History (1993): French ATG Gigadisc Subsidiary of US Company NIC

But not becoming American

By Jean Jacques Maleval | October 6, 2020 at 2:18 pmIt was a big surprise in Europe to hear that ATG or Art-Tech Gigadisc (Toulouse, France), a 12-inch WORM drive and media manufacturer, to be controlled by a US company, hardly known, NIC or Network Imaging Corp. (Reston, VA), from the document image processing and network segment.

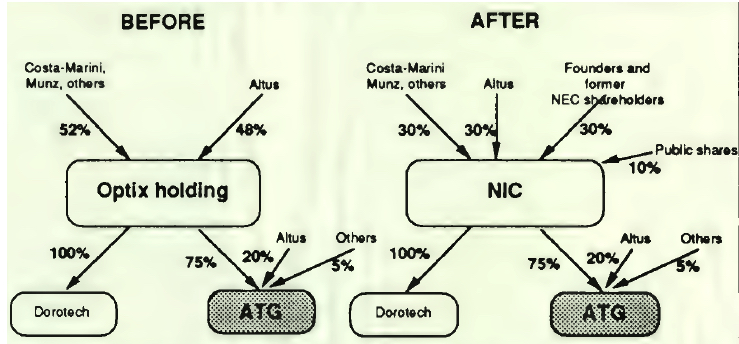

But this doesn’t mean that ATG is becoming American since French private people and a French company took over NIC’s control by bringing in assets from ATG and Dorotech (Nanterre, France), one of the leading European optical disk integrators. This operation is subject to shareholders’ approval and government authorizations that should be obtained.

To be more precise, there first was in France (see diagram below) a financial holding, Optix, owned by a majority of Dorotech’s founders, at their head, Bruno Costa-Marini, then Manuel Munz and Altus Finances, a Crédit Lyonnais subsidiary capital venture. This holding owned 100% of Dorotech and 75% of ATG. These same shareholders took more than a 60% majority participation into NIC.

The incorporation of the 2 French companies, ATG and Dorotech, into NIC will materialize by the issuing of new shares totalling close to $39 million. An extra $10 million will be added by Altus. NIC’s future board of directors will include Robert Bernardi, CEO, John Mann and Robert Sterling, chairman, NIC’s 3 founders, plus Costa-Marini and Munz, from the Optix holding that disappears, and Yves Chassagne, a representative of Altus. And finally, ATG and Dorotech will become NIC subsidiaries at 75% and 100% respectively. NIC was founded in 1990, and is listed at the Nasdaq in New York (IMGXW) and on Boston’s stock market (IMXW).

The 125-employee group includes 7 companies acquired in 2 years: Centennial Computer Services (Houston, TX), CM Technologies (Reston, VA), Hunsbury Computer Services (Northampton, U.K.), Kramer Systems International (Silver Spring, MD), NSI (Baltimore, MD), PE Systems (Alexandria, VA) and Symmetrical Technologies (Knoxville, TN).

NIC reported consolidated sales of $9.6 million in 1991 and $15.8 million in 1992. It has been continuously in the red since it was created, reporting a $269,000 loss last year.

“When you add all the entities, they representa total sales of $60 million, equally shared between ATG, Dorotech and NIC,” says Christian Maillard, ATG’s GM.

“We count on $100 million all together for 1993,” plans Olivier Penet, Dorotech’s chairman, the total staff amounting to 300 people worldwide.

Maillard adds that, in its fiscal period ended in December 1992, ATG reported a FF10 million loss and FF100 million sales, a 5% drop compared to 1991, but this year looks better with a 30% sales improvement in the three first months.

“ATG will always have a separate activity. For us, NIC and Dorotech will be customers. And we will have the advantage of being considered as an US company in the US,” said Maillard.

The US market is very important for the manufacturer that has sold for $5 million of products in 1992 and hopes to reach $7 million this year.

One of the first consequences of this merging is that ATG has put in its catalog a card originated from NIC, named GigaNet (SpanServer for NIC). It allows the direct connection of 12-inch optical drives or a jukebox (Gigastore from ATG or Cygnet) to an Ethernet network with compatibility with Novell NetWare and Sun Microsystems NFS. This card, not priced yet, should soon be manufactured in ATG’s plant in Toulouse and integrated in the drive.

It will also be announced next September in connection with a 5.25-inch optical disk drive with a jukebox bought from another manufacturer, unchosen, but the subsystem will bear ATG’s label.

This article is an abstract of news published on the former paper version of Computer Data Storage Newsletter on issue 65, published on June 1993.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter