Status of Object Storage

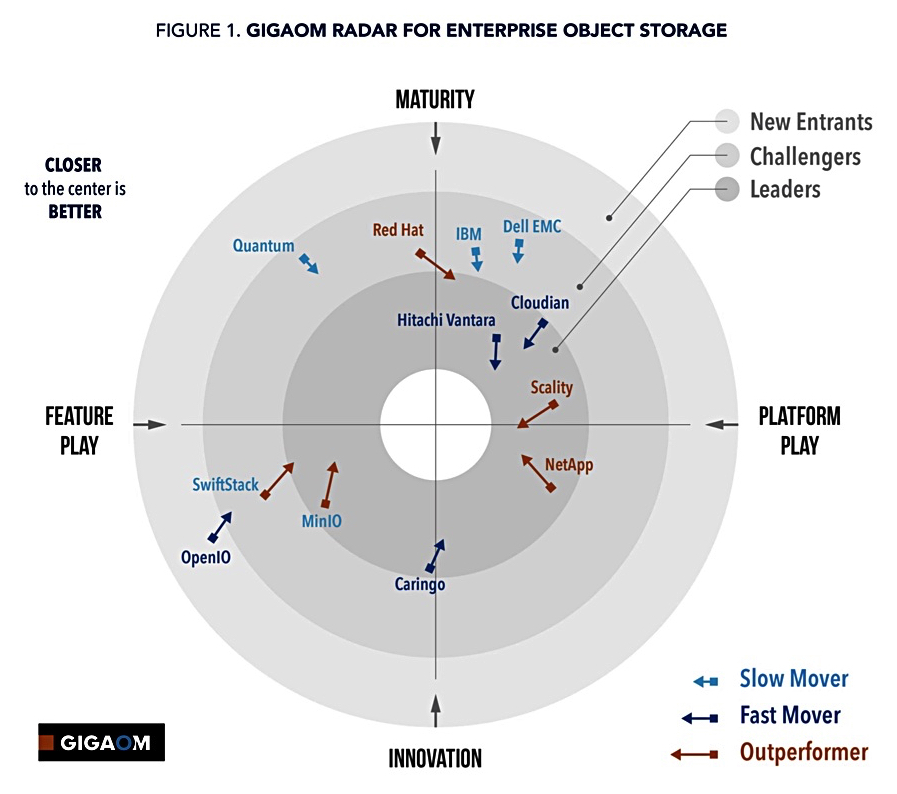

Leaders Hitachi Vantara, Scality, NetApp and MinIO, then Cloudian and Caringo, Red Hat and SwiftStack

This is a Press Release edited by StorageNewsletter.com on March 25, 2020 at 2:28 pm This report was written on March 9, 2020 by Enrico Signoretti who tracked the changes in the storage industry as a Gigaom research analyst, independent analyst and contributor to El Register.

This report was written on March 9, 2020 by Enrico Signoretti who tracked the changes in the storage industry as a Gigaom research analyst, independent analyst and contributor to El Register.

The Status of Object Storage

A Quick Analysis of the Object Storage Market

NVIDIA recently announced the acquisition of SwiftStack, an object storage start-up that, in the last year, refocused most of its work on high performance and AI workloads.

This follows a similar hand over from Western Digital to Quantum about the ActiveScale business, another object store that was more and more tailored to specific workloads. These 2 object stores will compete for less in the general-purpose S3 space, and will be instrumental in the creation of end-to-end solutions.

The object storage market is maturing and evolving pretty quickly. We recently published two reports on object storage (Key criteria for evaluating enterprise object storage and GigaOm Radar for enterprise object storage). In these reports, object stores are grouped in enterprise, high performance, and specialized categories, depending on their characteristics.

In fact, most of the vendors have finally found out 2 important reasons to differentiate themselves from the general-purpose S3 market:

- The Cloud Wins: Many enterprises are moving more and more of their apps and data to the cloud. If your organization does not have a particular need to stay on-prem such as a particular regulation or restriction, the cloud is just better. And, to be honest, applications and data want to stay next to each other.

- Differentiation in Traditional Object Storage is Minimal: If you think about object storage as an S3-compatible system for storing cold data. At the end of the day, differentiation is minimal, and it all comes down to $/GB and a few other secondary characteristics with minimal impact on overall TCO and ROI.

With fewer opportunities and minimal differentiation, there are no clear winners in object storage.

Differentiation, Specialization, Ecosystems

- SwiftStack was not the only one working on performance last year. OpenIO, for example, shifted its focus to high performance as well.

- NetApp and Hitachi Vantara have integrated their object stores in their ecosystem, making them instrumental for the execution of their strategies.

- Scality is investing their efforts in a multi-cloud and scale-out file system, which is appealing to large enterprises.

- Red Hat has a 2-fold strategy, with multi-cloud (with NooBaa) and ecosystem integration with Ceph being the default choice for OpenShift Storage.

- Caringo is focusing more and more on the M&E industry with features aimed at simplifying media management, specialized edge appliance, and so on.

- MinIO, who in the past, I defined as the MySQL of object storeshttps://juku.it/minio-wants-to-be-the-mysql-of-object-storage/, wants to be the object store of choice for every developer and Kubernetes/containerized application.

- There is a group (Dell EMC, IBM, Cloudian) still trying to sell general-purpose S3-compatible storage but, again. At the same time, Dell EMC and IBM object stores are part of a larger ecosystem, Cloudian will soon need to find something on which to specialize or they will risk competing only on $/GB every time … and this is not something that will please investors or be sustainable in the long term.

Furthermore, S3 interface is now more and more common across storage systems of any kind. Scale-out file storage systems have it (Pure Storage FlashBlade, Qumulo, Vast Data, Isilon, you name it), HCI vendors have it (Nutanix, for example), primary storage systems have it too (e.g., Infinidat). This makes the traditional object store less interesting for a growing number of use cases, especially when capacity and cost are not on top of the priorities.

Closing the Circle

Object storage is becoming more relevant for every IT organization, on-premises or in the cloud, no matter if it is by choice or part of an end-to-end solution.

S3 compatibility is now table stake (not a differentiator), and object storage vendors know that. They are targeting new markets and workloads with features that are much more sophisticated than the basic Put, Get, Delete, and $/GB. It is the only way to survive in the long term.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter