Seagate: Fiscal 1Q21 Financial Results

Nearline HDD shipments down 19% Q/Q in tough 3-month period

This is a Press Release edited by StorageNewsletter.com on October 23, 2020 at 2:15 pm| (in $ million) | 1Q20 | 1Q21 | Growth |

| Revenue |

2,578 | 2,314 | -10% |

| Net income (loss) | 200 | 223 |

Seagate Technology plc reported financial results for its fiscal first quarter ended October 2, 2020.

“Seagate delivered solid September quarter results supported by strong recovery in the video and image applications market and

healthy cloud data center demand, which drove double digit Y/Y revenue growth for our mass capacity storage solutions. We see indications for enterprise demand to improve and we expect this to continue as the broader markets gradually recover, supporting our positive December quarter outlook and reinforcing our revenue expectations for the fiscal year,” said Dave Mosley, CEO. “Demand for data continues to explode, even through this current period of market uncertainty. As a leader in mass data management, Seagate is executing a technology roadmap focused on helping customers put their valuable data to work. We are on track to ship our first HAMR drives for revenue in December, which is an important industry milestone to support the growing need for mass capacity storage. We also have introduced CORTX, an open-source, object-storage software, along with Lyve Rack that together offer enterprises a simple, secure and efficient way to manage massive volumes of data. These developments illustrate our confidence in identifying and capturing future growth opportunities, and we are further underscoring the confidence in our strategy and long-term cash gen abilities with a 3% increase in our quarterly dividend and a $3 billion increase to our existing share repurchase authorization.”

The company generated $297 million in cash flow from operations and $186 million in free cash flow during 1FQ21. It maintained a healthy balance sheet and during the fiscal first quarter 2021, the company paid cash dividends of $167 million and repurchased 1.5 million ordinary shares for $68 million. Cash and cash equivalents totaled $1.7 billion at the end of the quarter. There were 258 million ordinary shares issued and outstanding as of the end of the quarter.

The company is providing the following guidance for its fiscal second quarter 2021:

• Revenue of $2.55 billion, + or – $200 million

• Non-GAAP diluted EPS of $1.10, + or – $0.15

Share Repurchase Authorization

The available portion of Seagate’s share repurchase authority now amounts to $4.2 billion. The authorization does not have a time limit and any share repurchases will be dependent on Seagate’s financial position, results of operations, available cash, cash flow, capital requirements, distributable reserves, and other factors deemed relevant by the company.

Comments

Revenue was $2.31 billion, above firm's guidance midpoint, down 8% Q/Q and 10% Y/Y.

Shares slip 5.4% after these results.

Highlights:

. Video and image (VIA) applications market recovered as revenue doubled Q/Q

• Solid cloud nearline revenue on healthy demand

• Covid-related costs remain a margin headwind, although slightly better than original expectations

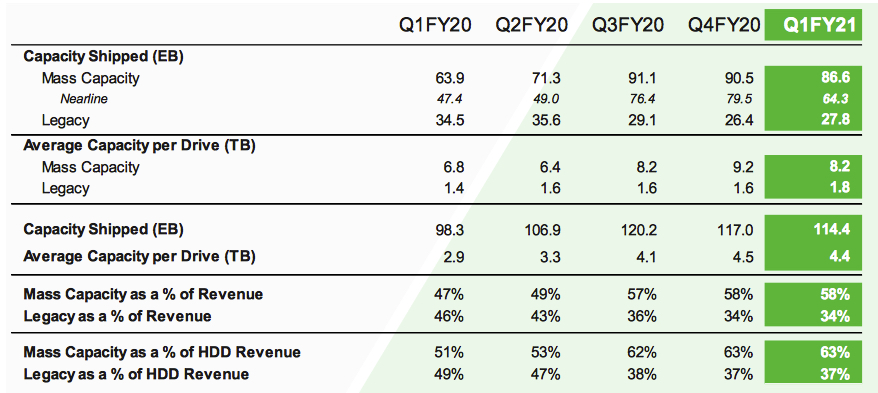

HDD Product Mix Trends

Total HDD capacity shipments were 114EB in 1FQ21 down 2% sequentially. Mass capacity shipments were 87EB compared with 91EB in the prior quarter, and 64EB in the year ago period.

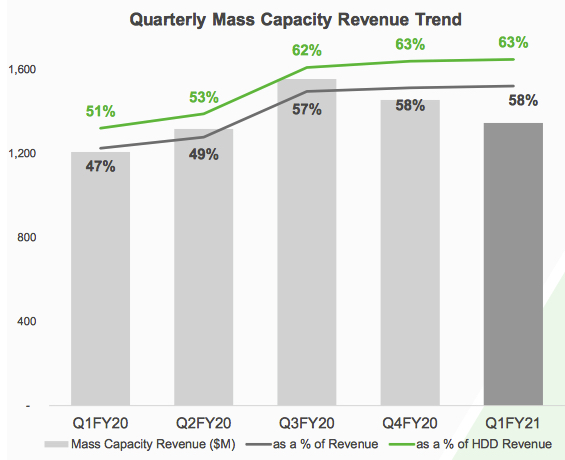

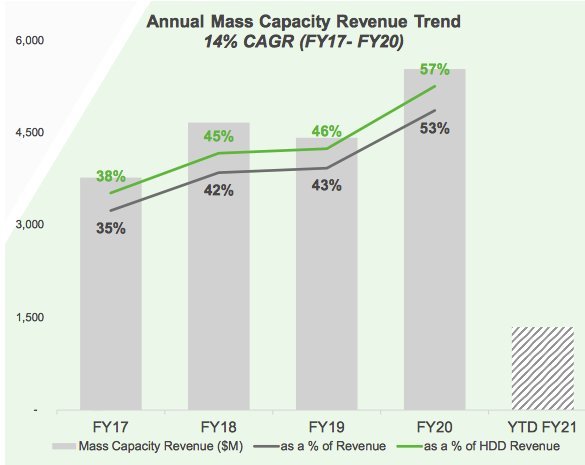

Mass Capacity

Mass capacity storage (nearline, video and image and NAS) represented 58% of September quarter revenue and 63% of HDD revenue, no change from a percentage basis, with the June quarter, and up from 47% and 51% respectively, in the prior year period.

Nearline

Nearline revenue declined Q/Q but remains healthy and within its historical range, centered around 70% of mass capacity sales. Nearline shipment was 64EB, down 19% from record levels in June, but up 36% Y/Y, reflecting growth massive demand for our high capacity nearline drives. The firm estimated 16% of nearline capacity shipments are to replace existing drives, which equates to about 10EB in 1FQ21. Average capacity per nearline drive increased 8% sequentially to 11.6TB, supported by sales of successful 16TB drives,

Legacy

The legacy market (nearline, video and image and NAS) represented 34% of 1FQ21 revenue, up 13% from prior quarter and down 46% Y/Y. Increased sales for consumer drives partially offset the decline in the enterprise mission critical market and sub-seasonal demand for PCs. Exabyte shipments into this market increased 5% sequentially to 28EB supported by the uptick in the consumer products, which have average capacity of 2.7TB for a consumer drive. The firm realized double-digit revenue growth for consumer drives, and in the video and image applications markets, revenue doubled Q/Q, following resurgence in on-prem security and smart video projects.

Non enterprise

Non-enterprise business made up the remaining 8% of September quarter revenue flat on a percentage basis with the prior quarter. Non-HDD revenue is still below pre-Covid levels.

Expectations for 2FQ21

- Seagate is still facing headwinds from Covid related costs, and expect this will gradually decrease over the next couple of quarters.

- Revenue is to be up 10% sequentially at the midpoint.

- For the December quarter support shipment growth is ahead of the long-term demand CAGR of 35% to 40% forecasted for this market.

- The company expects consumer demand to remain stable in the December quarter with some improvement in the mission critical markets consistent with gradually enterprise recovery.

- It expects furthermore solid cloud data center demand to continue in the December quarter supportive of its view for a more elongated cycle.

- It also remains on track to ship 20TB HAMR drives starting in December. Seagate stated that it will be the first to ship this technology with a path to deliver 50TB HAMR drives forecast in 2026.

Dave Mosley, CEO, said: "We are encouraged by the recovery trends we're seeing in key end markets, but still expect macro uncertainty to persist near-term. We now believe the September quarter marks the bottom of the Covid-related demand disruptions."

Revenue by products in $ million

| 4FQ20 | 1FQ21 |

Q/Q Growth | % of total revenue in 4FQ20 |

|

| HDDs | 2,321 | 2,137 | -8% | 92% |

| Enterprise data solutions, SSD and others |

195 | 177 | -9% | 8% |

Seagate's HDDs from 2FQ15 to 4FQ20

| Fiscal period | HDD ASP | Exabytes shipped |

Average GB/drive |

| 2Q15 | $61 | 61.3 | 1,077 |

| 3Q15 | $62 | 55.2 | 1,102 |

| 4Q15 | $60 | 52.0 | 1,148 |

| 1Q16 | $58 | 55.6 | 1,176 |

| 2Q16 | $59 | 60.6 | 1,320 |

| 3Q16 | $60 | 55.6 | 1,417 |

| 4Q16 | $67 | 61.7 | 1,674 |

| 1Q17 | $67 | 66.7 | 1,716 |

| 2Q17 | $66 | 68.2 | 1,709 |

| 3Q17 | $67 | 65.5 | 1,800 |

| 4Q17 | $64 | 62.2 | 1,800 |

| 1Q18 | $64 | 70.3 | 1,900 |

| 2Q18 | $68 | 87.5 | 2,200 |

| 3Q18 | $70.5 | 87.4 | 2,400 |

| 4Q18 |

$72 | 92.9 | 2,500 |

| 1Q19 | $70 | 98.8 | 2,500 |

| 2Q19 |

$68 | 87.4 | 2,400 |

| 3Q19 |

$72 | 76.7 | 2,400 |

| 4Q19 | $79.7 | 84.5 | 2,700 |

| 1Q20 |

$81 | 98.3 | 2,900 |

| 2Q20 |

$77 | 106.9 | 3,300 |

| 3F20 | $86 | 120.2 | 4,100 |

| 4F20 |

$89 | 117.0 | 4,500 |

| 1F21 |

$82 |

114.0 |

4,400 |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter