Caringo S3 Object Storage Appliance Line

Swarm servers enable content-driven organizations to keep archived assets accessible for remote workflows and streaming.

This is a Press Release edited by StorageNewsletter.com on April 24, 2020 at 2:31 pmCaringo, Inc. announced that their Swarm Object Storage is available on a new line of Swarm Server Appliances.

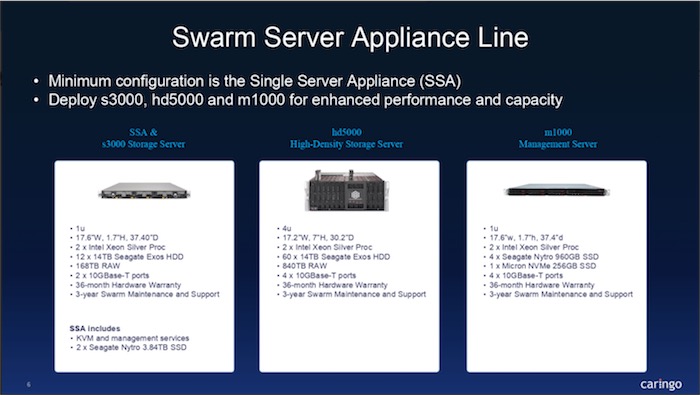

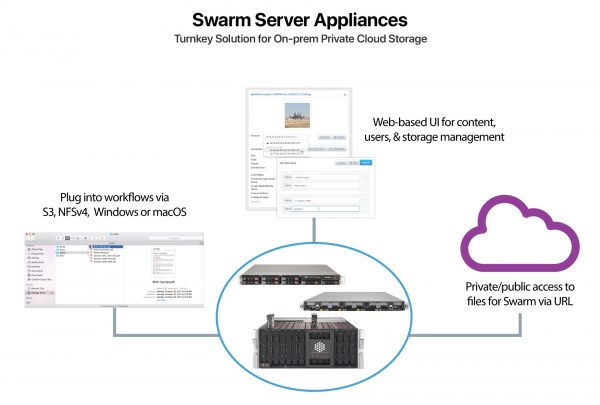

The on-prem private cloud storage solution starts at 168TB in a single server appliance, and scales to hundreds of petabytes in multi-server configurations. This latest addition to the product line enables customers to reduce costs while supporting the growing demand for instantly accessible data and content for collaboration, streaming and monetization.

Swarm server appliances start at 32% less than the cost of other on-prem object storage solutions and 42% less than Amazon S3 storage service fees for the same capacity over 3 years. Deployment is flexible and fast. Organizations can expand in a matter of minutes and easily scale to hundreds of petabytes with integrated backup to any S3-enabled device or service for seamless disaster recovery and cold archiving. This means that content-driven organizations can now optimize their on-prem resources and benefit from the distributed protection of the cloud while ensuring their content is instantly accessible for continued use and monetization.

“We recently deployed the new Swarm Servers for a professional sports team and they were up and running in a matter of hours,” said Liz Davis, VP, media workflow group, Diversified. “They went with Swarm servers instead of tape to ensure they had immediate access to their videos for production and to enable streaming services in the future. We recommended Caringo due to the ease of deployment, excellent value and feature set.”

In addition, version 11.1 of Swarm Object Storage Software has been released which brings enhancements to S3 protocol compatibility and performance as well as email and Slack alerting. The new update facilitates scaling for large clusters of over one-thousand nodes and integrates Elasticsearch 6 while delivering many valuable features to end users, including built-in data management, and secure file sharing.

Tony Barbagallo, Caringo CEO, said: “Digital content and how it is consumed has dramatically changed over the past few years, forcing organizations to quickly modernize their storage infrastructure. With our new line of Swarm Server Appliances, we can help customers quickly find a solution that fits their data center footprint, cost and performance requirements – so they can deliver instant access to archives, enabling remote workflows and streaming services.”

Swarm Server Appliances and Swarm 11.1 are available.

Comments

This Caringo announcement is an opportunity to take a snapshot of the object storage landscape.

Founded in 2005, the company is a pioneer of object storage, recognized by the market and probably one of the most adopted among commercial object storage products. It has a sweet spot between 500TB and 1PB today and is supported by 250+ paid customers, not counting try and buy versions for entry level configuration. 50% of the revenue comes from new customers.

With this new announcement, the company confirms that object storage doesn't imply scale-out, multi-systems and erasure coding. Some vendors pitched this but it's just wrong. Users can deploy an object storage service with just one server and it illustrates that object storage is essentially about access method even if internally some other properties and attributes are key like a flat namespace, location independence, self-describing capability, multi-tenancy by design to list a few.

In its Map 2019 for Object Storage published in December 2019, Coldago Research elected Caringo as a challenger.

And a fun point, all 3 founders quit and the company name Caringo is no longer associated with their name Paul CARpentier, Jonathan RING and Mark GOros. Does the new team will change the name?

This storage category has seen quite a few M&As (not all vendors acquisitions are pure object storage vendors in this list).

It exists a paradox in this segment with plenty of players, being a real answer for some users needs and some acquisitions at the same time. Some gorillas continue to ignore that storage category without any solution and by solution it mean something they develop and own - HPE is a good example of such absence -, some others had difficulties and have found a honorable exit - SwiftStack swallowed by Nvidia and still nothing on Nvidia web site about it - and several vendors after 10 years of existence continue to raise money not being profitable. Investors are skeptical and anxious about these players and this segment. Formation Data Systems hit a wall and got bankrupt, same destiny for Coho Data and Skylable, and Igneous, initially a promoter of object storage with Ethernet drives, finally gave up and chose a new software direction.

Again why a company like HPE accepts to just resell a product and not build one for so many years or even put money on the table to buy one. The answer is simple, the sum of business they saw for several years are just too small projecting a break even point for a potential acquisition too far in the future.

Who is public? Did we see an object storage vendor going public? Never and we're not going to see any of them any time soon as the proposal is too weak to sustain growth by itself and it will reveal their finance reality even if utopia fills hope, represents a dream for some founders and flatter the ego. No we count them as zombies i.e an old company let's say here a 10 years start-up not being acquired and no IPO. And we don't find any unicorn and we don't see any potential ones for the coming quarters.

Some recent developments confirm the convergence between file and object and companies like VAST Data, Pure Storage, Cohesity and even the mysterious Stellus Technologies offer since the beginning both access methods as it is a way to expose same unstructured data via 2 different interfaces.

Beyond that, object storage as an interface and especially being added or coupled to other storage products. It also means that people don't ask for an object storage but a S3 storage.

Users globally don't care about how things are organized internally. In other words putting S3 on top of NAS is the same in term of users experience, applications integrations and support. Some file servers vendors understand this. And don't say that doing this is less efficient, it's probably the most deployed case today. Some vendors did many years ago with file servers exposing a block device instantiated from a "big" file on a file system a bit like a upside down model. Purists again can argue a few things but it was and it is a success, market proves it.

VAST Data offers S3 in addition to NFS and local and remote users can access same content with a local protocol or a remote method. Qumulo picked MinIO in gateway mode and offer same capabilities. A real market expansion exists with several vendors selecting open source engine to provide such S3 access. Thus beyond a purist approach, users don't care about pure stuff, we all live in a blended world, users just ask for an S3 interface.

S3 plays same role as SCSI, NFS or SQL, it has become a standard and, even today, qualifies a category. All of these have in common to be access methods working at different levels and describe how data are exposed to users and applications.

Vendors' difficulties come from the fact that differentiators among offerings are less and less visible, many of them offer erasure coding, geo capabilities, file interface, many similar partnerships for same use cases. Reseller agreements may be different but it doesn't change the landscape. SDS has also contributed to make things more fuzzy between players, reducing price and margins.

Some players have tried to create a portfolio effect with product add-ons like tiering software, new companions such data router coming from small acquisitions or internal development. They wish to emulate a bigger valuation and they try everything. This dilution weakens partnership effort as these vendors are no longer seen by partners as a data platform to store data but also as a new competition. It's a race.

We saw recently a small object storage vendor trying to mimic a well recognized one in performance benchmark, both are open source players. It was fun to see and try to find some sort of grip on the market via this mechanism...

There is also the pressure from AWS, Azure and GCP, and among them their on-premises flavor with Azure Stack Blog Storage and AWS Outposts with S3 coming in 2020.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter