Paladian Data: Confirmation of NVMe-oF Slow Adoption as of Today

Several early players almost disappeared.

By Philippe Nicolas | September 11, 2020 at 2:18 pmPaladian Data, the new name of Apeiron Data Systems since few months, invites us to consider this topic as we realize several NVMe-oF players who initiated this technology wave finally got shaken, or acquired and some of them even disappeared.

Let’s put things in perspective first. NVMe is the new storage media connectivity standard and is here to stay delivering real value, finally filling a performance gap. Not really new as the first spec was published in March 2011 but NVMe is ubiquitous today.

The market is mature and dynamic with many players competing on implementation, product line, performance and price, in other words a pretty classic market. We see tons of products from gaming to enterprise to data center in different formats: U.2, U.3, M.2. AIC or PCIe boards. This wave has contributed to the idea of a full flash data center and it’s becoming more and more real. It also promotes indirectly a DAS model and serves as the new reference. The immediate effect is the consideration of architecture where compute and storage layers are glued together in a shared nothing model. Over the years this model got a lot of adopters with HDDs, SSDs and even SCM whatever the storage platform is. It means here exposing a block, file or object interfaces, and even a combination of these.

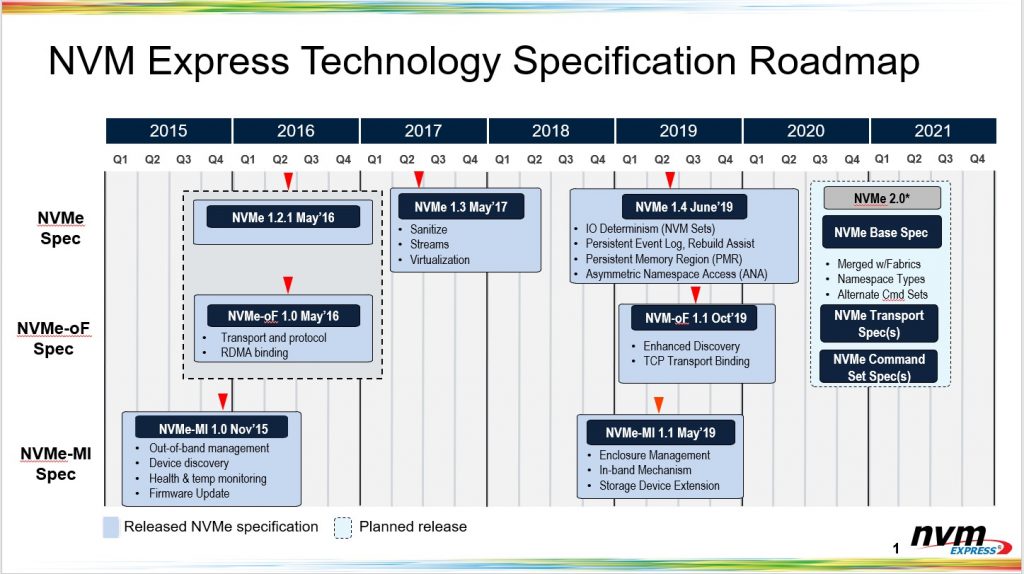

So the natural evolution was to extend NVMe over a transport layer, like IB, Ethernet or FC or even more recently with TCP, to offer a similar experience and almost same performance levels as “local” storage. The NVMe-oF 1.0 specification was unveiled in June 2016 and last version 1.1 was published in October 2019. You can access it with this link. The roadmap for NVMe and NVMe-oF shows interesting developments. These dates are pretty important when you put players on the map.

That trend initiated a new architecture model where compute and storage can be decoupled and scaled independently. Immediately we found players introducing shared everything architecture claiming new levels of scalability and performance. Decoupling compute and storage helps to build dynamic infrastructure, limited to storage or with compute included. This initiative is known as composable infrastructure (CI) with the capability to compose, decompose, recompose dynamically virtual computers, clusters or storage arrays aligned to what internet giants are doing. This approach helps to control IT resources with a fine granularity and align them to workloads needs again dynamically.

In the NVMe-oF segment, there are some interesting initiatives, some founders have anticipated this trend, and as often, being too early means failure more from a market standpoint than a product one. In other words, it’s difficult to find a market when it doesn’t exist yet. Having no demand is critical especially when other existing products are good enough for users.

Among these pioneers or relevant players, we can list Apeiron Data Systems, DSSD, E8 Storage, Excelero, Kaminario, Kazan Networks, Lightbits Labs, Mangstor, OCZ, Pavilion Data Systems, Smart IOPS, SolidFire, Vexata, Violin Memory and XtremIO.

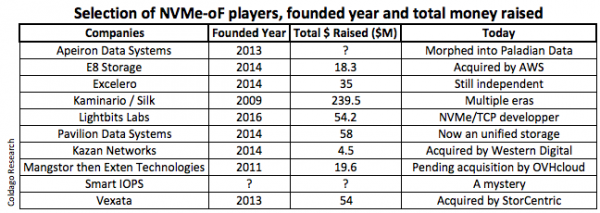

- Apeiron Data Systems, founded in 2013, introduced a proprietary NVMe over a transport layer with a proprietary implementation. Does it explain their difficulties? We don’t know but the reality is that the company got silent to reappear beginning of 2020 under the name Paladian Data with several same leaders like the CEO Lee Harrison.

- DSSD, founded in 2009, started before the NVMe-oF wave and even before the first NVMe official specification but clearly initiated some interesting architecture direction. EMC acquired the company in 2014 for $1 billion and the product line was stopped in 2017 under Dell leadership.

- E8 Storage, founded in 2014, is a pioneer in the NVMe-oF storage array segment with a proprietary implementation illustrated by host agent to install. E8 confirmed the difficulty to find a demand and the story finally ended at AWS as the Internet giant acquired the company in 2019.

- Excelero, founded in 2014, is a software player promoting a proprietary NVMe-oF design with host agents again. The company is pretty confidential and the market reveals recent departures. We’ll see how this story will evolve.

- Kaminario, founded in 2009, before the NVMe existence adopted it rapidly and promoted actively NVMe-oF and composable infrastructure moving from an appliance/software model to a pure software and even now a cloud one. The company recently renamed itself Silk to reflect all these changes.

- Kazan Networks, founded in 2014, very confidential with very low financing, got acquired by Western Digital in 2019.

- Lightbits Labs, founded in 2016, is a more recent actor who played a key role in developing the TCP transport support for NVMe-oF being by nature a standard. Thus the direction is somewhat different as the team embraces only standards.

- Mangstor, founded in 2011, developed a proprietary NVMe-oF implementation that finally didn’t find its market. The company almost disappeared to revive as Exten Technologies, being itself under an acquisition process by OVHcloud.

- OCZ Technology Group, founded in 2002, existed before the NVMe wave but note that Toshiba Corporation, now Kioxia, acquired the company in 2014 and becoming the root of KumoScale, Kioxia’s NVMe-oF activity.

- Pavilion Data Systems, founded in 2014, embraced NVMe-oF and the company, still independent, expands product to other access and network protocols.

- Smart IOPS is also a mystery without much information on the various financial sites and even on its own corporate site. The company is still pretty confidential trying to exist in the landscape.

- SolidFire, founded in 2010, anticipate AFA needs and finally landed at NetApp in 2015 for $870 million.

- Vexata, founded in 2013, developed a dense block storage array with NVMe-oF in mind. Long sales cycles and finally small demands forced the team to accept an offer from StorCentric in 2019.

- Violin Memory, founded in 2005, appeared before the NVMe wave. The company had several lives and finally got acquired by Quantum Partners LP in 2017. In 2018, the team acquired the storage business of X-IO Technologies. The company is today named Violin Systems.

- XtremIO, founded in 2009, started to develop a new array architecture and got acquired by EMC in 2012 for $430 million. Unlike DSSD, XtremIO is still a brand used with product developed and promoted for Dell.

We can even mention Annapurna Labs, founded in 2011, acquired by AWS in 2015 for $370 million.

The table below summarizes some events on the market with the amount raised for a selection of companies.

This situation represents a new opportunity to mention again a classic purchase behavior. Big clients buy from big vendors, small clients are flattered to be considered by big vendors even via channels and they buy from small vendors as well. So big clients buy only from small vendors when big ones are not delivering enough innovation, being not in the top developers for some technologies. But the risk is that the vendor disappears, the good thing in that case would be to land to large OEMs.

A key element with innovation is the adherence to standards. Some companies have anticipated the market to gain footprint and released their implementation. And we see companies who continue to do proprietary developments after the standard is released. But exceptions exist and globally we see standards more adopted as they offer some sort of guarantee and long term security or investment protection for users.

Also intrusive software with agent or driver to install limits market adoption.

The surprise is the difficulty many of these vendors had with their financial having real difficulties to raise rounds to extent their experience and life.

And of course we have to mention that difficulties encountered by innovators and pioneers, are also the result of the arrival and pressure put by gorillas and usual suspects. We mean here DDN, Dell EMC, Fujitsu, Hitachi Vantara, HPE, Huawei, IBM, Infinidat, Lenovo, NEC, NetApp and Pure Storage… We can even add here Quantum. Plus the file players such Panasas, Qumulo, VAST Data and WekaIO. The segment is so hot that we must list also vendors like Nebulon, Fungible, ScaleFlux, NGD Systems or Pensando who all develop intelligent compute/storage boards.

Does all these events explain difficulties some vendors listed above encountered. Probably.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter