History (1993): Dramatic Growth for Libraries

Removable media mass storage products to grow from $1.2 billion in 1992 to $2.1 billion in 1997

By Jean Jacques Maleval | September 2, 2020 at 2:10 pmThe WW market for removable media mass storage products will grow from $1.2 billion in 1992 to $2.1 billion in 1997, according to a new market analysis published by Freeman Associates, Inc.

“The need for reliable automated media handling subsystems is greater than ever. The good news for the industry is that the need will continue to grow during the next 5 years for most types of products,” declare Robert C. Abraham and Raymond C. Freeman Jr., authors of the newly completed Freeman Report, Mass Storage Outlook. (291 pages, $1,775). “The market for removable-media mass storage products is driven by mushrooming memory requirements for imaging, CAD/CAM, and archiving applications. The fastest growing segments include half-inch cartridge tape, 8mm tape, and rewritable optical disk libraries.”

These products will clash as users and integrators weigh storage performance requirements, functionality, and storage costs.

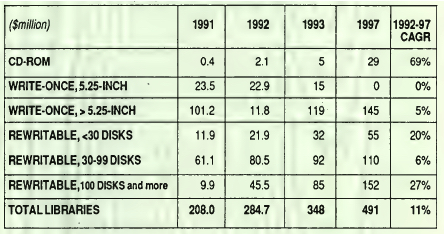

Seven categories of tape libraries and 6 categories of optical disk libraries are analyzed, and market sizes are forecast through 1997.

The report is based upon detailed research with all 45 companies known to be using or planning automated libraries and 21 companies known to be involved in tape stacker/loaders or multidisk optical cartridge drives.

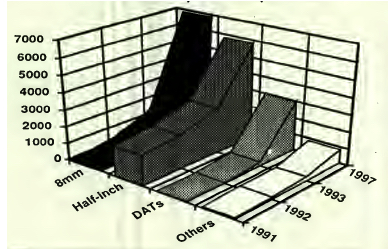

The authors predict combined shipments of all classes of automated tape and optical disk libraries to grow from 15,000 units in 1992 to over 45,000 in 1997, a 25% annual rate.

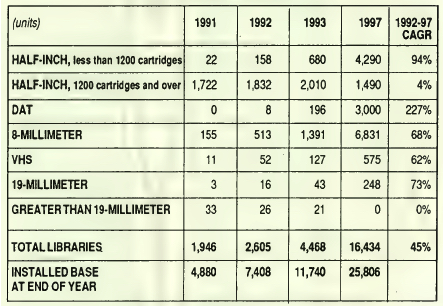

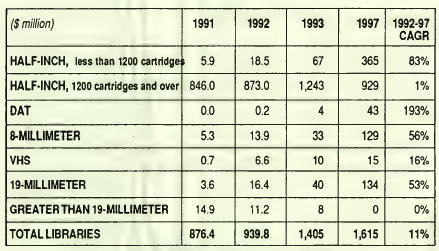

Explosive growth for tape libraries predicted

Demand for all types of tape libraries is forecast to grow from 2,605 units in 1992 to more than 16,000 units in 1997, a CAGR of 45%. Libraries using industry standard half-inch cartridges currently dominate this market, with 76% of shipments and 95% of revenue in 1992. Although shipments drop to 35% of the total in 1997, revenue for half-inch products remains very strong at 80%.

Units with less than 1,200 cartridges will fuel the continued expansion of this class. A flat market for libraries using 1,200 or more cartridges will still contribute the lion’s share of industry revenue, however.

“This class of library is the de facto choice for most commercial and scientific mass storage requirements,” observes Abraham.

These high performance libraries are oriented towards mainframe environments, but smaller, lower-capacity, lower cost versions are emerging to serve mid-range and small network storage requirements.

Demand for libraries using DAT drives and media is off to a slower start than earlier anticipated. Shipments of DAT libraries started in 1992 and will increase to 3,000 units in 1997. These products utilize the smallest media package of any library product class.

Unit shipments of 8mm libraries will grow from 513 in 1992 to nearly 7,000 in 1997, a rate of 68%. These mid-range libraries benefit from a rapidly growing installed base of 8mm drives and media, particularly in networked systems.

Unit shipments of tape libraries using VHS cassettes are forecast to grow from 52 units in 1992 to 575 units in 1997, a CAGR of 62%.

Shipments of very high capacity/high-performance tape libraries using 19mm D-1 and D-2 cassettes will occur during the forecast period, but in limited quantities.

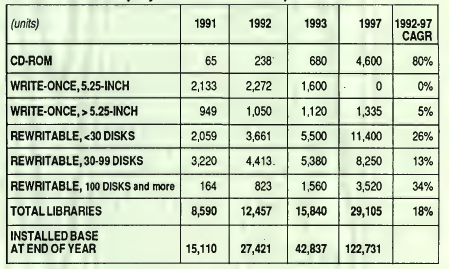

Rewritable/multifunction libraries lead optical

Rewritable and multifunction devices will dominate the market for optical disk libraries throughout the forecast period.

“Demand for these products benefits from their random access to data. Higher performance drives and media, combined with intense competition which is expected to keep prices down, will stimulate future growth for these devices,” Freeman stated.

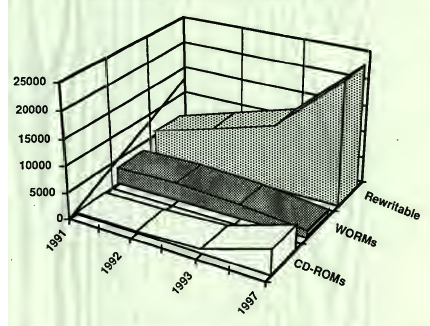

Unit shipments of all optical libraries will grow from more than 12,000 units in 1992 to 29,000 units in 1997, a CAGR of 18%.

Rewritable libraries accounted for 71% of industry units and 52% of industry revenue in 1992, growing to 80% and 65% in 1997. Shipments are forecast to grow from 8,900 units in 1992 to over 23,000 units in 1997, a rate of 21%.

Annual growth of 26% will position compact libraries utilizing less than 30 disks to lead this class in shipments in 1997, with more than 11,000 units.

Leading the revenue race will be large rewritable libraries with 100 or more disks, driven by annual growth of 27% over the forecast period.

Unit shipments of CD-ROM libraries are forecast to grow at a rate of 80%, from 238 units in 1992 – their second year of shipment -to 4,600 units in 1997. These libraries automate the handling and searching of vast amounts of reference information.

Write-once optical libraries using 5.25-inch media will decline in shipments from 2,200 units in 1992 to 210 units in 1995, their last year of shipments. These products will be replaced by multifunction libraries which offer a write-once mode.

The report foresees continued market acceptance for optical libraries that use 12-inch and 14-inch write-once disks. Demand will grow at a 5% rate, from 1,050 units shipped in 1992 to 1,335 units in 1997. Such products will maintain a capacity and performance edge over 5.25-inch libraries, providing an upgrade path to a dedicated cadre of users.

MassStorage Outlook gives specs for 204 models of libraries, stacker/loaders, and multidisk cartridge drives produced by 45 manufacturers.

Tape libraries

1/ projected worldwide shipments

2/ projected worldwide revenue

Worldwide shipment of tape drives

Optical disk libraries

1/projected worldwide shipments

2/projected worldwide revenue

f5 Worldwide shipments of optical libraries

This article is an abstract of news published on the former paper version of Computer Data Storage Newsletter on issue ≠61, published on February 1993.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter