Box: Fiscal 2Q21 Financial Results

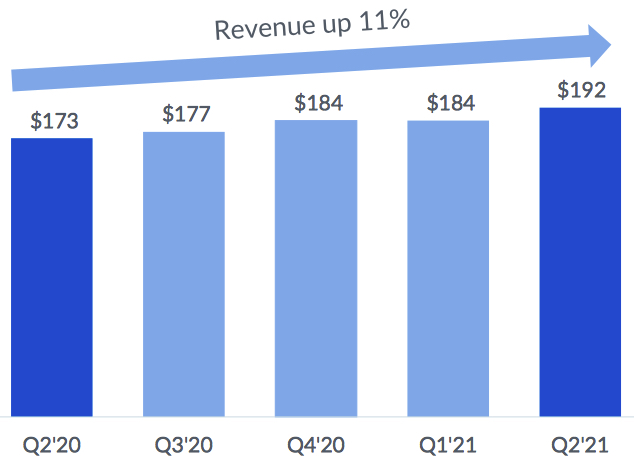

$192 million in sales up 11% Y/Y and 5% Q/Q, with lower loss

This is a Press Release edited by StorageNewsletter.com on September 3, 2020 at 2:13 pm| (in $ million) | 2Q20 | 2Q21 | 6 mo. 20 | 6 mo. 21 |

| Revenue | 172.5 | 192.3 | 335.5 | 375.9 |

| Growth | 11% | 12% | ||

| Net income (loss) | (36.2) | (7.7) | (73.1) | (33.2) |

Box, Inc. announced financial results for the second quarter of fiscal year 2021, which ended July 31, 2020.

“The world is fundamentally different today than it was just a few months ago as organizations must support remote work and rethink their business processes in the cloud,” said Aaron Levie, co-founder and CEO. “Customers are leveraging the full power of Box by adopting products like Shield and Relay and our bundled Suite offering to securely manage, collaborate, and drive workflows around their most important content. Our market leadership enables us to meet the needs of our customers in today’s environment and provides us a large growth opportunity going forward.”

“Our strong Q2 results demonstrate the progress that we’ve made in delivering an excellent balance of growth and profitability, even in these uncertain times,” said Dylan Smith, co-founder and CFO. “Our heightened focus on driving expansion and renewals in our existing customer base drove strong top line results, while our focus on overall cost discipline allowed us to improve operating margins and cash flow. For FY21, we now expect our non-GAAP operating margin to be 12 to 13% of revenue, a significant improvement from 1% a year ago.”

2FQ21 Highlights

• Revenue was $192.3 million, an increase of 11% from 2FQ20.

• Remaining performance obligations were $726.7 million, an increase of 13% from 2FQ20.

• Deferred revenue was $364.9 million, an increase of 10% from 2FQ20.

• Billings were $188.8 million, an increase of 9% from 2FQ20.

• GAAP gross profit was $137.0 million, or 71% of revenue. This compares to GAAP gross profit of $118.7 million, or 69% of revenue in 2FQ20.

• Non-GAAP gross profit was $141.4 million, or 74% of revenue. This compares to non-GAAP gross profit of $123.0 million, or 71% of revenue in 2FQ20.

• GAAP operating loss was $7.5 million, or 4% of revenue. This compares to a GAAP operating loss of $36.3 million, or 21% of revenue, in 2FQ20.

• Non-GAAP operating income was $30.1 million, or 16% of revenue. This compares to a non-GAAP operating income of $0.5 million, or 0% of revenue, in 2FQ20.

• GAAP net loss per share, basic and diluted, was $0.05 on 154.7 million weighted-average shares outstanding. This compares to a GAAP net loss per share of $0.25 in 2FQ20 on 147.0 million weighted-average shares outstanding.

• Non-GAAP net income per share, diluted, was $0.18. This compares to a non-GAAP net income per share of $0.00 in 2FQ20.

• Net cash provided by operating activities totaled $32.3 million. This compares to net cash used in operating activities of $4.7 million in 2FQ20.

• Free cash flow was positive $13.3 million. This compares to negative $19.0 million in 2FQ20.

Business Highlights Since Last Earnings Release

• Delivered wins and expansions with organizations such as Access Information Management, Apleona GmbH, Better Up, Lord, Abbett & Co. LLC, San Diego Zoo Global, Sanki Engineering Co., Ltd., and Stanley Black & Decker.

• Addition of intelligent, automated classification to Shield, which allows to automatically scan files and classify them based on their content, helping businesses detect and secure sensitive data.

• Introduced improvements to Relay to automate and accelerate processes around content. The new capabilities include a new library of pre-built templates to make it easier for end users to create workflows without IT support, multi-file support, and an integration with File Request.

• Availability of Collections and Annotations as part of the All-New Box experience to enable users to organize files and folders easily and review content by highlighting and adding annotations to 100+ file types directly in Box Preview.

• Strategic partnership with Google Cloud to help customers transform the way they work. Under the strategic partnership, thr firm will leverage Google Cloud to enhance the scale, performance, and intelligence of its platform. Both companies will also deepen the Box and G Suite integration to create a more seamless experience for the thousands of enterprises using G Suite with Box.

• New Adobe Acrobat for Box integration, which will enable users to seamlessly open PDF files from Box directly in the Acrobat web viewer and access essential PDF and e-signature tools while ensuring all changes and updates go back into Box.

• New Box for Webex Teams integration that makes remote work easier. Teams can share and view Box content from within a Webex Teams space to enable more effective collaboration.

• Smart Links for Box, a new Box for Confluence integration, which adds rich context and preview capability of Box content within Confluence.

• Recognized as a Top Bay Area Corporate Philanthropist in 2020 by San Francisco Business Times and one of Fortune’s Best Large Workplaces for Millennials for 2020.

3FQ21 Outlook

Revenue is expected to be in the range of $193 million to $195 million. GAAP basic and diluted net loss per share are expected to be in the range of $0.10 to $0.08. Non-GAAP diluted net income per share is expected to be in the range of $0.13 to $0.15. Weighted-average basic and diluted shares outstanding are expected to be approximately 157 million and 163 million, respectively.

FY21 Guidance

Revenue is expected to be in the range of $767 million to $770 million. GAAP basic and diluted net loss per share are expected to be in the range of $0.39 to $0.35. Non-GAAP diluted net income per share is expected to be in the range of $0.56 to $0.60. Weighted-average basic and diluted shares outstanding are expected to be approximately 156 million and 163 million, respectively.

Comments

Revenue was $192.3 million, up 11% Y/Y and 5% Q/Q, and more than 15% non-GAAP operating margin compared to 0% a year ago, and non-GAAP EPS of $0.18 compared to zero cents a year ago, both above guidance.

Box ended the last 3-month period with RPO at $726.7 million, up yearly 13% and expects to recognize approximately 65% of its RPO over the next 12 months.

Second quarter billings came in at $188.8 million representing 9% Y/Y growth and as we mentioned on its last call, it still expects billings growth so slightly lag revenue growth for the remainder of FY21.

28% of this revenue came from regions outside of USA, up from 25% a year ago and driven by continued strength in Japan.

In the quarter, the cloud storage company closed 64 deals worth more than $100,000 vs. 68 a year ago and 3 deals over $500,000, which is in line with a year ago and no deals over a $1 million vs. 2 year ago. Looking at a pipeline, the firm is seeing stronger demand for 6-figure enterprise deals and expects to see solid Y/Y growth in its large deal counts in 3FQ21.

Over 100,000 customers now rely on Box to power secure collaboration and critical processes across their businesses.

The firm ended 2FQ21 with an annualized net retention rate of 106% vs. 105% a year ago and 107% in Q1

For 3FQ21, it anticipates revenue of $193 million to $195 million, representing 10% Y/Y growth at midpoint.

It also expects our FY21 sales in the range of $767 million to $770 million, or the same 10% annual growth at midpoint.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter