Do We Need U.3 After U.2 Interface Spec?

And who really benefits from it?

This is a Press Release edited by StorageNewsletter.com on August 28, 2020 at 2:15 pmThis article was written on The G2M Research Enterprise Storage Market Pulse Newsletter published on August 2020 by G2M Communications, Inc.

Do We Need U.3, and Who Really Benefits From It?

Ever since NVMe was introduced as a new interface for SSDs in January 2013, there has been a “food fight” between supporters of the NVMe 2.5 inch SSD interface (U.2 or SFF-8639) and the SAS/SATA interface for 2.5 inch SSD interface (SFF-8482).

The problem is made worse in a sense because the SAS/SATA interface also support HDDs, while no one has built a HDD with a U.2 interface to date.

The “disconnect” between these 2 standards poses a variety of problems:

• It forces server vendors to have SAS/SATA only servers, NVMe U.2-only servers, or to support multiple SKUs, each with a different mix of drives for a given server form factor. That means that a server vendor could potentially have to support 3 SKUs for a 2U, 16-drive server (all-SAS/SATA; all-U.2; and half SAS/SATA, half U.2), or up to 4 SKUs for a 4U, 48-drive server (all-SAS/SATA; all-U.2; and 16xSAS/SATA, 32xU.2; and 21xSAS/SATA, 16xU.2).

• It forces end-users to decide a priori what they will need in their servers for the next 2-3 years: HDDs (high capacity but slow); NVMe SSDs (really fast); or SAS/SATA SSDs (not as fast as NVMe SSDs, but generally cheaper on a per-terabyte basis). And if you guess wrong (which is likely), you potentially impact system capacity and/or performance for the next three years that you own the server.

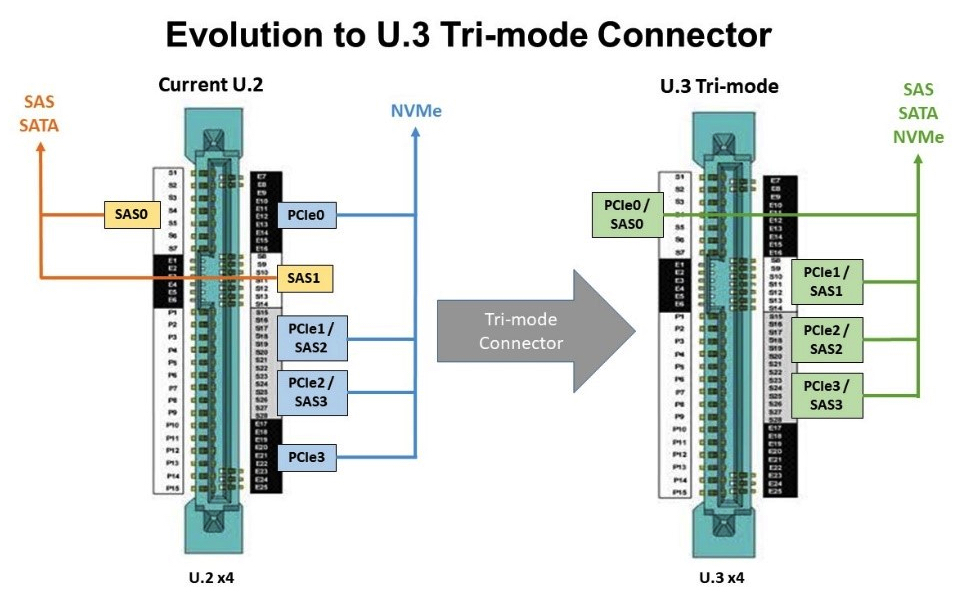

In a sense, U.2 is/was like the PlayStation 4 – you can run the newest stuff on it (NVMe SSDs for U.2, games for PS4), but not the older technologies (SAS/SATA SSDs for U.2, PS1-PS3 games for the PS4). This is why the Storage Networking Industry Associationwww.snia.org developed the U.3 spec, which is also known as SFF-TA-1001. It provides an interface that supports both SAS/SATA and NVMe U.2 drives in a single connector.

The U.3 spec has potential benefits for many market participants. For the companies such as Broadcom, Inc. that make the tri-mode interface chips, there is an opportunity to add a new chip to their portfolio, and likely one that is more expensive than the U.2 or SAS/SATA interface chips that it replaces. For server vendors, there is an opportunity to simplify their lineup of SKUs and at the same time provide customers more granular choices as to what media they utilize (NVMe SSDs, SAS/SATA SSDs, and/or HDDs).

Similarly, U.3 is potentially attractive to companies that design and build storage arrays for much the same reasons.

For end-users, particularly enterprise datacenter customers, the value is a little less obvious. While having the ability to change the mix of drives and/or add new drives of any flavor to existing servers sounds good, it is something that most large enterprise datacenter operators do not do today. Rather, most deploy a rack of servers in a predetermined configuration, and do not touch the server racks again until they are decommissioned.

In fact, many datacenter operators design their deployments so that they can have individual components “fail in place” and not be replaced. For datacenter operators following this approach, U.3 only provides more flexibility in the initial configuration of the server.

But the real question is whether 2.5-inch SSDs, and by extension the U.3 spec, are simply transitional technologies in the deployment of flash storage media. In laptop computers and increasingly in desktop systems, 2.5-inch SSDs have been supplanted by the NVMe-based M.2 form factor.

But the biggest disruptor in flash form factors is the Enterprise Datacenter Small Form Factor (EDSFF) flash spec, which was designed specifically to maximize the density of flash devices in 1U and larger servers. For 1U servers, EDSFF provides a huge advantage in device count, storage density, and capacity over 2.5-inch SSDs, with the ability to support up to 32 devices in a single 1U server. This increase in density and devices should be attractive to datacenter operators (smaller footprint, lower CapEx and OpEx), server vendors, and storage array vendors.

The final question that will determine the long-term success of U.3 is “what happens when NVMe SSDs reach price parity ($/TB) with SAS/SATA SSD?“

When this happens, the only use case for SAS/SATA SSDs is as replacements for failed SAS/SATA SSDs or HDDs. Also, the ability to put HDDs and SSDs in the same cabinet is not likely by itself to keep U.3 viable, since HDDs are being relegated to cold storage use cases, which do not require SSDs to be collocated with them.

This may be a 2-3-year transition, but customers and technology companies should keep it in mind as they make their technology bets in the SSD market.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter