History (1993): Unit Shipments of Tape drives to Grow in Europe at 13% CAGR, From 553,000 in 1991 to 1 Million in 1996

Revenue at 4% CAGR

By Jean Jacques Maleval | October 12, 2020 at 2:07 pmHere is the second of the 3-part series published by Dataquest on European storage devices that includes rigid magnetic disk drives, tape drives and optical disk drives.

The main trends in tape drive technology are towards higher-capacity products and faster data transfer rates. Today’s quarter-inch cartridge tape drives use stable ferric oxide as the recording medium. Research is currently underway at drive and media manufacturers to develop barium ferrite technology for u e in quarter-inch tapes. This could theoretically quadruple tape cartridge capacities.

Thin-film recording head technology has recently been demonstrated, this will allow 10GB of capacity without compression on a 5.25-inch cartridge drive, and 3GB of capacity without compression on a 3.5-inch minicartridge. Dataquest expects volume production of these drives in the latter half of 1994.

At the same time, new thin-film magneto-resistive heads will be introduced. These drives will offer a sustained data rate of 1.5MB/s on 5.25-inch cartridge drives and up to 880KB/s on 3.5-inch minicartridge drives. The head will use 3 channels (read-write-read) with one read channel dedicated to reading servo positioning information. A fourth channel will provide backwards R/W compatibility with previous gens of quarter-inch tape cartridges and minicartridges.

A major development in half-inch tape technology was represented by the February 1991 launch of the IBM 3490E 400MB enhanced capability magnetic tape subsystem. It has an enhanced capability format using 36-track bidirectional recording, the drives are read-compatible, but not write-compatible, with the earlier IBM 3480 18-track format. Later in 1991, IBM announced support for an enhanced-capacity cartridge with a media length of 1,100 feet, which doubled the capacity a second time to 800MB.

Digital Equipment’s development of its half-inch cartridge technology should result in the availability of a 20 to 50GB drive during the next 5 years. This would be achieved by increasing the number of recording tracks using thin-film media and heads, implementing servo positioning and data compression.

Over the next 5 years, helical scan technology will develop to produce higher-density media, improved modulation code, thinner tape, narrower tracks, higher linear density and faster tape drive speeds. This combination of factors could produce leading edge 4mm DAT products with 16GB of capacity, and a data transfer rate of 1.3MB/s by 1998, and 8mm tape products with 6MB/s by the end of t he decade.

Market analysis

- Unit shipments of tape drives will grow in Europe at a CAGR of 13%, from 553,000 in 1991 to 1 million in 1 996.

- Revenue from tape drives will grow at a CAGR of 4%.

- The average factory selling price of tape drives will decrease by 9% CAGR over the forecast period, from $1,600 to $710.

- The largest country market in Europe is the UK, with a unit shipment market share in 1991 of 37%.

- No other country has a market share as large in 1991, the shares for other European markets were:

Over the forecast period, market shares by country will not change.

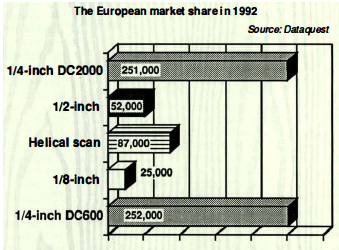

- Most (76%) unit shipments in 1991 were QIC drives, either DC-600 or DC-2000. The remaining shipments were half-inch drives (11%), helical scan drives of either 4mm or 8mm diameters (10%) and eighth-inch drives (3%).

- Unit shipments of half-inch tape drives will decline in absolute terms over the forecast period, and by 1996, will only account for 5% of the total shipped. Unit shipments of helical scan tape drives will increase in absolute terms over the forecast period, and by 1996 will account for 21% of the total shipped.

- However, the largest increase over the forecast period in absolute terms – 345,000 u nits – will be in QIC drives. This is despite the fact that the quarter-inch proportion of total unit shipments will decline slightly from 76% to 71%. The greatest increases will be in DC-2000 drives, accounting for 299,000 units of the total 1991 to 1996 increase. DC-600 will account for only 46,000 units. By 1993, annual shipments of DC-2000 tape drives will exceed those of DC-600.

- The CAGR in unit shipments by tape class between 1991 and 1996 will be:

Market trends

DC-2000 drives

Over the next 5 years, the target market for quarter-inch DC-2000 drives will remain primarily the desktop PC market. Their low prices, media capacities, 3.5-inch form factors and floppy interfaces make them ideally suited for this market. The potential high volume of sales makes this market segment attractive to new vendors. TEAC and Iomega entered the market in 1991 and other new entrants are expected in the coming years. New products are emerging which do not conform to either QIC or Irwin standards. These products will find slower acceptance in the market, especially from OEM customers. The market is characterized by price competition. At the same time, the demand for DC-2000 products is very sensitive to price and sales increased after a 50% price reduction at the end of 1991 and early 1992.

DC-600 drives

DC-600 drives are attached to a wider variety of computer systems than any other tape drive. DC-600 products are found on mid-range systems, workstations and servers. Also a large proportion is found on PCs. The majority of computer system OEMs still offers a DC-600 product, and continued success in the OEM market is critical for this technology. Current activity in the quarter-inch DC-600 market revolves around strategies to maintain the existing customer base and to prevent the erosion of the market by 4mm and 8mm technologies. Since helical scan tape drives began to ship in volume, DC-600 products have been threatened by this newer technology. The large installed base of DC-600 drives is a major plus point when considering the future of DC-600 technology. However, the availability of 2GB/2.1GB and 10GB drives is crucial to the continued growth of this market.

4mm drives

The 4mm market is extremely price-competitive and vendors have been known to price products in order to obtain business and to achieve market share in the early life of this technology. The competitive environment will continue, making it hazardous for any company attempting to enter the market. Several OEMs endorsed 4mm technology in 1991 and 1992. The 3.5-inch form factor 4mm drives entered the market in mid-1991. This small form factor, in combination with native capacities of up to 2GB, is very attractive to users of workstations and network servers. End-user prices have not eroded to the same degree as OEM prices. The high end-user price has meant that sales into the single-station PC market segment have been sluggish. This situation is now beginning to change.

8mm drives

The 8mm market is served exclusively by one company, Exabyte. These products are challenged by 4mm as well as by high-capacity QIC products. The low end of the 8mm market, 2.5GB drives, is experiencing increased price competition, and the mix over time is shifting to the higher-margin 5GB products. Exabyte has built up several strong relationships with computer vendors and has a loyal base of VARs and resellers. With 8mm products selling well for library applications, the Exabyte 8mm libraries are providing an increased contribution to both revenue and net income.

Half-inch drives

The half-inch reel-to-reel is the oldest tape drive technology, dating back to the early 1950s. Reel-to-reel products that began shipping more than 10 years ago are shipping today with only minor modifications. This is still the only universal data interchange device accepted across all levels of systems, and no other tape technology will achieve the same degree of market acceptance. The need for reel-to-reel drives will continue for many years, especially in the aftermarket. The rate of growth of the market for high-end 3480/3490 half-inch cartridges is expected to diminish over the next 5 years. This is because of increased penetration of other tape products into mainframe markets, as well as the negative rate of growth in the mainframe market itself. The low-end 348O/3490 market segment is expected to be positively affected by IBM’s lower-cost rackmount product. The other half-inch cartridge segment is expected to decline as Digital ships other tape products on its workstations.

Distribution analysis and trends

Most unit shipments in 1991 were sold in Europe either through the OEM channel (59%) or through the distributor channel (41%). It is most uncommon for the small tape drives to be “captively” produced.

- OEM generally, direct OEM purchases from tape drive manufacturers are only made by the high-volume manufacturers of computers in Europe. Purchases by other computer manufacturers are usually made from distributors. These latter drives are being sold through the distributor channel, not the OEM channel. Certain key accounts are afforded direct status even though their volumes do not warrant such treatment and support. Dataquest is aware of several long-standing OEM relationships in the tape market. Tandberg supplies QIC drives to IBM, Archive (Conner) supplies 4mm DAT drives to ICL, Apricot and Nokia, and QIC drives to Hewlett-Packard, Olivetti, ICI, NCR, NEC, Compaq, Siemens Nixdorf, Apricot, Bull, Philips, Digital Equipment/Kienzle, Nokia, Norsk Data and Unisys. Exabyte supplies 8mm drives to ICI, Bull, SNI and Olivetti, Hewlett-Packard sells tape drives to Olivetti, SNI, Elonex, Dell and Apple, and Wangtek sells them to Digital.

- Distribution

Dataquest estimates there are about 220 distributors of tape drives in Europe. These 220 distributors are owned by approximately 190 distribution companies. Only a handful of distribution companies operate in more than one country in Europe. More than half (58%) are multivendor distributors. Over half of those sell for 3 or more vendors. The average sales of tape drives per distributor in 1991 were approximately 1,000 units, yielding a revenue to the distributor of $0.75 million. Tape drives constituted about 6% of distributor revenue, most of the rest derived from sales of rigid disk drives, floppy half-inch disk drives, optical disk drives, monitors, memory upgrades and communications products. The average distributor only sells tape drives to customers in the country in which the distributor is located. Few regional distributors exist. Companies which sell in more than 1 country tend to set up a separate company in each country, rather than service their foreign customers from the home country. A small proportion (9%) of tape drive distributors export tape drives to countries outside Western Europe. The most common destinations are the countries of Eastern Europe, including the republics of the former URSS. Other destinations include the Middle East and Africa (mostly the Republic of South Africa). Distributors sell to 4 main customer groups: OEM customers, systems houses and retailers. These 3 account for 98% of sales through distributors. The remaining 2% is sold directly to major users, or is sold for applications outside the computer industry (such as the automobile and electronics industries). The largest customer group is the systems house, comprising systems integrators and VARs. Systems houses accounted for 56% of sales through distributors in 1991, which is forecast to remain unchanged through to 1996. OEM customers, which comprise PC manufacturers, workstation manufacturers and some minicomputer manufacturers, typically purchase less than 300 tape drives per month through distributors. Larger OEM customers tend to purchase direct from the vendors, not from the distributors. OEMs accounted for 2 1% of sales through distributors in 1991, and this is forecast to decline slightly to 20% by 1996. Retail customers consist of mass merchandisers, wholesalers supplying high street retailers, retail chains buying on behalf of their outlets, and large individual retail outlets. They accounted for 21% of sales through distributors, this is forecast to increase slightly to 22% by 1996.

This article is an abstract of news published on the former paper version of Computer Data Storage Newsletter on issue 66, published on July 1993.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter