Cloudera: Fiscal 3Q20 Financial Results

Revenue up 67% and net loss increasing 217%

This is a Press Release edited by StorageNewsletter.com on December 6, 2019 at 2:16 pm| (in $ million) | 3Q19 | 3Q20 | 9 mo. 19 | 9 mo. 20 |

| Revenue | 119.0 | 198.3 | 335.4 | 582.5 |

| Growth | 67% | 74% | ||

| Net income (loss) | (25.9) | (82.1) | (107.1) | (272.3) |

Cloudera, Inc. reported results for its 3FQ20, ended October 31, 2019.

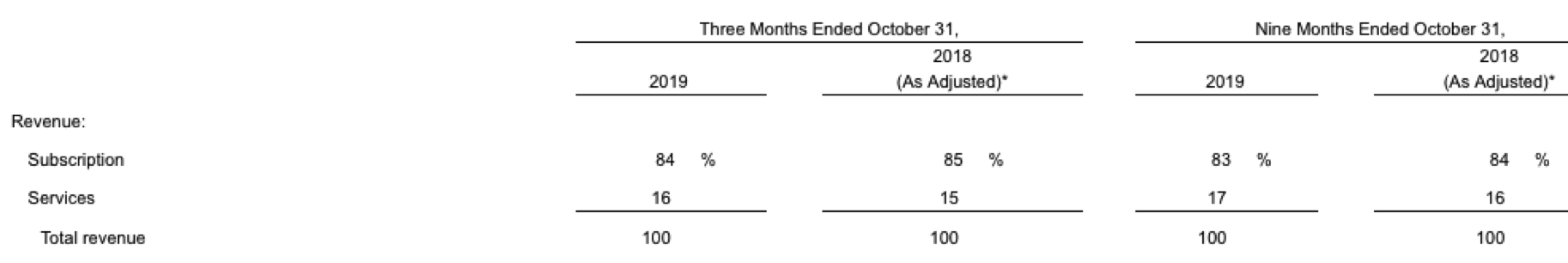

Total revenue for the quarter was $198.3 million, and subscription revenue was $166.9 million. Annualized recurring revenue grew 13% Y/Y.

“I am pleased to report that we executed well in Q3, building on the positive momentum generated in Q2. We delivered strong operating and financial results across the board and launched the Cloudera Data Platform to a great reception from customers, partners and industry analysts,” said Marty Cole, COB and interim CEO. “Customers now have a highly competitive set of cloud-native services from Cloudera, and we’ve made hybrid cloud data management and analytics a reality via the industry’s first enterprise data cloud.”

Financial figures for 3FQ20

- GAAP loss from operations was $82.5 million, compared to a GAAP loss from operations of $25.7 million for 3FQ19.

- Non-GAAP loss from operations was $8.2 million, compared to a non-GAAP loss from operations of $3.1 million for 3FQ19.

- Operating cash flow, which includes $6.1 million of merger-related payments, was negative $5.9 million, compared to operating cash flow of negative $6.8 million for 3FQ19.

- GAAP net loss per share fwas $0.29 per share, based on weighted-average shares outstanding of 283.3 million shares, compared to a GAAP net loss per share of $0.17 per share for 3FQ19, based on weighted-average shares outstanding of 152.2 million shares.

- Non-GAAP net loss per share was $0.03 per share, based on weighted-average shares outstanding of 283.3 million shares, compared to a non-GAAP net loss per share of $0.02 per share for 3FQ19, based on weighted-average shares outstanding of 152.2 million shares.

- As of October 31, 2019, the company had total cash, cash equivalents, marketable securities and restricted cash of $502.2 million.

Recent Business and Financial Highlights

• Annualized recurring revenue was $697.4 million, representing 13% Y/Y growth

• Non-GAAP subscription gross margin for the quarter was 86%

• Operating cash flow was negative $5.9 million, including $6.1 million of merger-related payments

• Customers with annualized recurring revenue greater than $100,000 were 977, up 24 from the prior quarter

• Launched the Cloudera Data Platform (CDP) on Amazon Web Services and Microsoft Azure

• Delivered CDP Data Center, next-gen on-premises offering, representing the strongest elements of the former Cloudera and Hortonworks platforms and new innovations for better scalability, performance and private cloud readiness

• Cloudera debuted as a Strong Performer in The Forrester Wave: Streaming Analytics, 3Q19 and was named one of The 11 providers that matter most in streaming analytics

Outlook for 3FQ20

• Total revenue in the range of $200 million to $203 million

• Subscription revenue in the range of $173 million to $176 million

• Non-GAAP net loss per share in the range of $0.04 to $0.02 per share

• Weighted-average shares outstanding of approximately 294 million shares

Outlook for FY20

• Annualized recurring revenue in the range of $700 million to $720 million

• Total revenue in the range of $782 million to $785 million

• Subscription revenue in the range of $659 million to $662 million

• Operating cash flow in the range of negative $55 million to negative $45 million, including $60 million of merger-related payments

• Non-GAAP net loss per share in the range of $0.21 to $0.19 per share

• Weighted-average shares outstanding of approximately 281 million shares

Comments

Results are better than expected.

Cloudera has now 977 customers who exceed $100,000 of annualized recurring revenue (ARR), a net increase of 24 for the quarter. It had an increase in customers representing greater than $1 million of ARR to 150 in total.

When the company launched its CDP Public Cloud, there was a waiting list of 50 customers who have indicated interest and intend to trial it. As of today, the firm transitioned 49 of these customers through the evaluation phase.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter