4Q19 WW Converged Systems Market Grows 1.1% Y/Y to $4.2 Billion

1/ Dell (33% market share), 2/ Nutanix (14%), 3/ Cisco (6%), 4/ Lenovo, 5/ HPE (5%)

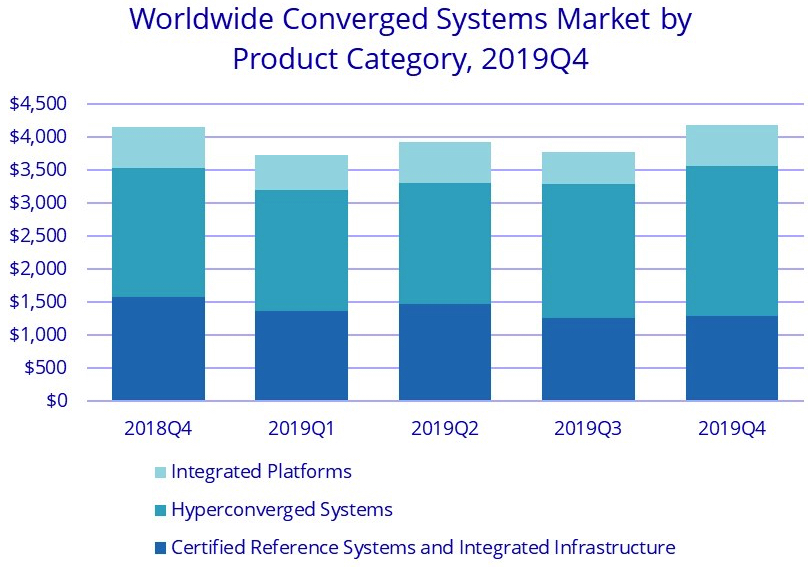

This is a Press Release edited by StorageNewsletter.com on March 20, 2020 at 2:22 pmAccording to the International Data Corporation’s Worldwide Quarterly Converged Systems Tracker, WW converged systems market revenue increased 1.1% year over year to $4.2 billion during the 4CQ19.

“Hyperconverged system sales remained robust during the fourth quarter and carried overall converged systems market growth despite annual declines of other product types,” said Greg Macatee, research analyst, infrastructure platforms and technologies, IDC. “The hyperconverged system growth picture was largely consistent across the globe with growth in every region in the low to mid double-digit range as these types of systems continue to provide value to a wide variety of businesses in both hybrid and multicloud environments given their easy-to-deploy and automated software-defined nature.”

Converged Systems Segments

Converged systems market view offers three segments: certified reference systems and integrated infrastructure, integrated platforms, and hyperconverged systems. The certified reference systems and integrated infrastructure market generated nearly $1.3 billion in revenue during 4Q19, which represents a contraction of 18.5% Y/Y and 30.7% of all converged systems revenue. The integrated platforms segment grew 0.1% Y/Y in 4Q19, generating $620 million worth of revenue. This amounted to 14.8% of the total converged systems market revenue. Revenue from hyperconverged systems grew 17.2% Y/Y during the 4Q19 and totaled $2.3 billion. This amounted to 54.5% of the total converged systems market revenue.

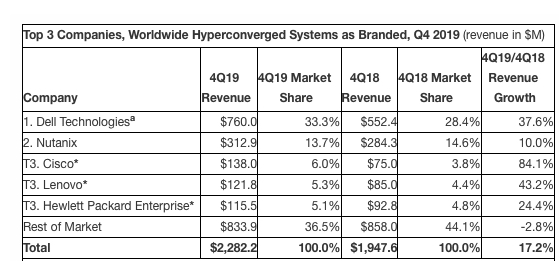

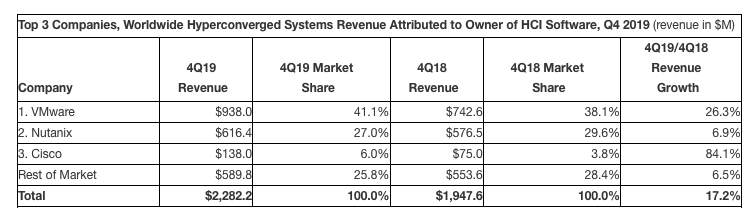

IDC offers 2 ways to rank technology suppliers within the hyperconverged systems market: by the brand of the hyperconverged solution or by the owner of the software providing the core hyperconverged capabilities. Rankings based on a branded view of the market can be found in the first table of this press release and rankings based on the owner of the hyperconverged software can be found in the second table within this press release. Both tables include all the same software and hardware, summing to the same market size.

As it relates to the branded view of the hyperconverged systems market, Dell Technologies was the largest supplier with $760.0 million in revenue and a 33.3% share. Nutanix generated $312.9 million in branded hardware revenue, representing 13.7% of the total HCI market 4Q19r. There was a 3-way tie* for third between Cisco, Lenovo, and Hewlett Packard Enterprise, generating $138.0 million, $121.8 million, and $115.5 million in revenue, which represents 6.0%, 5.3%, and 5.1% share of the market share, respectively.

Table Notes:

a Dell Technologies represents the combined revenues for Dell and EMC sales for all quarters shown.

* Statistical tie in the worldwide converged systems market when there is a difference of one percent or less in the share of revenues or unit shipments among two or more vendors.

From the software ownership view of the market, new systems running VMware hyperconverged software represented $938.0 million in total 4Q19 vendor revenue, or 41.1% of the total market. Systems running Nutanix hyperconverged software represented $616.4 million in 4Q19 vendor revenue or 27.0% of the total market. Both amounts represent the value of all HCI hardware, HCI software, and system infrastructure software sold, regardless of how it was branded at the hardware level.

Taxonomy Notes

Converged systems are defined as pre-integrated, vendor-certified systems containing server hardware, disk storage systems, networking equipment, and basic element/systems management software. Systems not sold with all four of these components are not counted within this tracker. Specific to management software, IDC includes embedded or integrated management and control software optimized for the auto discovery, provisioning and pooling of physical and virtual compute, storage and networking resources shipped as part of the core, standard integrated system.

Certified reference systems and integrated infrastructure are pre-integrated, vendor-certified systems containing server hardware, disk storage systems, networking equipment, and basic element/systems management software. Integrated platforms are integrated systems that are sold with additional pre-integrated packaged software and customized system engineering optimized to enable such functions as application development software, databases, testing, and integration tools. Hyperconverged systems collapse core storage and compute functionality into a single, highly virtualized solution. A key characteristic of hyperconverged systems that differentiate these solutions from other integrated systems is their scale-out architecture and their ability to provide all compute and storage functions through the same x86 server-based resources. Market values for all three segments includes hardware and software but excludes services and support.

Beginning with the release of 2019 results, analysts have expanded its definition of the hyperconverged systems market segment to include a new breed of systems called Disaggregated HCI (hyperconverged infrastructure). Such systems are designed from the ground up to only support distinct/separate compute and storage nodes. An example of such a system in the market today is NetApp’s HCI solution. They offer non-linear scaling of the hyperconverged cluster to make it easier to scale compute and storage resources independent of each other while offering crucial functions such as quality of service. For these disaggregated HCI solutions, the storage nodes may not have a hypervisor at all, since they don’t have to run VMs or applications.

The analyst firm considers a unit to be a full system including server, storage, and networking. Individual server, storage, or networking nodes are not counted as units. Hyperconverged system units are counted at the appliance (aka chassis) level. Many hyperconverged appliances are deployed on multinode servers. IDC will count each appliance, not each node, as a single system.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter