Pure Storage: Fiscal 4Q20 Financial Results

FY20 revenue at $1.6 billion, up 21% Y/Y, with $201 million loss never ending since inception

This is a Press Release edited by StorageNewsletter.com on March 3, 2020 at 2:23 pm| (in $ million) | 4Q19 | 4Q20 | FY19 | FY20 |

| Revenue | 422.2 | 492.0 | 1,360 | 1,643 |

| Growth | 17% | 21% | ||

| Net income (loss) | (25.8) | (4.7) | (178.4) | (201.0) |

Pure Storage, Inc. announced financial results for its fourth quarter and full-year ended February 2, 2020.

“Pure finished the year with the strongest growth and margin profile in the industry,” said Charles Giancarlo, chairman, and CEO. “We are well-positioned for a successful year ahead with a growing and robust technology portfolio, and our strategy to deliver the Modern Data Experience.“

Key Financial Highlights:

- Revenue: $492.0 million for 4FQ20, up 17% Y/Y, $1.643 billion for FY20, up 21% Y/Y

- Gross margin: 4FQ20 GAAP gross margin 70.8%; non-GAAP gross margin 72.1%, FY20 GAAP gross margin 69.0%; non-GAAP gross margin 70.5%

- Operating loss: 4FQ20 GAAP operating loss $0.7 million; non-GAAP operating profit $60.9 million; FY20 GAAP operating loss $191.2 million; non-GAAP operating profit $55.6 million

- Operating margin: 4FQ20 GAAP operating margin -0.1%; non-GAAP operating margin 12.4%; FY20 GAAP operating margin -11.6%; non-GAAP operating margin 3.4%

- Operating cash flow: 4FQ20 operating cash flow at $69.9 million, down -14% Y/Y; FY20 operating cash flow at $189.6 million, up 15% Y/Y

- Free cash flow: 4FQ20 free cash flow at $56.2 million, up 9% Y/Y; FY20 free cash flow at $101.7 million, up 59% Y/Y

“Our 4FQ20 performance was the result of solid execution and growth from our expanding product and subscription services portfolio,” said Kevan Krysler, CFO. “Through expansion of our portfolio, we look forward to continued industry leading growth rates and gross margins.“

Recent company Highlights

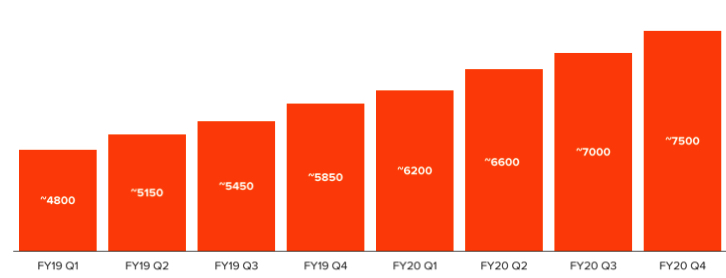

Customer Traction: It added more than 500 new customers in the quarter equating to greater than 5 new customers per day, reaching over 7,500 total customers.

Advancing Modern Data Experience:

It announced availability for the third-gen all-NVMe FlashArray//X family that provides customers with higher performance and enables faster time-to-market. With its one-of-a-kind, EvergreenStorage model, customers have access to continuous innovation that includes these and future updates to its product and solutions suite.

It continues to advance its multi-cloud strategy with the beta launch of Cloud Block Store on Microsoft Azure. It also joined Google Cloud’s Anthos Ready Storage Initiative for hybrid cloud environments earlier this month.

Industry Recognition: In 4FQ20, peer review site Gartner Peer Insights recognized FlashArray//X with a Customers’ Choice distinction for Best Primary Storage in 2020.

Guidance

For FY21:

- Revenue of approximately $1.90 billion

- Non-GAAP gross margin of approximately 69.5%

- Non-GAAP operating profit of approximately $60 million

For 1FQ21

- Revenue of approximately $365 million

- Non-GAAP gross margin of approximately 69.5%

- Non-GAAP operating loss of approximately $40 million

Comments

Ten-year old Pure Storage never was profitable, accumulating losses of around 1.1 billion since inception.

But net loss decreased to $4.7 million for the more recent quarter and it expects non-GAAP operating profit of approximately $60 million for next quarter.

Shares are little changed after the company posted better than expected results for 4FQ20 but offered April quarter revenue guidance below current Street expectations.

For the quarter, the AFA company reported revenue of $492 million, up 17% from a year ago and ahead of the Wall Street analyst consensus forecast of $488.7 million.

Product revenue was $377 million growing 11% Y/Y and subscription services revenue was $116 million growing yearly 41% which includes revenues from Evergreen subscriptions Pure as-a-Service and Cloud Block Store.

Total revenue in USA in 4FQ20 was $345 million up 15% Y/Y and international revenue was $147 million growing 21% Y/Y.

FY20 finished with total revenue of $1.64 billion growing 21% Y/Y while navigating through an industry pricing decline but in 4FQ20, the firm started to see a return to a more normalized pricing environment.

Total customers (7,500 to date)

Total headcount at the end of the year was 3,400 employees and 2,900 employees at the end of the prior year.

Charles Giancarlo, chairman and CEO commented about Corona virus: "Based on what we know today we do not anticipate a significant impact to this quarter's supply and operations although the situation remains quite fluid. Pure has in place a multi-continent supply chain strategy to source components and assemble our products and we continue to monitor the developing situation diligently."

Revenue are expected to be down as much as 26% Q/Q for next quarter, and up 16% for FY21.

Revenue in $ million

(FY ended February 2)

| Period | Revenue | Y/Y growth | Loss |

| FY13 | 6.1 | NA | (23.4) |

| FY14 | 42.7 | 603% | (78.6) |

| FY15 | 174.5 | 308% | (183.2) |

| FY16 | 440.3 | 152% | (213.8) |

| FY17 | 728.0 | 65% | (245.1) |

| FY18 |

1,023 | 41% |

(159.9) |

| FY19 |

1,360 | 33% |

(178.4) |

| 1Q20 |

326.7 | 28% |

(100.3) |

| 2Q20 |

396.3 | 28% |

(66.2) |

| 3Q20 |

428.4 | 15% | (28.2) |

| 4Q20 |

492.0 | 17% |

(4.7) |

| FY20 |

1,643 | 21% | (201.0) |

| 1FQ21* |

365 | 12% |

NA |

| FY21* |

1,900 | 16% |

NA |

* estimations

Earnings call transcript

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter