2Q20 Enterprise SSD Prices Forecast Corrected: Up to 10-15% Increase Q/Q

From previously 5-10%

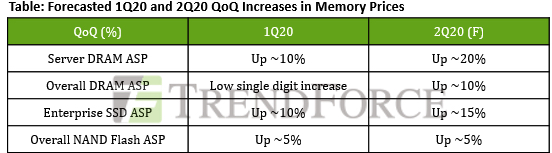

This is a Press Release edited by StorageNewsletter.com on March 16, 2020 at 2:44 pmCiting the US government’s JEDI contract as well as the increased need for telework due to the COVID-19 outbreak, the DRAMeXchange research division of TrendForce, Inc. has now raised its previous forecast of 2Q20 server DRAM price trend from a 15% increase Q/Q up to a 20% increase Q/Q.

The same uptrend is reflected in 2Q20 enterprise SSD prices as well, with the previous forecast of a 5-10% increase Q/Q now corrected up to a 10-15% increase Q/Q. In addition, memory suppliers are now facing low inventory levels, subsequently prompting them to maintain the 2Q20 price upsurge.

The massive JEDI contract from the US government in 4Q19 continues to galvanize demand in the server market. On the other hand, the outbreak is rapidly extending its reach globally, thereby triggering another wave of server demand related to telework services.

In particular, the demand from China’s cloud service operators rose considerably in February. Demand from Alibaba and Tencent was driven mainly by their telework arrangements. ByteDance has more server orders than anticipated for the deployment of its data centers in North America because its portfolio has expanded to include e-commerce, gaming, and fintech.

Meanwhile, the growing demand for server DRAM led to low inventory levels for both clients and suppliers. Also, following a new round of tenders from Chinese telecom operators in February, the supply of server DRAM has become much tighter, in turn maintaining the upward pull on server DRAM prices. Though the outbreak has been temporarily contained in China, it is spreading rapidly in Europe, while multiple cases have also been confirmed in several US states, in turn weakening consumer confidence across the globe. It remains to be seen how the outbreak’s development will affect server DRAM prices in 2H20.

Corresponding surge in enterprise SSD demand iexpected to boost 2Q20 prices by up to 15%

Demand for enterprise SSDs began to rebound in 4Q19, while data center operators in North America continue to increase their orders for servers and server memory products in 1Q20. At the same time, the outbreak has severely affected the Chinese market and drove up the demand for enterprise SSDs due to the increased need for cloud services and the stay-at-home economy. The influx of additional and urgent orders outside of normal contract transactions has overwhelmed NAND flash suppliers, which earlier adopted a cautious stance with regards to raising production capacity. There is a high probability that the undersupply of NAND flash will cause the demand surge to carry over to 2Q20.

As the demand for enterprise SSD continues to rise, PC and smartphone OEMs have not slashed their flash memory orders, thus exacerbating the NAND flash shortage in 1Q20. TrendForce’s latest survey of the NAND flash market finds that PC and smartphone OEMs are struggling to quickly accumulate enough component inventory because the whole production and shipment period for actors in the supply chain has been extended to more than two weeks due to the outbreak. Hence, the supply of NAND flash will remain very constricted in 2Q20. NAND flash suppliers are also in a much stronger position when negotiating prices with their clients. Considering the latest market situation, TrendForce has updated the price forecast of enterprise SSDs for 2Q20 and corrected up the Q/Q increases to the 10-15% range.

Enterprise SSD prices in 2H20 depend on the extent to which the outbreak affects the global economy. As the outbreak rapidly spreads across Europe and USA, Italian leaders have ordered the lockdown of Milan, Europe’s central hub of transportation. Should the outbreak persist into 2H20, the global economy is expected to take a turn for the worse, which may force PC OEMs and smartphone makers to revise their production projections for the second half of the year.

In sum, whether the NAND flash market will upturn its shortage back to oversupply will depend on the progress on resolving this global health crisis.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter