed in standalone configurations or as gateways. PBBA solutions deployed in a gateway configuration connect to and store backup data on general-purpose storage. Here, the gateway device serves as the component that is purpose built solely for backup and not to support any other workload or application. Regardless of packaging (as an appliance or gateway), PBBAs can have multiple interfaces or protocols. They can also provide and receive replication to or from remote sites and a secondary PBBA for DR.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter