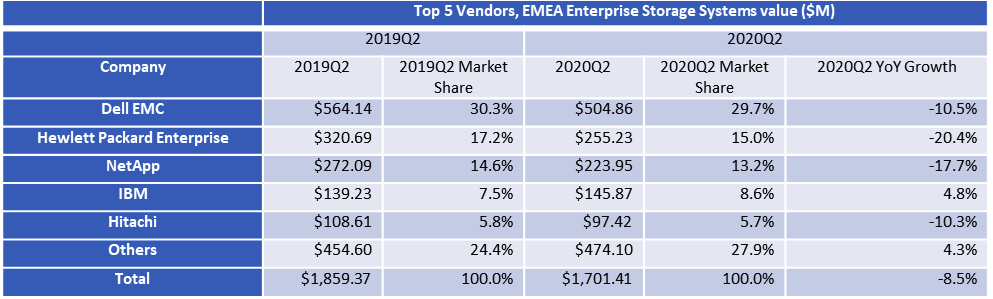

2Q20 EMEA External Storage Systems Market Down 8.5% Y/Y

HPE -20%, NetApp -18%, IBM +5%

This is a Press Release edited by StorageNewsletter.com on September 14, 2020 at 2:16 pmThe EMEA external storage systems market value in 2Q202 was down 8.5% Y/Y in dollars and 6.6% in euros, according to International Data Corporation‘s EMEA Quarterly Disk Storage Systems Tracker.

Once again, the quarter saw marked differences across subregions, with Western Europe down yearly 12.4% and CEMA up 2.7% (both in dollars).

On a bright note, the AFA segment retained its steady path to growth at 9% Y/Y, bringing its share on the external storage market value to 43.6%, up from 36.6% in the same quarter a year ago.

The increase happened at the expense of both hybrid flash arrays (HFAs), down by more than 20% Y/Y and covering 37.4% of value shipments, and HDD-only arrays, down by roughly 15% and representing only 19% of shipment value.

“The EMEA market is still suffering from the general decline in business brought about by COVID-19, but it scored marginally better than the previous quarter,” said Silvia Cosso, associate research director, storage systems, IDC Western Europe. “Geographical differences persist, with CEMA still on positive territory and Western Europe with double-digit decline. Despite the decline, hot areas of growth remain: AFA and HCI reported Y/Y growth, signaling that the appetite to adopt more efficient technologies remains a business priority. There is a special note for Purpose-Built-Back Up Appliances (PBBA), which is back in positive territory after 5 quarters.”

Western Europe (WE)

WE external storage market value was down again by 12.4% in dollars (-10.6% in euros).

AFAs jumped to 43.6% of total value, recording a 4% increase Y/Y and therefore proving to be considerably more resilient than HFA and HDD-only arrays.

Most of the major countries have reported declining values on the wave of extensive lockdown measures, though a note of cautious optimism can be drawn for the WE market, where the yearly decline was still in the low double-digits, but slightly better than the previous quarter.

“However, the risk of a second wave of contagions bringing about new lockdowns of various extent and the end of support schemes from governments could further jeopardize recovery in the remaining part of the year,” said Cosso.

Central and Eastern Europe, the Middle East, and Africa (CEMA)

The projects pipeline managed to keep CEMA storage market on the positive side in 2Q20, with 2.7% Y/Y growth or $488.1 million value. The pandemic lockdown and economic downturn resulted in varying performance across countries depending on government measures for business and their dependence on international trade.

The nearly 24% growth of AFAs offset the decline in hybrid and HDD-only arrays, bringing the segment’s market share to the same level as in Western Europe. Surprisingly, the MEA subregion was the first to surpass the 50% threshold. However, the trend was different between WE and CEMA with traditional storage solutions prevailing over HCI and PBBA in the latter during the quarter.

“The surge in traditional storage is expected to be only short-term while investments in cost optimization solutions and remote consumption models are set to continue,” said Marina Kostova, research manager, storage systems, IDC CEMA. “The expectations till the end of the year are for a moderate decline followed by growth in only particular workloads, where the MEA region will be contributing significantly to AFA and HCI penetration across EMEA.”

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter