History (1991): 8% Increased in FDD Shipments in 1990 – Disk/Trend

To reach 41.5 million drives

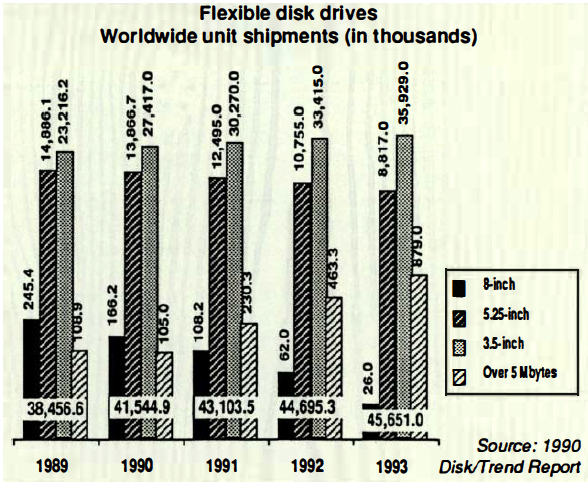

By Jean Jacques Maleval | January 28, 2020 at 2:12 pmWW shipments of flexible disk drives are expected to reach 41.5 million drives in 1990, up 8% from the previous year, according to the recently released 1990 Disk/Trend, Mountain View, CA, report on flexible disk drives ($1,290).

Continuing growth in floppy drive unit shipments is also forecasted for the next 3 years, but at an average annual rate of only 3.1%, as demand for older drive configurations drops.

3.5-inch or microfloppy drives overtook 5.25-inch units in total shipments in 1988, with microfloppy drive expected to provide 78% of the industry’s unit shipments in 1993.

WW revenues from floppy drive sales are expected to decline throughout the 1989-93 period covered by the report, as average prices continue to fall.

Total floppy drive revenues for all drive manufacturers were $2.5 billion in 1989, but the 1993 total is forecasted at only $2.1 billion.

Here are other highlights from the report on flexible disk drives:

- The continuing miniaturization of PCs is reflected in the floppy drive industry, as even microfloppy drives are packaged in ever-smaller form factors. By 1989, one-inch high models were providing 80% of the 3.5-inch drive total, replacing the original larger configurations. However, new microfloppy drives with heights of 0.75 inches or less are expected to dominate the 1993 WW 3.5-inch drive market, with 71% of total shipments.

- Within the evolving microfloppy form factor, there is also a trend to increased capacities. Drives with unformatted capacities of 1MB or less peaked in shipments in 1988, and by 1989 were only 35.7% of the total shipments. Models with 1.6 to 2MB capacities now have the lead, and are expected to provide 82% of 1993’s microfloppy drive shipments. New 4MB drives are expected to be adopted by major system manufacturers in 1991, and by 1993 are projected at 7% of the microfloppy total.

- Despite continuing delays in establishing high volume production capability, it is expected that the market for high capacity floppy drives over 5MB will start an upward climb in 1991, as new 3.5-inch drives in the 20MB range enter the market. Although media interchange standards are not yet established, the new high capacity microfloppies offer downward compatibility to current microfloppy drives, one-inch high form factors, and competitive pricing. Shipments of 825,000 high capacity microfloppy drives are forecasted for 1993.

- Sony’s long-term leadership in 3.5-inch drive shipments continued in 1989, with 4.9 million drives, 22.6% of the WW total. Although the overall 5.25-inch drive market was declining, Teac’s 5.25-inch floppy drive shipment, increased in 1989, to 3.6 million drives, for a 27.5% share of the WW non-captive total. The small remaining market for 8-inch non-captive floppy drives was led by Y-E Data with 63.7% of the WW total, and Iomega held 83.1% of the 1989 market for high capacity non-captive floppy drives over 5MB.

This article is an abstract of news published on the former paper version of Computer Data Storage Newsletter on issue ≠37, published on February 1991.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter