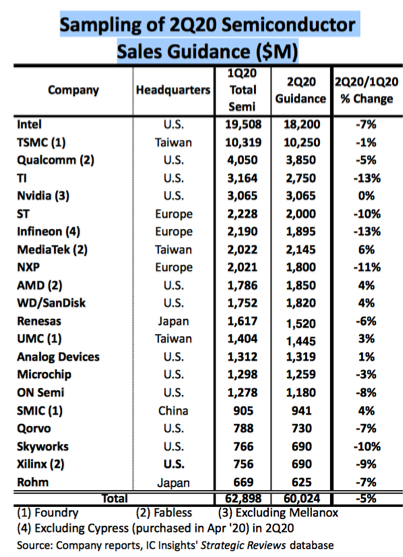

Sampling of 2Q20 Semiconductor Sales Guidance Now At -5%

6 companies expect sales increase, 15 companies anticipate flat or declining sales.

This is a Press Release edited by StorageNewsletter.com on June 12, 2020 at 2:15 pmAs part of its May update to the 2020 McClean Report, A Complete Analysis and Forecast of the Integrated Circuit Industry ($4,990), IC Insights, Inc. compiled a list of semiconductor companies that have provided 2Q20 sales guidance. The list included companies from across all geographic regions and all product categories.

Because of uncertainty regarding the impact of Covid-19 on business in 2H20, many semiconductor companies have not provided full year 2020 guidance.

However, several provided an outlook for 2Q20 (figure below). Of those that issued quarterly guidance, most expanded the range of their projections to be wider than normal due to uncertainty surrounding the impact of the coronavirus pandemic. The numbers shown in figure below represent the mid-point of the guidance.

Collectively, the 21 companies on the list anticipate a sequential sales decline of 5% in 2Q20. Despite tentative economic conditions, six companies expect to see their sales rise during this quarter, and 15 anticipate a sales decline.

Companies projecting an increase in their 2Q20 sales include MediaTek, AMD, Western Digital/SanDisk, UMC, Analog Devices, and SMIC. MediaTek’s 2Q20 sales outlook of 6% ranks highest among the 21 listed companies. The company credits its positive second-quarter revenue guidance to expanding sales of its 5G-chipset sales for smartphones. Evidence of strong demand for NAND flash from datacenter and SSD applications is reflected in the 4% sales growth guidance from Western Digital/SanDisk, whose flash sales are heavily weighted toward these 2 end-use markets.

At the opposite end of the spectrum, double-digit sales declines are anticipated by each of Europe’s 3 largest semiconductor suppliers, as well as TI and Skyworks.

IC Insights forecasts that the total IC market will decline by 6% in 2Q20 compared to 1Q20.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter