History (1992): After 1991 Crisis, Recovery for WW Storage Industry

But for how long?

By Jean Jacques Maleval | June 11, 2020 at 2:20 pm1991 was a bad year for the WW storage industry.

But business seems to start again in 1992 that could probably be a memorable year, but 1991 is to forget.

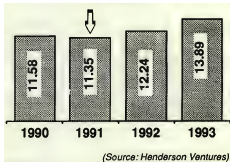

Figures prove that the past year was a dull one. According to Henderson Ventures, the US production of storage devices remained blocked, from $11.6 billion to $11.35, from 1990 to 1991.

For the first time in the entire history of disk drive industry, Disk/Trend reported a drop in revenues last year, even if more units were sold, which means that prices and manufacturer margins considerably lowered. The downturn was reached in 3Q91, with a recovery that began in the last quarter and that keeping on. US production of storage devices (in $ billion)

ProlitiX figured that revenues in 1991 calendar for the six largest independent manufacturers of HDDs improved 8.8%, to reach $7.6 billion, but only 3 companies made profits (Conner, Micropolis and Quantum), and two (Quantum and Conner) reported consecutive quarters with benefits.

This industry always has this type of rebounds. It’s a usual sinusoidal movement which is the result of the difference between offer and demand.

At the beginning of last year, pushed by the forecasts of optimistic OEM computer manufacturers, makers of storage devices hastened their production, but users didn’t rush to buy computers. A large stock of unsold drives were left on the market, which led to a strong cutback in prices. Many units were bargained away on the grey market and official distributors lost deals at the benefit of brokers. The result was that manufacturers pushed both feet on the brakes to slow down their production.

And when demand started back, which wasn’t predictable, they weren’t ready and didn’t have very much left on their shelves.

This is how a shortage of some models ensued and even, an usual fact, some prices went up.

Shortage

At the end of March 1992, Lucien Dalmasso, GM for the distributor Additional Design (Les Ulis, France) was deploring the situation: “We haven’t received a single disk in 2 weeks. I’ve never seen anything like that before. On an order of 40, Fujitsu only shipped us two and 1.2GB drives arrived in driblets.”

“Shortage began in November 1991, but already it’s less noticeable,” said last April Jean-Pierre Robinot, EMEA VP sales in Paris, France. “And it’s mostly in the 40 to 120MB range, especially 40MB units. This product was considered as finished by drive manufacturer. But truth was different and demand for this type of product is even stronger than 6 or 9 months ago. Users are looking for the cheapest drives. And you have to add the fact that Western Digital and NEC are no longer in 40MB. On account of the shortage in 40MB, customers turned to 80 and 100MB which, at their turn, were short. But we can expect things to calm down this year as we go from 40 to 80-120MB as a standard for disks since the advent of Windows. There also is a shortage in the high range 1GBGb 3.5-inch drives.”

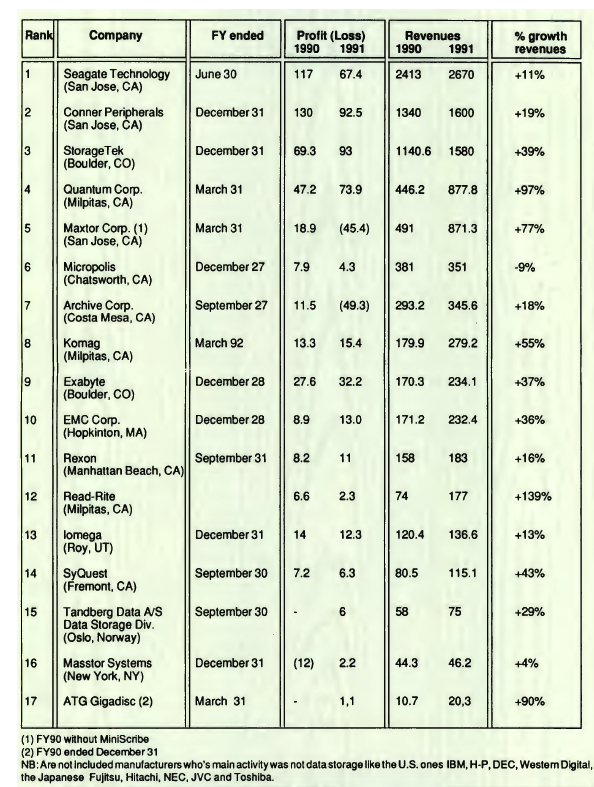

WW market storage’s main independent actors

(in $ million)

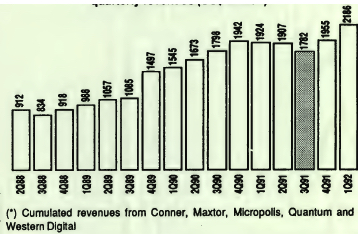

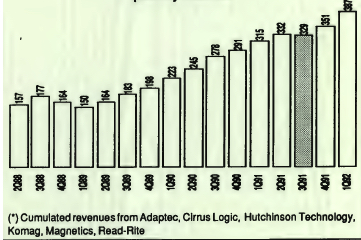

Disk drive manufacturers (*) quarterly revenues

($ million)

(Source: ProlytiX)

Drive components suppliers (*) quarterly revenues

There no longer is a 20MB 2.5-lnch disk market

There is an exception for 20MB 2.5-inch disks, those sold in 1990. Last year, notebook manufacturers opted for 30 or 40MB in the first half, then for 60 and 80 Mbytes as of the second half. And now we are at 120MB.

“The price for the 20MB has considerably decreased, because there is no market,” adds Robinot.

He even mentions a $70 unit price. In a way, 2.5-inch HDDs didn’t reach expectations, because sales of notebooks, too expensive, were low. But this could change.

“A notebook revolution of major proportions is coming,” ventured David Claridge, a principal in the market research firm of Hambrecht and Quist, on February 6, 1992, to an audience of 350 industry executives at a dinner meeting sponsored by the IDEMA. “By 1995, as much as 80% of the merchant disk drive market will be in 2.5-inch drives.”

An unpreceding fact: price going up

Shortage was not bad for everyone.

“I did something recently that I haven’t done in 20 years. I had to raise prices.” This is what Finis Conner, chairman and CEO of Conner Peripheral (San Jose, CA) said.

For 40MB 3.5-inch drives, prices dropped regularly by 5% each quarter, they have raised at an average of 2 to 3%, 3% for Conner and Seagate.

Being undersupplied, the distributors had to give in, by paying more and sooner shipments that were sometimes late and lunder what they had ordered.

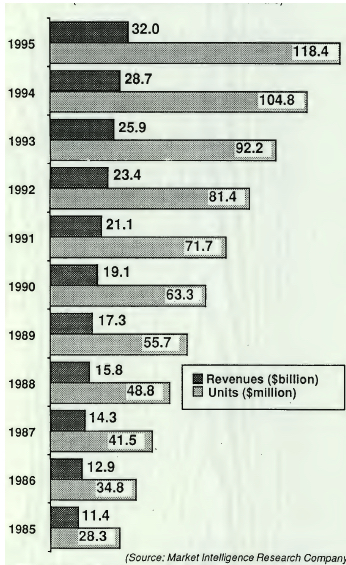

WW storage market

(millions of units and $billion)

An organized shortage?

You can wonder if this shortage was not deliberately wanted by manufacturers who would have agreed to raise prices to recuperate past benefit margins.

Dalmasso wonders and answers: “Maybe it’s true. Because, in the 17 years I have been involved in this business, I have never felt a shortage so strongly.”

Robinot (Seagate) brings up some strong arguments to prove the contrary: “Shortage touched Japanese as well as US manufacturers. No, if we could take extra shares of the market, we would.”

It seems hard to believe that the largest manufacturers, continuously fighting, with shares traded on the stock market, could agree to organize a shortage to raise their prices. Drive makers are not the only ones responsible of production dropping.

They have to wait for components they don’t always manufacture from makers that also slowed down their production. You can’t blame them all of being more cautious. Manufacturers are split between the hope of taking more shares of the market and the desire of not starting over too fast so they won’t end up in a difficult position they already experienced.

A few exceptions

Last year, drive sales for optical disks improved, but we’re still far from a mass market.

The best results come from magneto-optical disks and especially CD-ROMs. The floppy disk drive market remains stagnant and prices keep lowering, with a stronger demand for 3.5-inch diskettes.

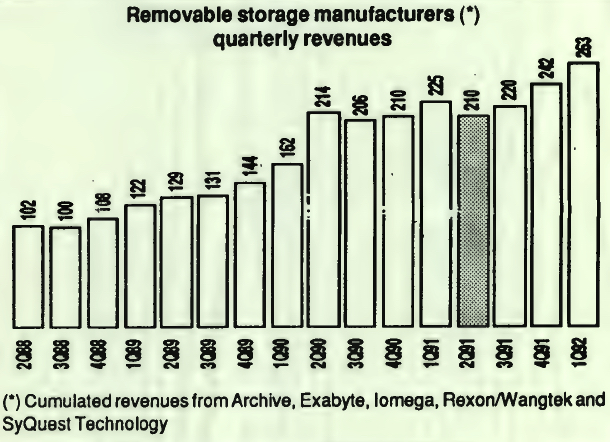

We also noticed that 1991 was not a black year for everyone, and first for removable magnetic disk drive manufacturers like Iomega and SyQuest.

“Removable storage is really the star of the (storage) industry in terms of profit margins,” explains Claridge.

Although this segment is one of the smallest in total dollar volume, Claridge said it enjoyed 1991 gross margins of 30 to 40%.

The magnetic tape backup segment encountered the same difficulties as drives. Archive’s business was not so great. But there are two main exceptions in this field: Exabyte, especially with its 8mm cartridge, and, at a lower level, Tandberg, with quarter-inch tape drives.

All the symptoms of recovery

Storage industry always came out of troubled periods. And it’s happening again.

Total 1991 WW OEM disk drive unit shipments (all form factors): 28.8 million drives f7

According to Alan Shugart, CEO of Seagate (Scotts Valley, CA): “The increased demand for disk drives which became apparent during the second quarter continued during the third quarter (ended March 31, 1992), with a significant portion of our drives having capacities from 40 to 240MB being on customer allocation. (.. .) This increased demand, the transition to the newer technology products and a more favorable pricing environment resulted in a gross margin of 21.1% for the quarter, the first time in nearly 2 years that we have exceeded a 20% gross margin.“

Robinot confirms: “Our quarter was good and it should continue in next one.”

Most manufacturers recovered a record sales rate, even if they didn’t reach the same profits as last year. But from quarter to quarter, profitability keeps on increasing.

“The global disk drive industry is headed for an upturn in 1992, based on improved demand in PC sales during the year. Longer term, drive companies can succeed if they adapt to the major miniaturization and major commoditization trends facing them,” believes Claridge.

IDC forecasts that computer shipments, from notebooks to multiuser systems, will increase 11% in 1992, compared with 9% in 1991. This improvement will lead suppliers of small Winchester drives to ship over 39.8 million units worldwide (+13.6%), for a total value of $12.6 billion (+9%).

For its part, Disk/Trend expects total worldwide unit shipments of rigid disk drives to reach more than 35.5 million this year, a 14% increase from 1991 shipments.

And shortage is already no longer as strong.

Gilles Temin, salesman for Fujitsu France (Créteil, France) announced at the end of March: “We had problems with shipments, but things should straighten out in 2 or 3 weeks.“

A distributor confirms the trend via Marie-Ange Vaillant, GM of Infodip (Gennevilliers, France): “1991’s last quarter was tough. We couldn’t ship the orders we had received, when it was the opposite at the beginning of the same year. Now it’s better. Things have practically returned to normal.”

The recovery of a segment like storage peripherals, an essential component of a computer, can only be the sign of a rebound of the entire computer business. As a matter of fact, most of the disk – more than tapes – sales market are intended for configurations recently acquired.

This article is an abstract of news published on the former paper version of Computer Data Storage Newsletter on issue ≠52, published on May 1992.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter