AsiaPac Storage Market Revenue Surged by 23% Y/Y in 4Q19

Dell EMC and Huawei tied for ≠1 spot

This is a Press Release edited by StorageNewsletter.com on May 21, 2020 at 2:18 pm![]() AsiaPac data-center (DC) storage equipment market revenue surged by 23% Y/Y in 4Q19 as uncertainty surrounding the US-China trade war began to dissipate, according Dennis Hahn, senior analyst, cloud and DC at Omdia (IHS Market), a registered trademark of Informa PLC and/or its affiliates.

AsiaPac data-center (DC) storage equipment market revenue surged by 23% Y/Y in 4Q19 as uncertainty surrounding the US-China trade war began to dissipate, according Dennis Hahn, senior analyst, cloud and DC at Omdia (IHS Market), a registered trademark of Informa PLC and/or its affiliates.

The strong fourth quarter storage increase changed APAC regional server external storage revenue in 2019 from being down Y/Y, to rising by 3% for the full year.

The leading DC storage suppliers in the region, Huawei, Inspur and Lenovo, attained combined revenue growth of 59% Y/Y in 4Q19, as reported by the latest edition of Omdia’s Data Center Storage Equipment Tracker.

The strong increase represented a major turnaround from the 2% Y/Y increase in 1Q19.

“Excess purchasing of storage capacity in late 2018 and uncertainties concerning the US-China trade war inhibited the growth of the DC storage market through the first half of 2019,” said Hahn. “However, during the second half, the poor macroeconomic conditions for DC storage dissipated. The uptick in APAC vendor revenue in 2H19 was driven by enterprises and Chinese communications service providers taking advantage of favorable government economic policies and the easing of trade tensions.”

Government policies benefiting the market included a move by the Chinese government to gradually ramp fiscal and monetary stimulus to support regional growth.

For the total APAC DC storage market, server external storage revenue increased by 23% Y/Y in 4Q19, while unit shipments rose by 35%, reflecting a strong quarter to close out 2019.

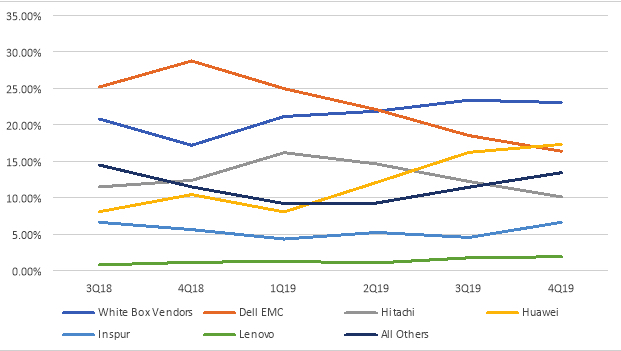

Dell EMC and Huawei tied for the ≠1 spot in APAC with 15% shares of the market. Dell EMC lost 13% percentage points of share compared to the fourth quarter of the previous year, while Huawei gained 5 points. Hitachi claimed the ≠3 spot with a 9% share in 4Q19, and Inspur took ≠4 spot with a 5% share. Lenovo didn’t make it into a top spot but did manage to grow 88% Y/Y in the 4Q19 in APAC.

Huawei and Inspur have steadily been building better storage software to be more competitive, since software functionality has been a barrier. This effort appears to be finally paying off. After struggling to find a storage strategy to take advantage of its server market strength, Lenovo appears to have solved this challenge by partnering with NetApp in an increasingly successful joint venture.

DC server external storage revenue in APAC by vendor

Chinese vendors progressing in DC Storage

Going forward, Omdia expects solid revenue growth in the APAC storage market driven by data demands as the world continues its progress into the information age. It forecasts that in 2024, APAC storage revenue will expand at a 14% 5-year CAGR as the region continues to grow driven by demand from enterprises and CSPs for storage. The easing of trade tensions with the signing of the phase 1 agreement between the US and China should also provide a tailwind for growth in both APAC and North America.

In 2020, it is expected APAC vendors to continue to expand their shares of the global DC storage market. Interestingly, Huawei, Inspur and Lenovo increased their global share by addressing mostly the APAC and the EMEA regions, while taking less than a combined 1% share in North America in 2019. In current forecast, it is estimated 1Q20 was down for APAC and second-quarter results will be down for North America, making for difficult vendor share comparisons across the globe in 1H20.

Additional DC storage highlights include:

• The global external DC storage market will expand to $78 billion in 2024, rising at a 12% CAGR from $45 billion in 2019.

• Array revenue was up 20% Y/Y in 4Q19; the all-flash performance category expanded by 11% Y/Y, while hybrid performance rose 22% and the capacity-optimized segment increased by 23% Y/Y.

• White-box vendors were still ≠1 in market share in 4Q19 of 2019 at 37%. Dell EMC took the second-placed spot, with a 20% share. Huawei was in third place, with a 6% share, IBM moved up to the fourth spot, up from seventh place during the previous quarter.

• White box products will account for 28% of storage revenue by 2024, up from 25% in 2019; Open Compute Project certified was 15% and traditional totaled 57%.

• FC controller ports represented 22% of total controller ports in 2024, down from 25% in 2019; 32Gb FC accounted for 47% of the total FC ports, while 16Gb FC was at 46% of FC ports in 2019.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter