NAS Migration Real Tough Challenge

Addressed by many players as pain is significant

By Philippe Nicolas | March 31, 2020 at 2:31 pmNAS migrations represent a critical effort for most enterprises having to make thing transparent for all their users and applications during a fast growing data volumes moment and budget pressure.

Key features are:

- Multi-protocols support essentially NFS and SMB,

- The overall performance with capabilities to parallelize move/copy jobs,

- To provide N:1, 1:N or even N:M migration models,

- LAN and WAN support,

- To copy permissions and make things identical,

- To preserve metadata,

- To maintain links,

- To interact with active directory or other IAM services,

- Or more recently with the integration with various clouds especially AWS, Azure and GCP.

Historically but it’s still the case, it was pretty common to see the utilization of tools like Rsync, SCP or Robocopy. It turns out that they’re less sophisticated than some commercial products.

Managed as a project for a short period of time during the migration in fact, many of these products, considered as tools, aren’t kept installed and running following their mission. Thus vendors are selling these trying to augment their customers’ footprint by adding other key data management features. The idea is to stay installed and used after the migration process. Other vendors with more rich features set are adding migration mechanism. Typically the first group can be illustrated by players like Databobi and the second group by Data Dynamics, Komprise, StrongBox Data Solutions, Hammerspace, Quest, StoneFly, Point Software and Systems, Starfish or Atempo.

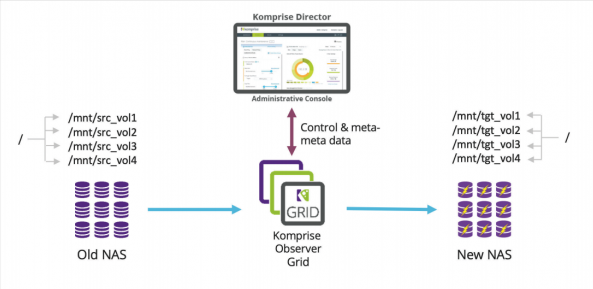

Among them, Komprise shakes established positions with a new product iteration named Elastic Data Migration unveiling a new design leveraging fine granular parallelisms at different level – shares and volumes, directories, files, and threads – and a dedicated optimized NFS client on their side to boost file transfers and reduce unnecessary protocol exchange, having demonstrated great advantage for WAN.

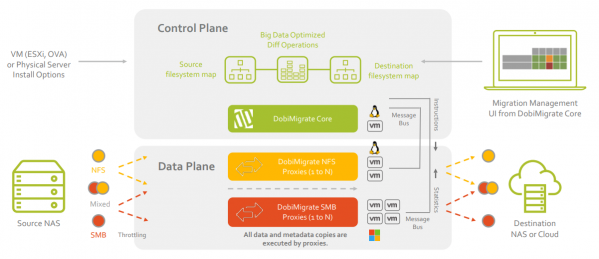

Datadobi, an other player often listed for such operations, just announced DobiMigrate 5.8 with an enhanced chain of custody to prove the equivalence between source and target files, supporting recent GDPR and CCPA requirements.

Some NAS/file server vendors offer a built-in migration tool, this is the case for Ctera Networks with their edge filers.

As some filers can be VMs, we extend a bit the coverage here with the cloud migration options by AWS, Azure and GCP. GCP acquired Velostrata in January 2019 and the same month, AWS picked CloudEndure. More recently Azure swallowed Mover.io. Don’t be confused with the Microsoft Mover.io acquisition in October 2019. And interesting to mention AWS Snowball or Azure DataBox and their on-premises presence with AWS Outposts or Azure Stack as well.

And even further with the file transfer tool as Komprise announcement touches WAN. Even if it’s different it’s worth noticing these managed and fast file transfer players like IBM Aspera, Signiant, Accellion, Catapult or File Catalyst that can help transfer large files like large compacted, tared or zipped directories or file system over long distance.

On the market for deployments projects, NAS and file server vendors have picked for most of them some market solutions in addition to some homegrown services:

- Dell EMC uses Datadobi in addition to EMcopy,

- NetApp recommends Data Dynamics and added recently Datadobi as well,

- Qumulo and DDN picked Atempo Miria, DDN promoting it as DataFlow,

- Pure Storage selected Komprise,

- Lenovo like NetApp uses Data Dynamics,

- VAST Data sees several Starfish instances, and

- We don’t know or find any specific recommendation or tools for Cohesity, Nutanix, HPE and IBM.

Historically we saw some users adopting a network file management (NFM) and virtualization (NFV) strategy consisting in the addition of a new access layer on top of file servers, filers and NAS. By doing this applications see only one virtual entity even if behind several servers exist. Thus moving data, tiering data and replacing file servers are transparent. It was the case for several vendors like Acopia Networks acquired by F5 Networks in 2007 for $210 million, Neopath Networks by Cisco in 2007, Rainfinity by EMC for $100 million in 2005, Nuview by Brocade for $60 million in 2006, AutoVirt and Attune, and more recently Avere by Microsoft in 2018. Among them AutoVirt and Attune Systems disappeared and F5 swallowed Attune’s IP. We can list in this NFM/NFV category players like Nasuni or Panzura, still private and independent.

The new challenge and thus being a real opportunity is the migration of HPC file storage i.e Lustre, IBM Spectrum Scale, BeeGFS, WekaIO or Panasas in all combinations. This is also accelerated by the new licensing model introduced by IBM for Spectrum Scale forcing some vendors to adopt a new strategy. Typical example is DDN who bought Whamcloud from Intel who wishes to replace all its GPFS/Spectrum Scale installed base by Lustre and its Exa5 product line.

And if you add the object storage migration, it becomes even more complex, challenging and demanding and can serve as a differentiator across offerings sometimes.

The NAS migration battle is on and there will be in 2020 some new partnerships and developments as this is a common need and often a nightmare for admins.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter