History (1991): WW Revenue for HDDs to Reach $26 Billion in 1990 Up 13% From 1989

44.5% for IBM, 29% for Seagate, 10% for Fujitsu and 8.5% for Conner

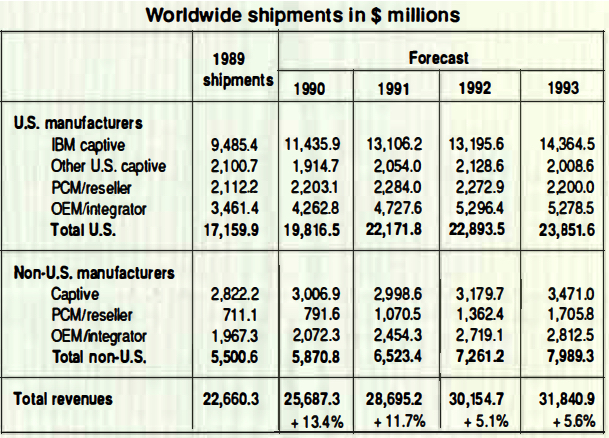

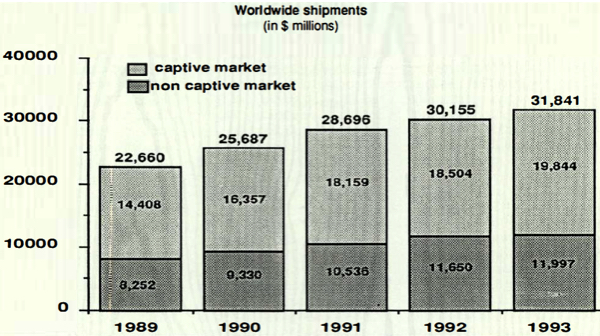

By Jean Jacques Maleval | January 21, 2020 at 2:04 pmWW revenues for Winchester drives are expected to reach $25.6 billion in 1990, up 13.4% from the previous year, according to the recently released 1990 Disk/Trend Report ($1,690).

The report disputes recent predictions that this industry will suffer from overproduction beyond computer system demand in 1990.

Instead, it points out that available production capacity is frequently not suitable to make the newest drives, which are most in demand.

For example, unit shipments of 3.5-inch drives are predicted to grow 44% in 1990, to over 19 million units, and the new 2.5-inch drives are expected to increase from nominal 1989 shipments to 789,000 units this year.

With a few exceptions, the independent manufacturers produce mostly for system manufacturers to fill specific orders, so mindless overproduction is not in the cards.

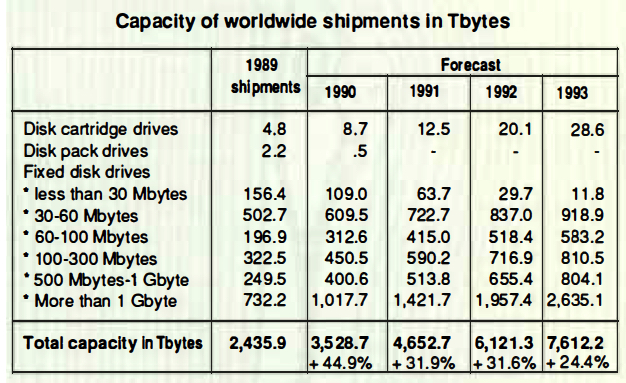

PC applications have made 3.5-inch drives the leader in industry unit shipments, with 1989’s 13.2 million units predicted to increase to 29.9 million in 1993. Drives in the 30-60MB range now provide more than half of the 3.5-inch total, but 100-300MB 3.5-inch drives are growing at the fastest rate, up an expected 232% in 1990.

2.5-inch drives have become the industry’s newest rising star. The 3/4 million drives forecasted for 1990 are almost all 20MB models, used in the rapidly growing notebook class of portable computers. However, rapid changes in product mix are expected, and more than half of the 2.2 million 2.5-inch drives predicted for 1991 will have capacities over 30MB. Shipments of 6.7 million 2.5-inch drives are projected for 1993.

IBM’s captive revenue is expected to increase 20.6% in 1990, to a total of $11.4 billion, providing 44.5% of the entire industry’s WW revenue. IBM’s performance is soarked by a strong growth year for the 3390 10.8-inch drive used with mainframe computer, plus rapid increases for the entire range of 3.5- inch drives and a new high-end 5.25-inch model.

The industry’s revenue for non-captive disk drives reached $8.2 billion in 1989.

Seagate Technology shipped 29.2% of the total, based on the combined total of Seagate and Imprimis, which was acquired during 1989. Fujitsu held 10.0% of revenues, including both the company’s OEM drives and its large plug compatible drives for mainframe computers. Conner Peripherals jumped into fourth place with 8.5%, boosted by its broad range of 3.5-inch drives for PCs and workstations.

This article is an abstract of news published on the former paper version of Computer Data Storage Newsletter on issue ≠36, published on January 1991.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter