WW Enterprise External OEM Storage Systems Market Continues to Decline, Down 1.4% Y/Y in 3Q20 at $6.8 Billion

Huawei +24%, IBM -22%, total capacity shipped up 9.6% to 18.9EB

This is a Press Release edited by StorageNewsletter.com on December 9, 2020 at 2:18 pmAccording to IDC Corp.‘s Worldwide Quarterly Enterprise Storage Systems Tracker, global market revenue for enterprise external OEM storage systems declined 1.4% Y/Yr to nearly $6.8 billion during 3Q20). Total external OEM storage capacity shipped was up 9.6% Y/Y to 18.9EB during the quarter.

Revenue generated by the group of original design manufacturers (ODMs) selling directly to hyperscale datacenters grew at 8.7% Y/Y to $6.4 billion in 3Q20, while capacity shipped grew yearly by 41.4% to 74.5EB. Total capacity shipments for the market (External OEM + ODM Direct + Server-Based Storage) increased 31.8% to 129.8EB.

“During 3Q20, the external storage systems market continued to face headwinds due to the effects of the global pandemic,” said Greg Macatee, research analyst, infrastructure platforms and technologies, IDC. “On a regional basis, China’s external OEM market fared better than other global areas, up 21.2% Y/Y. ODM vendors selling directly to hyperscale customers (i.e., ODM Direct) was once again a bright spot for the market. Collaboration tools and content delivery networks were key drivers of ODM sales as consumers continue to demand these types of at-home services on top of traditional enterprise-driven ODM Direct infrastructure consumption.”

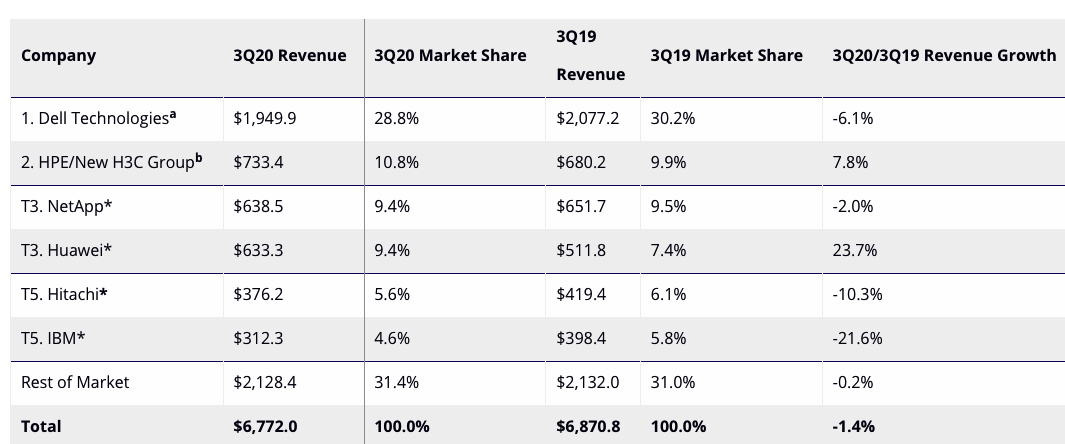

Enterprise External OEM Storage Systems Results, by Company

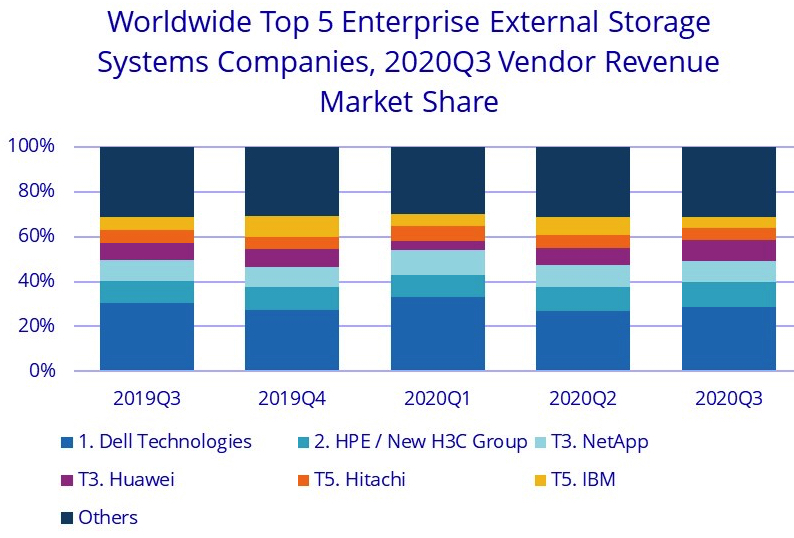

Dell Technologies was the largest external enterprise storage systems supplier during the quarter, accounting for 28.8% of WW revenue. HPE/New H3C group finished second with a 10.8% share. NetApp and Huawei tied* for third place in the market with shares of 9.4% and 9.4%, respectively. Hitachi and IBM finished tied* for fifth with market shares of 5.6% and 4.6%, respectively.

Top 5 Companies, WW Enterprise External OEM Storage Systems Market, 3Q20

(revenue in $ million)

Notes:

* Statistical tie in the worldwide enterprise storage systems market when there is a difference of 1% or less in the share of revenues or unit shipments among two or more vendors.

a Dell Technologies represents the combined revenues for Dell and EMC.

b Due to the existing joint venture between HPE and the New H3C Group, IDC is reporting market share on a global level for HPE as HPE/New H3C Group starting from 2Q16.

Flash-Based Storage Systems Highlights

The total AFA market generated $2.7 billion in revenue during the quarter, up 0.5% Y/Y. The hybrid flash array market was worth nearly $2.8 billion in revenue but was down 0.7% from the year ago quarter.

Regional External Storage System Highlights

On a geographic basis, storage revenue in China grew 21.2% Y/Y. Japan declined 4.4% on a Y/Y basis, while EMEA was down 4.8% in aggregate, USA was down 5.5%, AsiaPac (excluding Japan and China) was down 7.5%, Canada declined 9.4%, and Latin America was down 14.8%.

Taxonomy Notes

IDC defines an enterprise storage system as a set of storage elements, including controllers, cables, and (in some instances) HBAs, associated with three or more disks. A system may be located outside of or within a server cabinet and the average cost of the disk storage systems does not include infrastructure storage hardware (i.e. switches) and non-bundled storage software.

The information in this quantitative study is based on a branded view of the enterprise storage systems sale. Revenue associated with the products to the end user is attributed to the seller (brand) of the product, not the manufacturer. OEM sales are not included in this study.

Read also:

Top News WW Enterprise External OEM Storage Systems Revenue Declined 5% Y/Y in 2Q20

Dell -11%, HPE -15%, NetApp -10%, IBM +13%, Huawei +47% [with our comments]

September 9, 2020 | Press Release

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter