History (1993): 1992 FDD Shipments to Top 51 Million Units

But falling prices depress manufacturers' revenue.

By Jean Jacques Maleval | August 20, 2020 at 2:06 pmAnnual floppy drive shipments are expected to exceed 50 million drives for the first time in 1992.

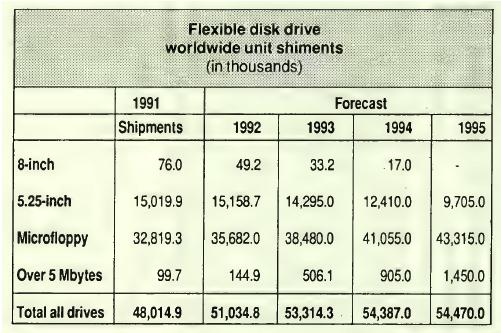

WW shipments are expected to climb 6% during 1992, with the total reaching 51 million floppy drives, according to the recently released 1992 report ($1,475) from Disk/Trend Inc. (Mountain View, CA) on flexible disk drives.

In contrast, 1992 revenue is expected to be down 4% from the previous year, with total floppy drive sales for 1992 projected at $2,479.6 million.

Floppy drive shipments received a boost from strong personal computer shipments during 1991-92, producing a level of growth which surprised the industry.

The report forecasts continued but slower growth in floppy drive shipments, with 54.5 million drives expected in 1995. Despite higher shipments, revenue for 1995 is expected to be slightly lower than in 1992, depressed by intense price competition and continuing changes in the industry’s product mix.

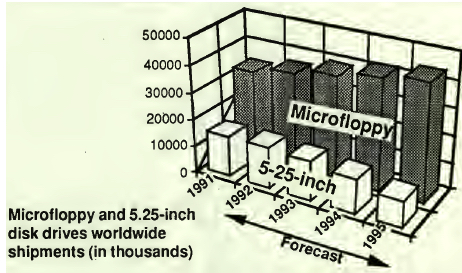

The microfloppy, mostly 3.5-inch models, is the dominant type of floppy drive in today’s markets. High PC shipments, driven by lower prices, faster processors and improved software, lifted 1991 microfloppy drive shipments to 32.8 million drives. The 1995 total is expected to reach 43.5 million drives, an average annual increase in excess of 7%.

Microfloppy drives provided 68.4% of 1991 ‘s total floppy drive shipments and are projected to be 79.5% of the 1995 worldwide total.

Within the 3.5-inch microfloppy group, the product mix is continuing to evolve. Drives with 720KB capacity or less dropped to 14.4% of 1991 shipments and are expected to be down to 3% in 1995.

1.44MB drives are now the industry’s mainstream product, with a continuing share in the 84-88% range, However, 2.88MB drives are now starting to achieve market penetration, with a projected 12.7% share of 1995 microfloppy drive shipments.

High capacity 3.5-inch drives, typically with 20MB capacity, are now in an early phase of growth, but are projected to ship 1.3 million drives in 1995.

Microfloppy drives are also getting smaller. Throughout the history of the floppy drive industry there has been a movement to smaller form factors, and the miniaturization trend continues with 3.5-inch microfloppy drives.

The first 3.5-inch floppy from Sony was 2-inch high, but the 1-inch height pioneered by Citizen Watch in 1984 has become the industry standard, with 73.5% of 1992 microfloppy drive shipments.

The impact of mobile computing is increasing, and the newer wave of 0.75-inch and 0.5-inch high drives is expected to provide 46.6% of 1995 microfloppy drive shipments.

The 5.25-inch floppy drive was the industry’s flagship product during the early growth of the PC market, but lost its leadership role to microfloppies in 2H80. To the surprise of many, 5.25-inch floppy drive shipments have actually increased slightly in 1991 and 1992, due to the requirement of many PC users to maintain the ability to interchange diskettes with older PCs. However, this requirement will diminish with time and 5.25-inch floppy drive shipments are expected to decline an average of 13.5% in the 1992-95 period.

The report analysis of total 1991 non-captive floppy drive revenues indicates that Teac retained its overall industry leadership, with sales of $350 million. Sony, the originator of the 3.5-inch floppy format, retained first place in microfloppy unit shipments, with 21.9% of the non-captive total. Teac continued to lead in 5.25-inch drive shipments with 26.1% of the non-captive total. The small remaining market for 8-inch floppy drives was dominated by Y-E Data’s 65.3% share, and Iomega retained its lead in high capacity floppy drives with 88.4% of the non-captive shipments, mostly 5.25-inch models. The report also contains specs on 195 floppy disk drives and profiles on 41 manufacturers.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter