WW Enterprise Storage Systems Market Revenue Down 5.5% to $28.7 billion in 2020

Impacted by Covid-19

This is a Press Release edited by StorageNewsletter.com on April 1, 2020 at 2:32 pmEnd user spending on IT infrastructure (server and enterprise storage systems) will decline in 2020 as a result of the widespread coronavirus pandemic.

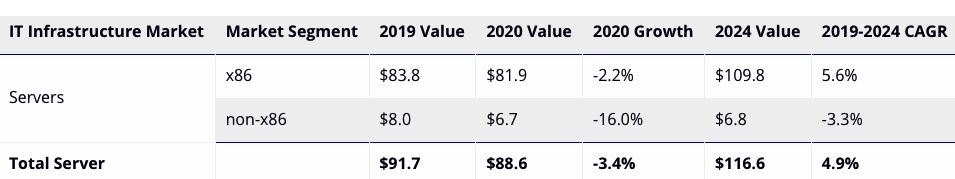

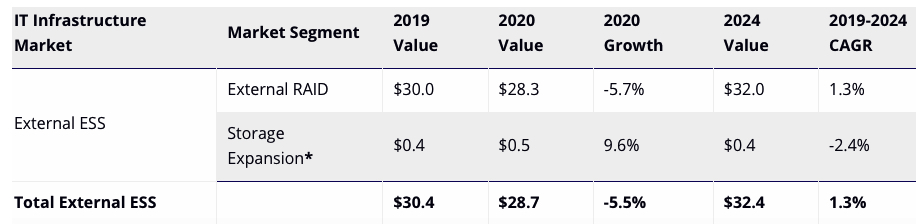

According to the IDC‘s Worldwide Quarterly Server Tracker and Worldwide Quarterly Enterprise Storage Systems Tracker, under the current probable scenario server market revenues will decline 3.4% Y/Y to $88.6 billion and external enterprise storage systems (ESS) revenues will decline 5.5% to $28.7 billion in 2020.

The server market is expected to decline 11.0% in 1Q20 and 8.9% in 2Q20 and then return to growth in 2H20. The external ESS market is forecast to decline 7.3% in 1Q20 and 12.4% in 2Q20 before returning to slight growth by the end of 2020 with further recovery expected in 2021.

IDC developed 3 forecast scenarios (optimistic, probable, and pessimistic) for the impact of COVID-19 on the IT infrastructure markets.

The probable scenario assumes a broad negative impact starting in China and spreading into other regions before slowing toward end of the year. Elements of the impact include changing demand expectations from various groups of IT buyers, supply chain shortages and logistical delays, short-term component price increases, and a suppressed economic and social climate. The current forecast is based on the probable scenario as of March 26, 2020. However, as the situation continues to unfold, the forecasts might be adjusted further.

The fast-changing environment has revealed some remarkable differences in how the pandemic has affected various segments of the market.

As the first to be hit by the coronavirus, China will see the greatest negative impact in 1Q20 while other regions will start to experience the impact in 2Q20.

Similarly, some industries (transportation, hospitality, retail, etc.) are facing reduced consumer activity and business closures and others are being hit by an unexpected wave of demand for services, including video streaming, Web conferencing, and online retail.

Facing economic uncertainty, many businesses are being forced to consider more expedited adoption of cloud services to fulfill their compute and storage needs. This spike in demand put unplanned pressure on the IT infrastructure in cloud service provider datacenters leading to growing demand for servers and system components.

As a result, the IT infrastructure market has 2 submarkets going in different directions: decreasing demand from enterprise buyers and increasing demand from cloud service providers.

This dynamic is impacting the server market the most, resulting in just a moderate decline for the overall market in 2020. The external storage systems market, with a higher share of enterprise buyers, will experience a deeper decline in 2020.

WW End User Spend on Servers, 2019, 2020 and 2024 and 5-Year CAGR (value in $ billion)

WW End User Spend on External Enterprise Storage Systems, 2019, 2020 and 2024 and 5-Year CAGR

(value in $ billion)

* Note: Storage Expansion category includes OEM and ODM Storage Expansions.

“The impact of COVID-19 will certainly dampen overall spending on IT infrastructure as companies temporarily shut down and employees are laid off or furloughed,” said Kuba Stolarski, research director, IT infrastructure. “While IDC believes that the short-term impact will be significant, unless the crisis spirals further out of control, it is likely that this will not impact the markets past 2021, at which point we will see a robust recovery with cloud platforms very much leading the way.”

In the longer term both markets will return to growth. The server market is expected to deliver a CAGR of 4.9% over the 2019-2024 forecast period with revenues reaching $116.6 billion in 2024.

Meanwhile the external ESS market will see a 5-year CAGR of 1.3% growing to $32.4 billion in 2024.

“The IT infrastructure markets are already going though a transformation and shifts in end user spending will bring an even faster changing IT buyer landscape,” said Natalya Yezhkova, research VP, IT infrastructure. “While the current crisis brings tensions and uncertainty to the market, it also will push organizations to expedite adoption of technologies and IT delivery models that help with optimization of IT infrastructure resources.”

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter