History (1993): Unit Shipments of 2.5-, 3.5- and 5.25-Inch HDDs to Grow in Europe at 16% CAGR

From 7.9 million in 1991 to 16.9 million in 1996

By Jean Jacques Maleval | October 9, 2020 at 1:39 pmDataquest published a three-part series on the European storage industry (each one for $2,800).

Here is a summary of the first one on magnetic rigid disk drives.

The 1.8-inch disk drive, introduced in 1989, has become the industry standard size for notebook and palmtop computers. A 1.3-inch disk drive was introduced in 1992. Drives of both sizes will be connected to these sub-laptop computers via the PCMCIA standard interface introduced in 1992.

The 2.5-inch disk drive has not yet achieved sufficient manufacturing volume to yield lower-cost storage per megabyte than the 3.5-inch disk drive. However, manufacturing volumes for 3.5-inch drives are sufficient to be highly competitive on a per megabyte cost basis with 5.25-inch drives.

There have been several technology advances in disk storage density. Dataquest believes that drives which allow heads to fly in contact with a molecular layer of lubricant could become a commonplace technology, glass disk substrates and magneto-resistive heads will all allow disk capacities to be boosted. Etched track technology and optical patterning technology will increase the track density, allowing more embedded servo information to be stored on the disk. New technologies capable of achieving high areal densities and faster rotational speeds will require new semiconductor parts for disk drive electronics. These parts will be available in 1993.

The IDE has proved to be a better and cheaper solution than the dumb disk interface, and will prevail in the market.

Software could further improve the performance of intelligent disk interfaces through buffering, caching and channel control. However, the implementation of advance technology is held back by the need to agree interface standards between manufacturers. SCSI will remain the main interface for all high-performance 3.5-inch and 5.25-inch drives in excess of 500MB. The IDE interface will continue to be popular for entry-level products.

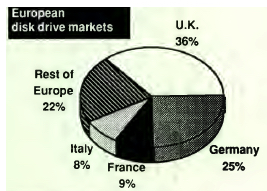

Market analysis Dataquest forecasts that unit shipments of 2.5-, 3.5- and 5.25-inch diameter small rigid disk drives will grow in Europe at a CAGR of 16%, from 7.9 million in 1991 to 16.9 million in 1996. Revenue from these drives will also grow at a CAGR of 16%. Their average price will remain unchanged over the forecast period. The largest country markets in Europe are the UK, with a market share in 1991 of 35%, and Germany with 25%. Over the forecast period 1991 to 1996, market shares by country will not change.

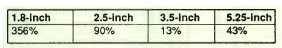

Dataquest forecasts that unit shipments of very small drives, 1.8 inch in diameter, will grow in Europe at a CAGR of 356%, from 1,000 in 1991 to more than 2 million in 1996. Revenue from very small drives will grow at a CAGR of 263%. The average price of very small drives will fall by 20% per year, from $340 to $110 over the forecast period.

Most (87%) unit shipments in 1991 were 3.5-inch drives. Unit shipments of 5.25-inch drives (11%) were smaller than had been forecast by Dataquest a year ago, while 2.5-inch drives began to be shipped in volume, accounting for 2% of the total.

Dataquest believes that unit shipments of 5.25-inch units will decline over the forecast period. By 1996 they will account for only 1% of the total number of the disk drives shipped. By 1996, unit shipments of 1.8- and 2.5-inch drives will account for 11% and 22% respectively.

However, the largest increase will be in shipments of 3.5-inch disk drives – nearly 6 million units – despite the fact that their proportion of total unit shipments will decline from 87 to 67%.

The CAGR in unit shipments by disk diameter between 1991 and 1996 will be:

These figures compare with an overall CAGR of 18% (16% excluding 1.8-inch drives).

Distribution trends

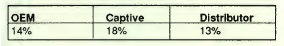

Most unit shipments in 1991 were sold either through the OEM channel (44%) or the distribution channel (37%). Captive manufacturing accounted for 19% of unit shipments. Dataquest believes that the relative importance of the distribution channels will change over the forecast period. The most significant change will be the increasing importance of the OEM channel and a corresponding decrease in the distributor channel.

OEM sales will account for 48% of 1996 unit shipments; distributor sales for 32%; and captive manufacturing for 20%. The CAGR in unit shipments by distribution channel between 1991 and 1996 will be:

These figures compare with an overall CAGR of 16%. OEM direct sales of rigid disk drives to the OEM tchannel will continue to depend on events in the PC market.

The European PC market is estimated to be growing at a total rate of 14% per year between 1991 and 1996. It is estimated that sales to OEM customers will grow at a total rate of 14% over the same period. The difference will be due to medium-size OEMs switching their source of supply from distributors to drive manufacturers themselves.

Only the largest PC manufacturers buy directly from drive manufacturers. Dataquest believes that an annual output total of 36,000 PCs manufactured nominally divides OEM producers into direct OEM customers and indirect OEM customers via distributors.

Few disk drives are manufactured in Europe. The largest independent manufacturer is Conner Peripherals. There are significant captive producers, in particular IBM, but also Digital and Hewlett-Packard. It is expected that IBM and Digital will supply disks to other PC manufacturers, thereby competing with the independent manufacturers for the OEM business.

The notebook computer market is the fastest-growing segment of the PC market over the forecast period, fueling the demand for 2.5-inch drives. Because of the size and value of notebook computers, Dataquest believes that PC manufacturers will “seal in” 2.5-inch products into notebook computers, reducing the supply of 2.5-inch product for replacement and upgrade via the distributor channel. The 2.5-inch OEM market is likely to be dominated by Conner Peripherals as an OEM supplier to Compaq, and by Toshiba, captively producing in Japan for own consumption in Europe.

The 3.5-inch OEM market is currently the healthiest opportunity in Europe. The largest market within Europe lies outside the major 4 countries (France, Germany, Italy and UK).

Workstation producers such as Digital, Sun and Hewlett-Packard are also prospects for high-capacity 3.5-inch drives.

The 5.25-inch market is the weakest, although there are opportunities for high-capacity, gigabyte-plus drives used in disk arrays.

Distribution

Three main factors affect the volume sales through distributors by country:

– First, sales will be higher in those countries in which medium-size and small OEM computer manufacturers and assemblers, typically buying less than 36,000 rigid disk drives per year, are located. This factor favors sales in UK and Germany, where the manufacturer and assembly of low-volume PC systems are more prevalent.

– Second, sales will be higher in those countries with a high penetration and use of PC systems. This factor favors sales in larger countries such as UK, France and Germany, as well as in smaller countries such as Sweden, Belgium, The Netherlands and Switzerland.

– Third, sales will be higher in those countries which act as sales conduits to countries in Eastern Europe, and other countries such as South Africa. This factor favors Finland, Sweden, Germany, Austria and Switzerland (for Eastern Europe) and the UK (for South Africa).

There are estimated to be around 240 distributors of rigid drives in Europe that are owned by approximately 210 distribution companies. A substantial number of distributors, 40%, are multi-vendor distributors, although most multi-vendor distributors sell products from only two vendors. Only one-quarter of the multi-vendor distributors sell for 3 or more vendors. Most vendors use one, or occasionally two, distributors per country: and most vendors have around 15 to 20 distributors marketing their products.

The average sales volume per distributor in 1991 was approximately 12,000 units, yielding a revenue to the distributor of $4.8 million.

Rigid disk drives constitute around 40% of distributors’ revenues, most of optical disk drives, memory upgrades, monitors and communications products.

The average distributor only sells rigid disk drives to customers in the country in which the distributor is located. The most common destinations are Eastern Europe and South Africa.

Distributors sell to 3 principal types of customer: OEM customers, systems customers and retailers. These 3 account for 98% of sales through distributors. The remaining 2% is sold directly to major users or for applications outside the computer industry (such as the automobile and electronics industries).

The largest group of customers for distributors is system house, which comprises systems integrators and VARs. Systems houses accounted for 53% of sales through distributors in 1991 and are forecast to rise to 57% in 1995.

The second-largest group of customers is the OEM, which comprises PC manufacturers and minicomputer manufacturers. Typical OEM customers purchase less than 3,000 rigid disk drives per month. Larger OEM customers tend to purchase direct from vendors, not from distributors. OEMs accounted for 24% of sales through distributors in 1991, a figure that is forecast to remain unchanged until 1995. The third group, retailers, consists of mass merchandisers, wholesalers supplying high street retailers and retail chains buying on behalf of their outlets.

Retailers accounted for 21% of sales through distributors in 991, but it is forecast that they will account for only 17% by 1995. An emerging trend in Europe is towards direct sales by vendors to mass merchandisers, eliminating the distributor in the sales hierarchy. The distributor market over the period 1991 to 1996 will be affected by an increase in the demand for rigid disk drives and by pressure on margins. Demand for rigid disk drives from distributors will increase over the forecast period 13% per year. In Dataquest’s opinion, this increased demand will be met by increased throughput among existing distributors rather than by the establishment of new distributors.

Distributors will want to improve their net margins by increasing the ratio of revenue per sale to cost per sale. At the same time, distributors will increasingly compete with each other in terms of delivery, quality and support. The key to vendor success in the distributor market will be for vendors to satisfy distributor’s needs in these three respects.

Dataquest forecast a decrease in the proportion of distributors revenue coming from rigid disk drives. As competition intensifies over the forecast period, distributors themselves will adapt and take on board additional computer peripheral products, such as printers and modems. Indeed, many will increasingly distribute fully configured PC systems.

This article is an abstract of news published on the former paper version of Computer Data Storage Newsletter on issue 65, published on June 1993.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter