Twist Bioscience: Fiscal 4Q20 Financial Results

Will need mome resources in capital intensive business.

This is a Press Release edited by StorageNewsletter.com on November 26, 2020 at 2:08 pm| (in $ million) | 4Q19 | 4Q20 | FY19 | FY20 |

| Revenue | 15.7 | 32.4 | 54.4 | 90.1 |

| Growth | 106% | 65% | ||

| Net income (loss) | (31.2) | (24.3) | (107.7) | (139.9) |

Twist Bioscience Corporation reported financial results for 4FQ20 and FY20 ended September 30, 2020.

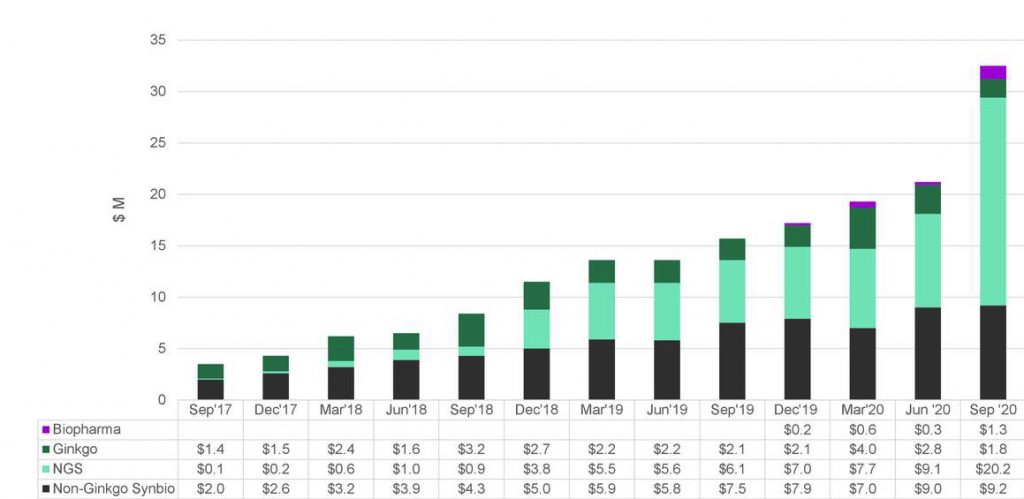

“We ended our fiscal year with record revenue and orders against the backdrop of a global pandemic and significant uncertainty,” said Emily M. Leproust, CEO and co-founder. “While we are proud of the new products we introduced to aid in the fight against Covid-19, which complemented our revenue, it was our core synthetic biology and next-generation sequencing (NGS) product lines that drove our overarching success. We have aggressive plans for growth and expansion in FY21 and beyond, continuing to build our foundation for sustained success across synthetic biology, NGS, biopharma and DNA data storage.“

Growth order

Click to enlarge

FY20 Financial Results

- Total orders received were $116.7 million compared to $70.0 million for FY19.

- Total revenues were $90.1 million compared to $54.4 million for FY19.

- Cost of revenues was $61.4 million compared to $47.4 million for FY19.

- R&D expenses were $43.0 million compared to $35.7 million for FY19.

- Selling, general and administrative expenses were $103.3 million compared to $80.1 million for FY19.

- Net loss for fiscal 2020 was $139.9 million, or $3.57 per share, compared to $107.7 million, or $3.92 per share for FY19.

- As of September 30, 2020, the company had $290.0 million in cash, cash equivalents and short term investments.

- 4FQ20 Financial Results

- Total orders received were $42.7 million, compared to $20.0 million for 4FQ19.

- Total revenues were $32.4 million compared to $15.7 million for 4FQ19.

- Cost of revenues was $17.6 million compared to $12.4 million for 4FQ19.

- R&D expenses were $11.7 million compared to $10.5 million for 4FQ19.

- Selling, general and administrative expenses were $27.2 million compared to $24.4 million for 4FQ19.

- Net loss was $24.3 million, or $0.54 per share, compared to $31.2 million, or $0.96 per share, for 4FQ19.

“Over the last year, we delivered on revenue, orders, margin and product pipeline in a very challenging environment,” commented Jim Thorburn, CFO. “We have a strong balance sheet and momentum moving into FY21, and look forward to an exciting year ahead.”

4FQ20 and recent highlights

- Shipped products to 2,200 customers in FY20, vs. 1,300 in FY19.

- Presented data on Twist Custom Target Capture Panel, Fast Hybridization Enrichment System and our Target Enrichment for Infectious Disease at the American Society of Human Genetics 2020 Annual Meeting.

- Announced strategic partnership with Neogene Therapeutics, Inc. to leverage Neogene’s proprietary expertise in targeting tumor neo-antigens, mutated proteins found in cancer cells due to cancer-associated DNA mutations, together with Twist’s DNA synthesis platform and product lines to develop personalized chimeric antigen receptor (CAR) T cell therapies and T cell receptor (TCR) therapies for patients with cancer.

- Reported preclinical data demonstrating the potent neutralizing effects of multiple potential therapeutic antibodies identified by Twist Biopharma, both Immunoglobulin G (IgG) antibodies and substantially smaller single domain VHH “nanobodies,” against SARS-CoV-2, the virus that causes COVID-19. These neutralizing effects were found to be comparable to or better than those seen with antibody candidates derived from patients who had recovered from Covid-19. The data were collected from studies conducted by Saint Louis University and independently verified by scientists at Colorado State University.

- Achieved milestones on DNA data storage roadmap to miniaturize the silicon platform technology down to 150 nanometer pitch or less. The firm is now able to synthesize DNA using 5-micron devices at a 10-micron pitch. In addition, it has fabricated next R&D-stage silicon chip with 300 nanometer devices on a 1-micron pitch chip.

- Formed the DNA Data Storage Alliance with technology and synthetic biology companies to create a comprehensive industry roadmap designed to help the industry achieve interoperability between solutions and help establish the foundations for a cost-effective commercial archival storage ecosystem for the explosive growth of digital data.

- New Netflix Original Series ‘Biohackers’ stored in Twist’s synthetic DNA.

FY21 Financial Guidance

- Revenue between $110 million and $118 million

- Revenue from Ginkgo Bioworks to be $11 to $12 million

- Synbio revenue excluding Ginkgo Bioworks between $41 and $44 million

- NGS revenue iof $54 to $58 million

- Biopharma revenue approximately $4 million

- Gross margin approximately 32%

- Operating expenses including R&D and SG&A to be $174 million

- Net loss in the range of $136 million to $141 million to reflect increased investments in commercial organization and research and development activities

- R&D approximately $60 million

- Stock-based approximately $20 million

- Depreciation to be $7 million

- Capital expenditures to be $30 million, including expansion into “Factory of the Future”

1FQ21 Financial Guidance: revenue between $25 million and $26 million

During 3FQ20, financial results were not significantly affected by the Covid-19. However, the extent to which the Covid-19 outbreak affects Twist’s future financial results and operations is subject to a high degree of uncertainty and will depend on future developments, including the duration, spread and treatment of the outbreak domestically and abroad.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter